Bitcoin under Head&Shoulders Formation (Feb 23, 2018) an in depth analysis of the cryptocurrency / / Bitcoin Demand at $10K Hints at Move Higher

Yesterday's closings make the specialized setting risky and troublesome mid-term expectations.

The principle cryptos are in various circumstances however the forthcoming situations are comparable.

Bullish continuation blocked by sudden move that brings cryptos to dubious circumstance

As we said in yesterday's post, the specialized setting created toward the beginning of the day by the bullish breaks was restrictive to the session shutting. In the long run, the upward expectations were not affirmed. We saw a commonplace move by proficient brokers, with deals expanding in the late American session that caused an end beneath the reference lines. The change most likely left numerous situations in terrible condition.

Therefore, the specialized arrangement has exacerbated and most cryptos are exchanging exceptionally molded conditions.

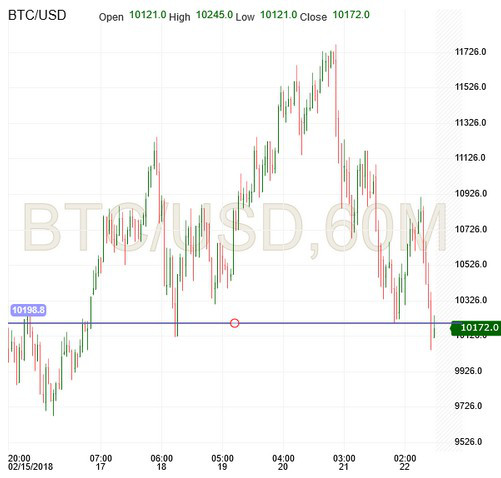

BTC/USD 240 min

Bitcoin hangs on above $11,000 in what we consider the main uplifting news for the primary crypto. On the awful side, the circumstance has turned out to be convoluted both from trendlines and markers perspectives.

BTC/USD is moving in the early American session in a little triangle drawn by the crossing point of a few trendlines. The figure thinness suggests that the circumstance ought to be settled temporarily.

The MACD separates from yesterday's most extreme, an unmistakable indication of shortcoming that doesn't propose a positive move. It is level, somewhat downwards yet undecided.

The Directional Movement Index indicates how deals showed up all of a sudden yesterday, while the buys diminished at a comparable rate. The D-surpasses the D+ barely, and proposes a bearish character for the present session. This sort of specialized example tends to change sides as the powers battle at the cost heading.

Above, there is a first protection at yesterday's most extreme at $11,764, trailed by $12,884. The head and shoulders base example is as yet legitimate however remains deactivated.

Underneath, the main help is at the triangle's base side, at $10,707, trailed by $9,958. On the off chance that these backings are broken, Bitcoin's cost could go down to the channel's base.

Bitcoin Demand at $10K Hints at Move Higher

Diligent request around the $10,000 stamp seems to have not just killed the prompt bearish point of view toward bitcoin, yet in addition indicates the digital money could be building a base for an inevitable move higher.

Costs on CoinDesk's Bitcoin Price Index (BPI) tumbled to $9,972.29 yesterday, before seeing a speedy recuperation to $11,000 levels. This is the fourth time in a week ago that bitcoin (BTC) has recuperated misfortunes subsequent to sinking beneath $10,000 levels. As of composing, bitcoin is at $10,990 levels. The digital currency has increased in value by 3.38 percent over the most recent 24 hours, as indicated by OnChainFX.

On Coinbase's GDAX trade, BTC saw two-way business yesterday with costs hitting highs and lows of $$11, 370 and $9,945, separately, before shutting (according to UTC) at $10,824 levels.

The circumstance looks the same today as the bounce back from the intraday low of $10,450 appears to have come up short on steam above $11,000 levels. The cryptographic money was most recently seen changing hands on GDAX at $10,970 levels.

The two-way value activity saw over the most recent 24 hours is characteristic of uncertainty in the commercial center and an unequivocal move (in either heading) would likely set the tone for the market. So, the value diagram examination today puts the chances of an unequivocal move higher over 50 percent.

The above diagram (costs according to Coinbase) appears:

BTC has reliably discovered takers at or beneath $10,000 (set apart by circles).

On an every day shutting premise, bears have been over and again neglected to drive costs beneath $10,391.02 (50 percent Fibonacci retracement of 2017 low to 2017 high).

The earlier day's doji light demonstrates hesitation in the market. Note that the doji flame has seemed following a 44 percent drop from the record-breaking highs and at basic help ($10,391.02). So it is more secure to state that the flame additionally reflects bearish weariness.

Thus, BTC might probably observe a more grounded move higher and set up a bullish here and now predisposition.

View

A positive close (according to UTC) today, ideally above $11,370 (yesterday's doji light high), would affirm a bullish doji inversion and open entryways for $13,000. An infringement there would open up upside towards $15,733 (61.8 percent Fibonacci retracement of December high to January low).

On the drawback, a nearby (according to UTC) beneath $10,391 could yield a supported move lower to $9,000.

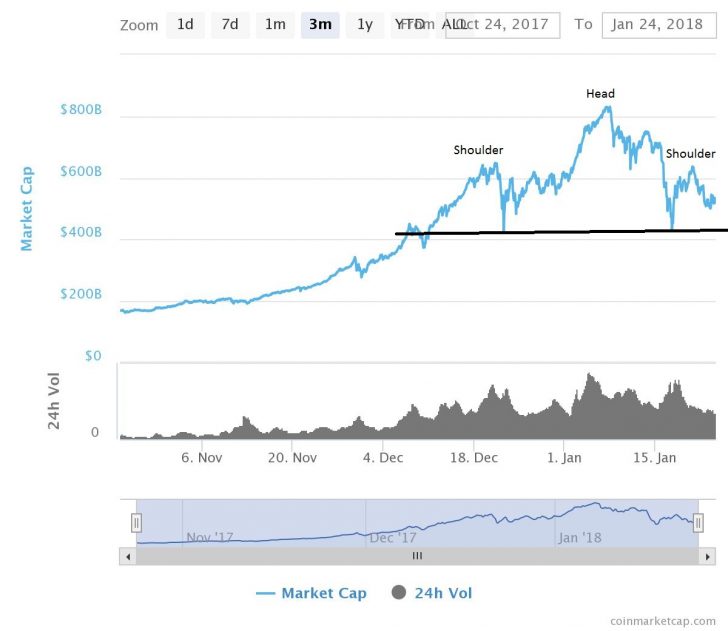

Notwithstanding, while there are indications of green shoots on bitcoin diagram, the market capitalization graph of all cryptographic forms of money calls for alert.

Add up to showcase top of cryptographic forms of money

The market top diagram demonstrates the arrangement of a head-and-shoulders bearish inversion design. A bearish example on showcase top could be an indication of residual shortcoming over the more extensive digital money advertise. Subsequently, there is justify in being wary.

![Upvote me.gif]

( )

)

nice post, you got upvoted and followed..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit