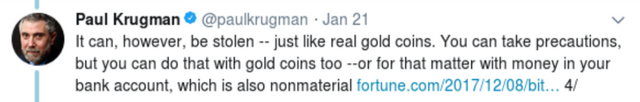

Dear Mr. Krugman,

Your recent tweet-storm prompted me to reply and clear up a few things, please consider my

arguments.

Screen Shot 2018-07-05 at 9.25.26 PM.png.

First of all, and this is to everyone, every time you want to utter the word ‘blockchain’ or ‘cryptocurrency’ please STOP and replace it with one of two acceptable descriptors:

(1) Bitcoin

(2) Altcoin

Blockchain and cryptocurrencies are misnomers, one must not forget that Satoshi Nakamoto invented a piece of software called Bitcoin which itself included the invention of the blockchain as you and the entire world know it. Not just any blockchain, an IMMUTABLE blockchain. Many altcoins don’t even possess a blockchain or workable code, much less an immutable public blockchain so to place all “cryptocurrencies” under one label is deceiving and comparing apples to oranges. We will talk about immutability later, but for now its important to recognize the immutable fact that Bitcoin invented the blockchain. No Bitcoin, no blockchain. With regards to “Beyond the Bitcoin Bubble”, the main thesis in the article is the correct acknowledgement that the big news about the Bitcoin invention is really not about cryptocurrencies, blockchains or asset classes, instead its really about the Internet 2.0. Its the Internet done the right way, its done in a secure way. So secure in fact that its first real world use is as a means of digitizing value into mathematically provable scarce data and enabling peer to peer “trust-less” transmission of said data over an intergalactic decentralized censorship resistant network. Bitcoin is in fact the secure Internet of money, the ultimate democratization of finance. Really its the latest iteration of our systems of money (which over the last 4,000 years have only been iterated on maybe 5 times, Bitcoin included). This latest iteration puts laser focus on the real question of “what is money?”.

- How can you verify gold is actually gold? Hint, biting it does not suffice!

Bitcoin == digital gold? Correct, great job Mr. Krugman! I think you are brushing this one off too easily, lets keep going with the gold comparison. Of course Bitcoin and gold can be counterfeited. Counterfeiting a blockchain based cryptocurrency is what we call a ‘51% attack’ but due to the extremely high amount of hash power protecting the Bitcoin fortress this is highly unlikely and in fact has not happened in Bitcoins existence, however it has happened multiple times in golds existence whereby reputable dealers such as the Royal Bank of Canada even fall victim to counterfeited gold. Say you own a million dollars worth of gold and want to verify it is in fact gold and not full of tungsten like the following news stories:

Royal Bank of Canada:

http://www.cbc.ca/news/canada/ottawa/fake-gold-wafer-rbc-canadian-mint-1.4368801

Manhattan Jewelery District:

http://www.businessinsider.com/tungsten-filled-gold-bars-found-in-new-york-2012-9

A simple search of ‘how to test gold purity’ will return responses as idiotic as a float test in water but we all know the only way to verify gold purity is by melting it. If I were a wealthy individual and owned large amounts of gold, you can bet your satoshis i'll be having those melted down and verified to be pure. Sounds practical and environmentally friendly to me.

In order to verify that Bitcoin is in fact 100% pure Bitcoin, all you need to do is use the Bitcoin core software (you can download it here: https://bitcoin.org/en/download) and you can independently and mathematically verify your Bitcoin private key is valid and your unspent Bitcoin belong to that private key. Personally i'd rather run Bitcoins software instead of melting down a bar of gold every time I wanted to save or transact, and I think you’ll find I’m not the only who feels this way.

What if I want to move and take my gold with me?

