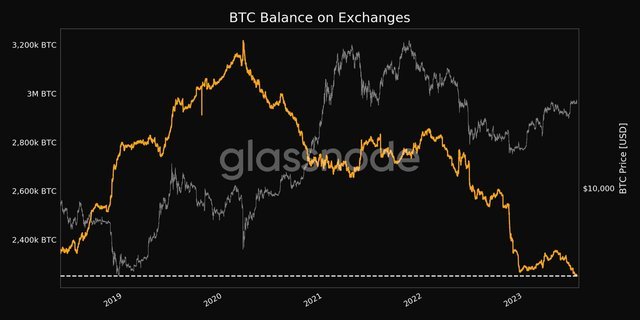

The balance of Bitcoin (BTC) held on cryptocurrency exchanges has reached its lowest point ever, signaling a significant shift in the crypto landscape.

Many individuals invested in cryptocurrencies have experienced challenges with various coins such as LUNA and FTX. These instances have highlighted the risks associated with holding wrapped BTC on alternative blockchains or keeping BTC stored on exchanges.

Consequently, a trend has emerged where investors are transferring their BTC to private wallets for enhanced security. However, this has resulted in reduced BTC liquidity on exchanges. This reduced liquidity implies that fluctuations in BTC prices could become more pronounced when buying or selling occurs. The scarcity of BTC is becoming increasingly evident and is likely to intensify over time.

Should BTC-based exchange-traded funds (ETFs) receive approval or if BTC becomes an accepted form of legal tender in emerging economies, the current low liquidity situation could act as a catalyst for a substantial surge in BTC value.