According to the latest report from the data provider in the chain Glassnode, Bitcoin (BTC) mining revenues have increased by 57%, regaining mid-2020 levels.

After the anti-crypto mining campaign by the Chinese government a few months ago, which displaced a significant percentage of global miners, mining levels fell sharply. In May, Bitcoin’s mining power peaked at 180 EH / s before falling by more than 50% following Chinese government action.

Currently, grid hashrate has increased by 25% since the May crash and stands at 112.5 EH / s.

Meanwhile, miners also recorded an increase in revenue due to the recent decline in network difficulty. After the Chinese government restricted mining activities in its jurisdiction, the difficulty of the network dropped significantly, causing a massive increase in profitability for mining pools in the US and EU.

Since the last BTC halving in May 2020, miners ’incomes have steadily dropped from 9.5 BTC per EH to 5.6 BTC per EH. However, over the last two months, the net position of the mining accounts balance has increased to +5,000 BTC per month. This development shows a significant reduction in selling pressure around Bitcoin, which recently controlled the market.

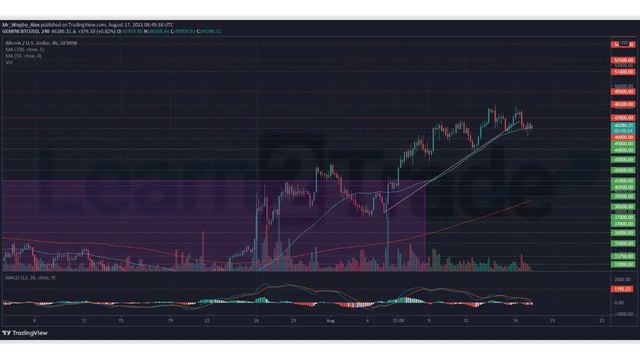

Top Bitcoin levels to see - August 17th

As predicted in our previous analysis, BTC had posted a steady correction towards the $ 45,000 axis to get out of the excess buy order. That said, the price is ripe for a healthy return to resistance at $ 48,300 in the near term as trading conditions return to neutral levels.

BTCUSD - 4 hour chart

However, the crucial point to break for bulls is the $ 46,600 level, which has acted as a strong ceiling for BTC over the last few hours. However, our trading bias remains bullish, as long as Bitcoin holds over $ 45,000.

Meanwhile, our resistance levels are at $ 47,000, $ 48,300 and $ 49,500, and our core support levels are at $ 45,000, $ 44,000 and $ 43,000.

Total Market Capitalization: $ Trillion 1.99

Bitcoin market capitalization: $ 868.1 billion

Bitcoin dominance: 43.6%