For starters you’re not going to get it across any international borders without incurring heavy taxes (at best) are you? Say you are a Venezuelan and you want to escape your hyper-inflated economy and take your gold with you to Columbia to start a brand new life as an economic refugee, do you really think that would work? It will be robbed from you and if you have too much of it the cost of moving it can make it impractical or impossible both physically and economically, as distance exponentially increases costs and risks. This is all stating the obvious. The point I’m making is Bitcoin is much better then gold, its portable, can be stored in your head. Its worth noting that Her Majesty's Royal Mint in England (https://rmg.royalmint.com/) literally copied the Bitcoin software to keep tabs on its gold, to efficiently prove who owns which bullion, just ask @lopp as he personally worked on the project. “Physical gold, digitally traded” is their slogan. If Her Majesties Royal Mint trusts the Bitcoin software to keep tabs of their reserves, then Bitcoin must be doing something right. I’d suggest you take a look at Her Majesties FAQs here https://rmg.royalmint.com/faqs/ as they actually answer some of the topics you seem to be struggling with about Bitcoin.

Whilst you are correct that someone can steal your Bitcoins and that someone can steal your gold, the more gold you own the higher the risk of it being stolen is and the more costly it is for you to own. With Bitcoin it does not matter if you own 0.00001 or 1,000,000, you put however much effort and funds into securing it as you want, a private key is just text (a number in fact) and can be hidden and secured away in innumerable ways, including solely in your head (https://en.bitcoin.it/wiki/Mnemonic_phrase). It can then be transported around the world and no one can stop you, all you need is a functioning brain. You don’t even need electricity or the Internet, if you have solar panels and a standard second hand satellite dish you can point it up to space and download the Bitcoin software and run it independently of all unconsidered factors and restrictions (https://blockstream.com/satellite/).

Of course you have to worry, Bitcoin forces you to put on your big boy pants and independently verify your Bitcoin is fully authentic and as secured as possible (which obviously not enough people do). It is your duty as a user to run a full node (https://en.bitcoin.it/wiki/Full_node) and define what Bitcoin is. The very fact that this is even possible for almost anyone on the planet to do is a modern day technological miracle and Bitcoins strongest attribute; democratization through decentralization. Bitcoin breeds financial responsibility, it turns finicky millennials into frugal savers and investors whilst simultaneously driving people to question what money is. It was not until I discovered Bitcoin that I payed any attention to digital security and privacy. Owning your own financial sovereignty will certainly motivate individuals to invest heavily in knowledge and technical know how so that you can ensure you’re assets are safe, authentic and secure. After all it is my money, not the banks, I want and deserve full control over my assets, no misaligned, self interested, corruptible fallible third party needed thank you!

I think what your missing here is that it is possible to create your own private keys, and then create and sign Bitcoin transactions all offline in airplane mode with no wifi and virtually no risk of digital theft whatsoever (https://en.bitcoin.it/wiki/Offline_transactions). Because your precious private key never actually touches the Internet EVER. You can store that digital gold in hand writing on a piece of paper. My Bitcoin for instance has NEVER touched the Internet except in the form of a serialized signautre inside a Bitcoin transaction which was created and signed offline and only then after its encoded and serialized gets broadcast to the Bitcoin network. This means your Bitcoin are stored outside of the realms and reach of the Internet and hackers. Remembering your password to your online banking account IS NOT THE SAME! Just because you’ve remembered your password does not mean someone can’t hack your account, steal your identity and ruin your life. This is ironic because Bitcoin is extremely easy to steal if not secured properly, hence why individuals must invest in knowledge. I cant imagine a better motivator for that then financial sovereignty.

Just imagine for a moment if you will, that tomorrow President Trump, feeling threatened by your liberal tweets, deems you a threat to his political survival and wrongly connects you to terrorist activity and freezes all your assets. Kind of like what happened to the Saudi royals recently. Well I promise you, that you would have wished you kept your assets stored in Bitcoin in a manner in which they are not seizable, I guarantee you whatever wealth those Saudis have left over is getting put into Bitcoin. In this political age you can not trust the state for simple day to day tasks, I do not want them in control of my finances. Not only does Bitcoin protect you from criminal theft it also protects you from state seizures. Bitcoin is insurance against all sorts of depressing outcomes, big brother and a dystopian future being one of them.

Bitcoin transactions are so immutable an un-censorable that I could in theory stop paying my bills and taxes and no government or law enforcement body would be able to confiscate or gain control of my Bitcoin, the Bitcoin would be waiting for me after I finished my jail sentence (although id probably be in for life, its still an interesting point), I could even transact in Bitcoin while in jail. There is no other asset class that allows this flexibility and security. This does not just appeal to criminals, this appeals the the vast majority of the world population who live under unpredictable regimes who

mismanage their national currencies as if they were playing with monopoly money. Often times its the institution or government who are the criminals.

