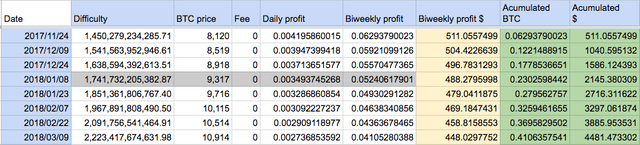

Let’s see the predictions for sun-mining from November onwards (http://www.cloudmininganalysis.com/2017/11/25/sun-mining-predictions-since-november-2017-for-btc-contracts/) . For the calculations we will make some assumptions regarding the last 6 months of BTC:

Difficulty increase of 6.294285714% every 2 weeks

Increase in BTC price of $ 399.0714286 every 2 weeks

For the example we will use this contract:

Duration: 3 years.

Hashrate: 24,200 GH/s.

Daily maintenance fee: None.

Price: $4,024.

Break even

Should we contract it today, the investment would be recovered in 4 months.

1 year predictions

In the first year we would have mined 0.8317 BTC, which would be equivalent to $14,720.9154, or what is the same, a ROI of 365.8279%.

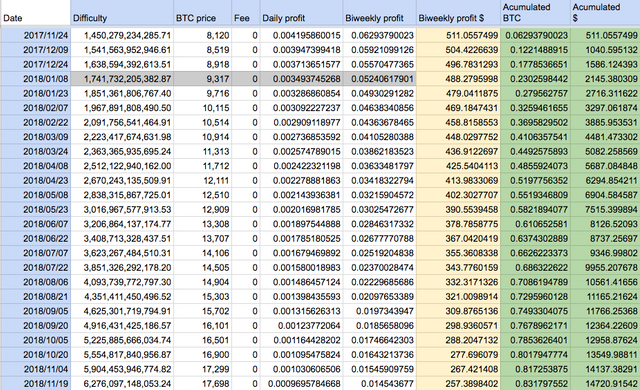

Until the end of the contract

The contract would last until October 2019, having been mined 1.0434 BTC, which would be equivalent to $38,869.4899, or what is the same, a ROI of 965.9415%.

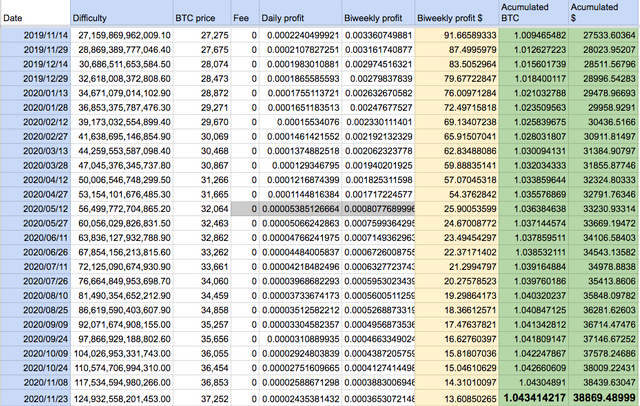

Mining BTC vs BTC direct purchase

If we buy $4,024 in BTC today (1 BTC = $8,630), we could buy 0.46628041 BTC.

For the mining contract it would be 1.04341421 BTC in 2020. We would obtain 123% more BTC.

If the post has been useful for you and you have thought about investing in sun-mining, you can do it through this link.

https://sun-mining.com/en/prices

See you next time!

Very nice post. I will make some calculations, but I think I will get this one. Cya.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit