I believe many people are wondering what the bear market is for this year. How and when will it end? Today, BitBione team Wei leads us into the world to see how the foreign media are analyzed.

One of the main questions that led to the bear market in 2018 was "when will the price of bitcoin rise?" Investors who had entered the field as early as 2010 were familiar with the market cycle of bitcoin.

Bitcoin has revised its price and has fallen more than 80% twice in its history, and again 70% from December 2017 to June 2018. It is worth noting that in the last fiscal year, the price of bitcoin has also risen by nearly 50%. It's hard to believe that it was commonplace to buy bitcoins for less than $1,000 just 18 months ago.

If you take 1 dollars as a starting point, bitcoin has doubled 16 times in its history. Having said that, there are still plenty of investors buying Bitcoins at the peak of the cycle in 2017, all asking the same question - when will I see a return? In my view, there will be no parabola in bitcoin in 2018.

Reasons for bearish in 2018

2018 will not be a year when the bull market returns. There are 8 main reasons:

Historical cycle

I've seen very few people interested in the Bit or other encrypted currencies in 2015, and I think that's what happens when we look back at 2018, when prices fall, very few people are interested in asset classes. Only 2.3 million new wallets were activated in 2015, compared with more than 9 million in 2017 - about a quarter of the total. Activating wallets is a good but imperfect indicator of the number of new investors joining the field.

If we take the bear market for 2014-2015 years as a case study, the bear market will last for about 19 months. The price has fallen to nearly 80% of the peak value. By your definition, we've been in a bear market for seven to nine months, and I can't see why this cycle is so different.

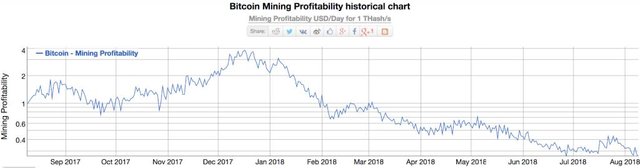

Hashrate

In the past 7 months, the mining rate has increased two times. This is how many times the bitcoin network calculates every second. According to Tuur

Demeester's argument, which means that a large number of new and more efficient mining equipment has been on-line.

If you're a miner without these machines, your profitability has fallen dramatically, which means you need to sell more bitcoins to cover the cost. We can estimate that about 1,800 bitcoins are mined every day (12.5 bitcoins per block, 144 bitcoins per day), so the miners are under a lot of pressure to sell because they are forced to sell bitcoins instead of holding bitcoins to pay for them.

Bitcoin's mining profit margin, in dollars, is 92.6% lower in each transaction than it was in December.

ETF delay

A popular view is that the regulated bitcoin ETF will bring a lot of money to asset classes, which will push up prices. The catalyst is usually compared with the first gold ETF, which was approved in 2004 and gold prices rose by 350% in the second year. Last week, the US Securities and Exchange Commission postponed its decision on the ETF proposal until the end of September 2008, and the ETF placed high expectations on the commodity-backed Bitcoin Exchange Trading Fund, Vaneck SolidX.

It makes sense that the ETF approval process gives the SEC a total of 240 days after submission to the Federal Gazette, including the extension they are allowed to make, and that the SEC will use all the time available to it. More time means more information and research about potential spot markets, enabling the SEC to make stronger and wiser decisions. The next extension is expected in late September, and the final date for a decision on the proposal will not exceed February 18, 2019. Therefore, do not expect ETF to push ahead with the next bull market in 2018.

Metcalfe's law

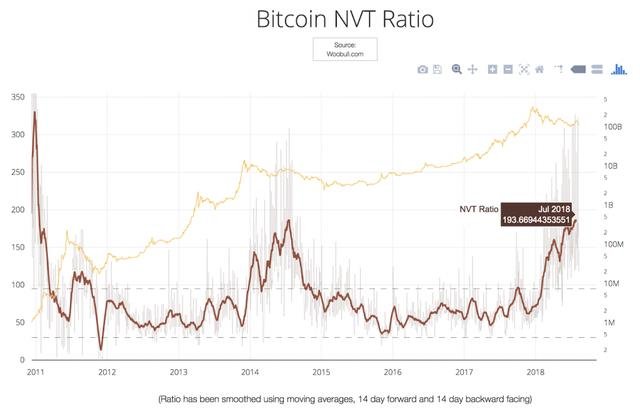

Metcalf's law describes the network effect in technology. The ratio of network value to Metcalfe (NVM) comes from this theory. Between 2015 and 2018, the NVM ratio showed that Bitcoin was undervalued by comparing its price with the number of activities on the chain, but in 2018 it changed - Bitcoin prices began to catch up with standardized NVM ratios.

Now, this ratio shows that the current market value of bitcoins is too high when considering trading activities. A similar comparison is the ratio of network value to transaction (NVT), which is compared with the PE ratio of stock market. This ratio is calculated by dividing the network value (market value) by the daily dollar transaction volume of bitcoin, or the token supply/bitcoin transaction volume. High NVT ratios may mean high growth or unsustainable bubbles, but ultimately it simply means that the network is overvalued compared to the money it transmits.

In 2018, the proportion of NVT increased from 65 to 193.

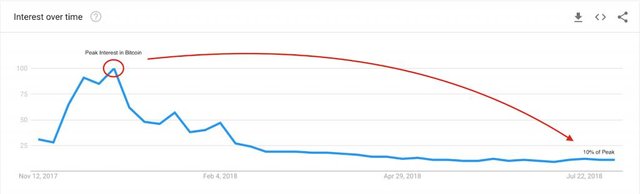

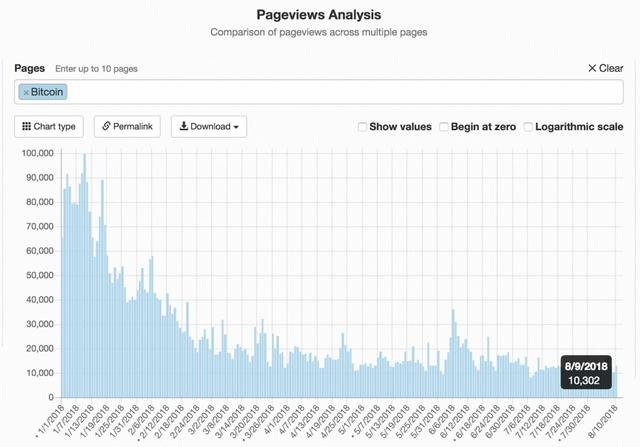

Retail interest rate

As prices plummet, retail interest rates gradually decreased in 2018. These retail investors worry that they miss the next big thing and are willing to buy Bitcoin at any price, because Bitcoin is growing exponentially to make sure they don't miss the chance to make a fortune. This is a catalyst that keeps pushing prices and volatility higher and higher. Bitcoin revenue fell by 50% compared with 2017, Google's search volume for Bitcoin dropped to a tenth of late 2017, and daily visits to the Wikipedia page for Bitcoin dropped by a tenth.

Regulatory clarity

In 2018, there were some clear regulations on regulation --- the SEC's William Hinman, outlining that Bitcoin is not a security. If the Bitcoin bull market is to become a global medium of exchange and value storage, more regulatory certainty is needed at the global level, not just in the United States.

When the Winklevoss ETF was rejected again half a month ago, one of the main reasons was speculation that the underlying spot market for the asset was manipulated. Governments around the world need to determine how to treat Bitcoin for tax purposes in the long run, and the underlying spot market needs to become more mature (to ensure there is no manipulation) to allow more money to flow into Bitcoin. These two variables take time.

Reasons for long-term prospects

6 long term catalysts and theories that have been followed closely indicate that there is a positive situation in bitcoin.

RMB

Most analysts agree that the best use case for Bitcoin now is cross-border payments - more specifically, feeling that it is best suited for capital flight and illicit money laundering because of regulatory constraints. This has led some to believe that the price of bitcoin is negatively related to the price of the renminbi. In 2018, the price of the renminbi has been falling relative to the dollar, which may indicate that if the exchange rate continues to fall, this could be a potential catalyst for capital to enter Bitcoin.

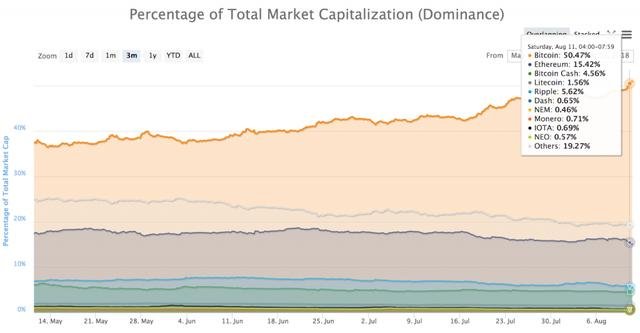

Bitcoin dominant position

I strongly believe that the undervalued projects of the 2017 ICO boom were the catalyst for the 2008 bear market, and that capital needed to be drawn from these overcapitalized projects to flow into the Bitcoin market to achieve the next bull market cycle. This means that the dominance of Bitcoin needs to be raised to a certain level, which I believe is well above 60%. In 2018, the dominance of bitcoin has been growing, climbing from 33% to 51%.

District awards halved

By May 2020, the award of bitcoin will be reduced from 12.5 BTC to 6.25 BTC each. From the following points of view, the profits of miners will be reduced or inflation will be reduced.

First, the halving of the block award is a positive sign, as it has had a positive impact on the price of the Bitcoin in the first two times. Second, because of Moore's law, the miners will continue to become more efficient by May 2020. Finally, basic microeconomics tells us that a decline in annual inflation from 3.7% to 1.79% will have a positive impact on Bitcoin prices.

ETF approval

As mentioned earlier, ETF will not be approved in 2018, but bitcoin ETF will eventually be approved. Once approved, institutional funds can easily buy Bitcoins from unregulated spot markets, and regulatory solutions will be in place.

Best-quality investment funds invested in Bitcoin are very good for the market, but the endorsement of the ETF provides a framework for trillion-dollar wealth funds to safely allocate the "high-risk" portion of their portfolios to Bitcoin. Personally, this is a better way to allocate funds than to invest in bad debt or negative income bonds.

Regulatory clarity

I think the U.S. government, especially after the Securities and Exchange Commission's announcement of Hester Pierce, is open to more exploration of Bitcoin and the promotion of technological innovation. As mentioned above, regulatory certainty, such as how Bitcoin is taxed globally and how citizens buy it safely, takes time, but I think the government is willing to provide a framework for the peaceful coexistence of Bitcoin, the legal tender and the government. As far as Bitcoin is concerned, I think the government wants a completely transparent chain of blocks so that they can monitor all transactions. Remember, bitcoin is anonymous, not anonymous.

Gold in the future

It may be an exaggeration to say that bitcoin will replace all the gold in the world someday.

I think Bitcoin is a great way to store the value of gold because it is superior to gold in terms of low storage costs, no capital controls, divisibility, no counterparty risk, and a fixed supply - and every year more and more gold is found and added to world reserves.