Just ask:

Grecians (https://en.wikipedia.org/wiki/Capital_controls_in_Greece)

Burmese (https://www.npr.org/sections/money/2013/05/10/182309623/why-almost-no-one-in-wanted-my-money) to name a few recent examples.

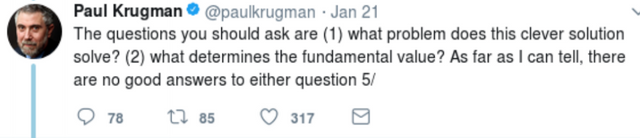

-What problem does Bitcoin solve?

Remember not everyone lives in your Goldilocks world Mr. Krugman, take off your blinders. Frankly your question depends on the myriad of people who use it and you’d have to run polls asking millions of people all over the world why they transact about $20 billion dollars a day in Bitcoin or how it serves them, what problems it has solved for them, I expect the responses to be diverse and rich. Its easiest to first describe what problems Bitcoin has solved for me.

-Problem: banks are not open 24/7

In fact their operating hours are extremely inconvenient. Also I am usually not physically in the countries where my bank is located, for example to send an international wire with NatWest you have to show up in person at the branch where you opened your account, not just any NatWest branch will do. Bitcoin solved this for me, I can now send money to anyone on the planet whenever I please.

-Problem: Wire transfers take forever

You never really know what your going to get when sending a wire transfer, it could be any amount of time in the next month. In fact if you’re a Brazilian you have to get explicit permission from the central bank of Brazil to send money abroad and the application process can take 45 days. Guess what Paul, I recently used Lightning Network and made a Bitcoin payment instantly and almost for free and it went around the world. I have sent many thousands of dollars for pennies, almost instantly around the world using Bitcoin. As someone who has used the modern day international banking system extensively I can tell you even with Bitcoins growing pains it is immeasurably better right now. My soul actually feels better knowing I’m supporting open sourced software and a decentralized system instead of Bank of America.

-Problem: Do I actually own my money when its in the bank?

Common sense would tell you that when I deposit my paycheck into an American bank that my money would stay in that account for me to take out whenever I wanted, I mean thats why they charge you fees right? Because they are providing you a service right? Wrong! As a depositor you are in actuality an ‘unsecured creditor’ (www.investinganswers.com/financial-dictionary/debt-bankruptcy/unsecured-creditor-5160). You have loaned your money to the bank and there is zero collateral, all you have is the “guarantee” by the federal government (FDIC) to cover $7 Trillion of personal losses if the banks go bust, even though the the FDIC only have a budget of $85 Billion dollars to

bail individuals out with, thats a shortfall of of $6.9 Trillion dollars Paul, please explain how that works exactly!? Especially in the context that our domestic government can not even function fiscally on a daily basis. Whats worse, if the banks do go bust you are losing your money anyways as your tax dollars are paying for the bailouts so they can get bigger and fail harder next time, meanwhile more money is getting printed and devaluing the dollars you already have by inflation. Fractional reserve banking layered on top of the fact that as a depositor you’re really an unsecured creditor is like adding fuel to the fire. As we saw in the financial crisis in 2008/09 banks can not be trusted to safely manage your money. The FDIC insurance fund balance as of 2017 was $85 billion dollars, in 2008 there was over $7 Trillion dollars being held by Americans in bank accounts, considering the interconnectedness of the financial universe its safe to say if one bank is going to crash then many will crash, the FDIC can only cover a tiny fraction of that. And guess what, Americans are not the center of the universe, there are other countries out there where capital controls are strict and monetary policy is inept, if your unlucky enough to be born in one of those places (the majority of the worlds population) then you may find Bitcoins solution to this problem much more relative.

-Problem: Inflation.

Mr. Krugman why is it when the federal reserve measures inflation they ignore 99% of what we humans deem as day to day necessities? Those annoying little things called consumer goods, like food, water, shelter. They stick to an arbitrary goal of 2% and even 2% per year compounded over time is a black hole of wealth destruction for savers. The point is our real inflation is in reality much higher, if you have international dealings you feel this burn much more when transferring your dollars into other currencies and vice versa. My problem is I don’t want my savings being sapped away by inflation, I don’t want my saving stored in an overvalued bond market and I certainly don’t want my savings invested in a bubbled out stock market, where oh where am I to go? Bitcoin = problem solved. Bitcoin is deflationary and should appreciate in value over time due to the supply demand balance and basic human animal spirits. Why do you think there is such a high premium on Bitcoin in the street in many third world countries, because it is worth more in these countries where risks of inflation, poor monetary policy and corruption are higher. Bitcoin holds value and on average appreciates in value (which is a priceless feature), ask an Argentinian, Venezuelan, or Indonesian about that if you don’t take my word for it.

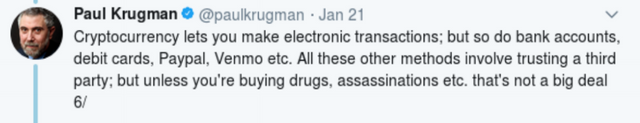

-Problem: Third parties.

I don't trust you, I don't trust Donal Trump, I don't trust Exxon-mobil, I don't trust Goldman Sachs. I know all banks are fallible, and all humans are fallible and subject to greed and corruption. I have traveled the world, you do not place trust in institutions in the vast majority of countries. When it comes to storing my savings I trust only myself, and the open sourced software I use, problem solved. Bitcoin allows me to operate in a trust free manner as I don't need to rely on any third parties for my wealth storage (or lack of) and transactions.

-Problem: 2 billion people without access to a bank

If I am an aspiring Baker in Nigeria how can I set up a business? Does my bank actually function? Is there a bank? Do they have credit cards for my business account? I wonder if they have a brokerage department? How can I hedge against inflation? The sad reality is even if they have access to a bank the rest of the world will not transact with them due to fraud risk, 2 billion people are unbanked and this keeps them outside of the financial world. Tell me how is someone supposed to get ahead financially when they don’t even have a means to safely store their funds or transact with peopl who are not physically next to them? Much less obtain legal paper work to open a business. The barriers of entry are too high around the world, now those barriers have been lowered. Almost every village in the world has a solar panel, a cell phone signal, at least one cell phone and maybe even a satellite dish. Well guess what Bitcoin just solved their problem, they can now freely interact on the universes financial markets 24/7.

-Problem: Fraudulent payments.

It was estimated that in the city of London 1 out of 3 credit card transactions was fraudulent. In my case I have to call my credit card, debit card companies and banks constantly to assure them everything is ok every time I travel or try and make a purchase online. Fraud is a such an enormous cost on the existing financial system that banks don't let you spend money out of fear, it is a completely broken system! Bitcoin solves this problem, goodbye fraud and good bye charge backs. In order to flex your financial sovereignty you must learn how to use Bitcoin, and you must exercise caution and have concern for security. The onus is on the user, this saves merchants an absolute fortune on their bottom line, just ask the CEO of Overstock.com. Credit card companies charge huge fees to merchants and if your business is low margin it adds something like a 40% cost to your bottom line. Dealing in Bitcoin and Lightning Network saves merchants a fortune, and saves me the headache of constantly being unable to spend my money when I need to because my bank is inept at figuring out what is and isn’t fraud.

-Problem: worldwide correlated assets all exposed to similar risk factors.

Bitcoin is an uncorrelated asset class allowing anyone to hedge against a number of likely undesirable outcomes, stock market crashes, bond market crashes, currency devaluations. As we saw in 2008 when the bubble pops it pops hard, considering we have people like Trump leading the way now you can rest assured any healthy regulation to stop these crises have been rolled back and have been neo-liberalized to the extreme. The interconnectedness of the financial world has only become more complex, badly regulated and over leveraged. Bitcoin will thrive when the masses realize how broken the current system is, it may not go up in price when the bubble pops, but it will serve as the only viable alternative, ironically Bitcoin may be the pin that pops the bubble.

-Problem: Politics and the established ruling class.

These groups are one in the same and have a death grip on the world wide financial system. Many people do not find it appealing to be a apart of this obviously broken system or subscribe to Donal Trumps ideology and want to opt out altogether. Bitcoin is by far the best and most effective way to do that, you can not speak louder then speaking with your money.

Thats both a cheap shot and a compliment. The first people to adopt true new disruptive technologies are usually “criminals", that is because they make lots of money and they find that this technology is far more efficient, to me that seems like a compliment and vouches for Bitcoins utility. Just because someone wants to protect their assets from the fallibility of governments and financial institutions does not make them a criminal Paul. Bitcoin is much easier to trace then cash PERIOD. In the future all governments will digitize their currencies and big brother will be watching more efficiently then ever thanks to the blockchain. The US Government is tracking cryptocurrency payments very tightly, its been studied and less than 1% of Bitcoin transactions relate to illicit activity and money laundering (https://coincenter.org/link/a-new-study-finds-less-than-1-of-bitcoin-transactions-to-exchanges-are-illicit). As I said, cash is worse... Nice clickbait though Paul.

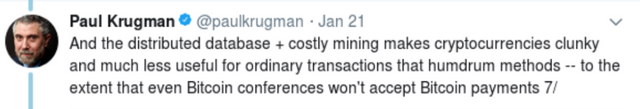

-Bitcoin is scaling.

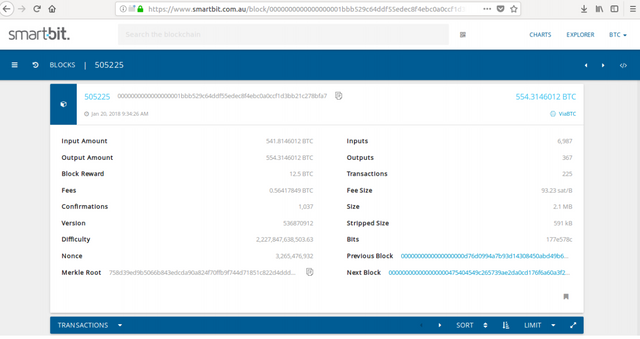

That ONE conference understandably took that action right at the time of peak spam on the bitcoin network, the fees have come down considerably since then as big players like Coinbase seem to become more technologically adept in their dealings with the Bitcoin network. Please see this block as an example of Bitcoin scaling in front of your eyes:

Ah yes the great scaling debate. Lets start with a quote from the late Hal Finney who in 2010 who was the first known person to run Bitcoin in conjunction with Satoshi Nakamato:

"Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient." -Hal Finney, Dec 2010”

This is not some issue that popped up out of nowhere, the solution was proposed years ago and has been in active development for the last two years at least and as you can see is now live and in use, with the participation rate increasing exponentially. The innovative improvements are called Segwit and Lightning Network, I would urge you to read this paper Paul https://lightning.network/lightning-network-paper.pdf, heres an excerpt:

“The bitcoin protocol can encompass the global financial transaction volume in all electronic payment systems today, without a single custodial third party holding funds or requiring participants to have anything more than a computer using a broadband connection. A decentralized system is proposed whereby transactions are sent over a network of micropayment channels (a.k.a. payment channels or transaction channels) whose transfer of value occurs off-blockchain.”

Lightning Network is a second layer, kind of like ETFs are a second layer to their underlying asset, except that in Lightning your actually dealing in the underlying asset and not a mirage of it. My point is, Bitcoin is scaling, fees have come down massively, we have blocks coming in at 2.1mb (more then double the traditional 1mb blocks pre segwit) in size with average fees of 1 satoshi/byte which is very low, 1 satoshi per byte means I can send millions or billions of dollars for a less then a $0.10 fee.

-Mining - Mining is THE feature.

This is the most off base comment you've made yet. Mining is expensive? Yea its expensive and it can also make you millions of dollars. Maybe you should ask @jihanwu how profitable Bitcoin mining has been for him. Clunky you say? There does not exist a higher incentive to adopt renewable energy then Bitcoin mining. The only real overhead is electricity, you will do anything to reduce that overhead. Many large mining operations utilize excess energy produced by renewables, renewables are the holy grail of Bitcoin mining:

“The bottom line is that solar-powered Bitcoin mining operations can be highly profitable and enjoy payback times as short as a year or two. After that, Bitcoin revenue comes with almost zero ongoing costs for another 25 years or more for solar farms”

“These plants often produce more energy than they can sell to China's state grid, and some plant owners have found they can either sell the surplus to bitcoin mines or set up their own mines.”

http://www.aljazeera.com/indepth/inpictures/world-chinese-bitcoin-mining-180116112117869.html

“Bitcoin transactions require a lot of processing power, which creates a lot of heat. So Ilya Frolov and Dmitry Tolmachyov built a wooden cottage in the Russian Siberian town of Irkutsk, and they’re heating it with two bitcoin mines. The men pocket about $430 a month from bitcoin transactions, while keeping the 20 square meter space warm.”

https://qz.com/1117836/b hitcoin-mining-heats-omes-for-free-in-siberia/

Bitcoin mining is a way to prove joules have been spent, here in lies the real intrinsic value of Bitcoin. Energy is intrinsically valuable if it is expended for anything anyone is willing to value. The amount of energy expended is directly proportional to the level of mathematical security the Bitcoin network creates, its users pay for that security in the form of transaction fees, even you should appreciate the beauty of this economic incentive based model. This protects the network from 51%

attacks, secure enough for a central bank. What problem does mining solve? It solves the problem of security, every new miner that mines Bitcoin adds to the unthinkably high barrier of mathematical proofs of hash power and energy spent.

This is energy well utilized, it provides Bitcoin with its immutable nature, its security, something that is mind bendingly difficult to boot strap. This makes Bitcoin the killer app. In the future the most important transactions in the world will take place on the Bitcoin blockchain and the wealthiest individuals in the world will be storing their wealth on the Bitcoin blockchain. Without mining and Proof of Work that all vanishes instantaneously. Bitcoin is immutable because the miners make it immutable, it is neither physically nor economically feasible to re-mine the history of Bitcoin and create an alternative blockchain unless you want to spend billions upon billions of dollars, and each day that goes by this difficulty exponentially increases. There are simply not enough super computers in the world to put a dent in the Bitcoin networks wall of cryptographic security.

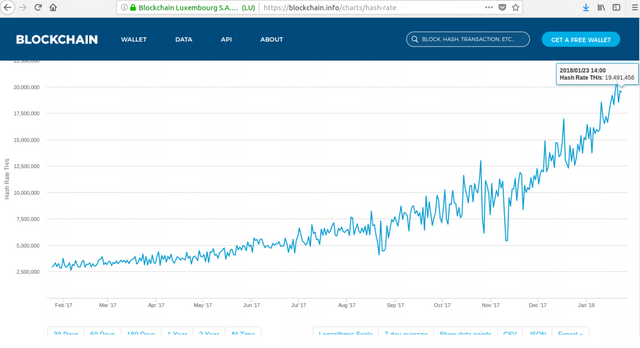

Here you can see the hash rate of the Bitcoin network as I type is 19,491,456 Trillion hashes per second, an increase of 9x this year alone. It was estimated in 2013 that the Bitcoin network could out compute the top 500 supercomputers in the world by 256 orders of magnitude, today in 2018 not enough super computers exist in the world to put a tiny dent in this sort of astronomical hash-power. “So the entire bitcoin network is roughly 256 times faster than all the top 500 supercomputers around the globe combined.” (in 2013!!!)

https://www.forbes.com/sites/reuvencohen/2013/11/28/global-bitcoin-computing-power-now-256-

times-faster-than-top-500-supercomputers-combined/#7e52a2dd6e5e

-Backstop? You mean bailout?

Governments fail Paul. Central Banks fail Paul. Governments bail out the banks then use tax payer money to pay for it, then they inflate your currency into oblivion. Maybe its a once in a lifetime event in your country or maybe its a yearly event in your country, either way its not worth risking my life savings on your flawed monetary policies and corrupt elected officials. Fiat is a house of cards waiting to tumble, on average fiat currency has a twenty year life span, a frightening experiment which essentially guarantees failure in the long run. I think there is and always will be a role for credit to play but the pendulum has swung too far, and I think that is physically expressed and manifested in our society today through mass consumption, mass consumerism, poor diet, and poor education. I buy Bitcoin because I don’t need or want your bailout.

-What gives fiat value?

Like anything its all about subjective value theory. Bitcoin IS valuable for the people who use it for their many diversified use cases, I have already laid out a few of those above from my own personal experiences. At its most basic level at least Bitcoin takes energy to create whereas digital dollars can be created willynilly.

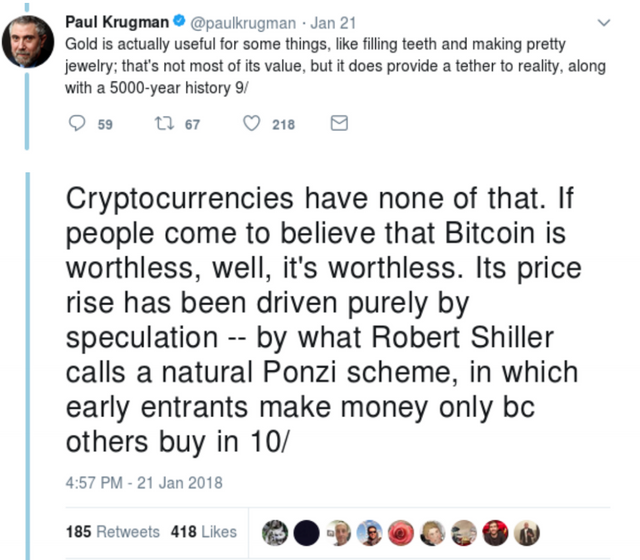

-“If people don't believe something has any value then it doesn't have value”

The same can be said of all assets. This is at best a non statement and you know it. This not a debate Paul, Bitcoin is useful to people, they DO USE IT, it has value. Just on the basis of an uncorrelated asset class alone it provides enormous value to institutions and individuals looking to hedge. The ponzi comparison is so boring, and illustrates that you know nothing about Bitcoin and know nothing about ponzi schemes. Robert Shiller has also just publicly stated that if eastern Europeans had Bitcoin in the 1940’s the communists and fascists would not have been able to confiscate their wealth, sounds like a ringing endorsement and an enormous value proposition and use case to me. Shiller also stated “Bitcoin is a clever idea”. You are cherry picking.

Paul, this is going to be the most insane price discovery process you or anyone has ever seen, this is money done better, hold on to your seats! Little blips like wannabe hackers in North Korea really don’t matter. Bitcoin is constantly attacked, it evolves for the better after each attack it is anti-fragile. The Bitcoin community welcomes such attacks, we live in an adversarial world and Bitcoin thrives in it.

Use cases :

-Hedge against inflation.

-Hedge against market crashes.

-Transparent voting results.

-Transparent budgets and public spending.

-Proof of ownership.

-True frictionless worldwide digital payments with little cost

-Transparent charity donations.

-Hedge against worldwide catastrophe.

-International remittances.

-Peer to peer payments.

-Store of value.

-Portable store of value.

-Immutable store of value.

-Censorship resistant transactions.

-Uncorrelated asset class used to hedge.

-Digitally secure wealth storage.

-Independently managed wealth.

-Fraud prevention.

-Means to claim financial sovereignty.

-Means to reject a system which your are ideologically opposed to.

-Means to say no to the world power structure as it stands.

-Means to take power away from the banking elite.

-A means to escape inflation and irresponsible monetary policy.

-A means to democratize finance.

-A means to bank the unbanked and un-bank the banked.

For you it may not be useful, and thats totally fine. At the end of the day you are just playing a role that will get you more clicks, taking advantage of a hot topic that you’d prefer didn’t exist as it threatens your world view. Rather then actually delving into the subject with an open mind you choose to entrench back into your gut feelings, letting 12 strands of confirmation bias (https://en.wikipedia.org/wiki/Confirmation_bias) stream through your consciousness, blissing your

ignorance.

Frankly, Bitcoin does not care what anyone thinks. Bitcoin exists and thrives because people use it and because developers all around the world contribute their intellect to improving it. Always remember, you can short Bitcoin!

-Disclosure I am long BTC.

✅ @f0nta1n3, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit