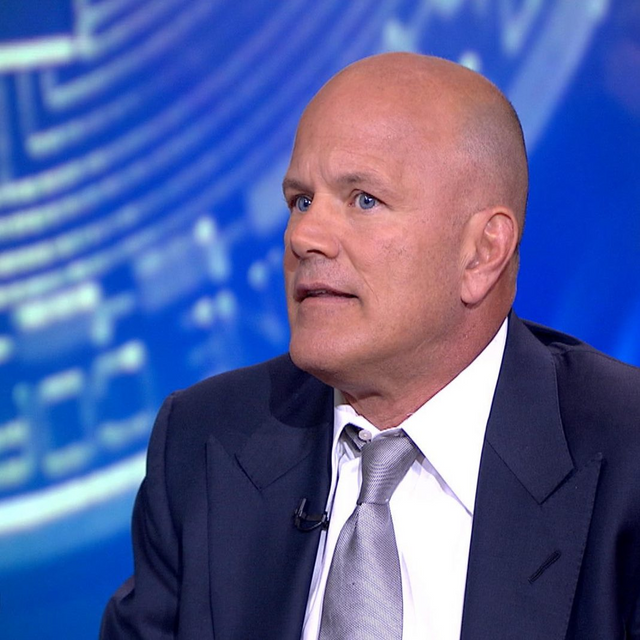

The financial mogul Michael Novogratz, a former Fortress Investment Group executive, stated back in September that he planned to start a cryptocurrency hedge fund. Now according to reports, the former macro trader is putting the hedge fund on hold as he’s not as confident as he once was, regarding bitcoin’s price. Novogratz believes the price of bitcoin is headed for the $8,000 range in the short term.

Former Fortress Macro Trader Michael Novogratz Once Believed Bitcoin Would Reach $40K by the End of 2018

Bitcoin markets have seen a bearish decline, and the dip seems to be depressing some of the most prominent proponents. Michael Novogratz has been a staunch believer in bitcoin and other cryptocurrencies for quite some time, and back in September, he announced he was creating a digital asset hedge fund. At the time Novogratz said he would build a $500 million dollar hedge fund by initially investing $150M of his own funds. The financial luminary explained the fund would invest in specific cryptocurrencies as well as initial coin offerings. On November 27 Novogratz was extremely bullish predicting the price would continue to gain exponentially in 2018. Novogratz stated on CNBC’s Fast Money:

Bitcoin could be at $40,000 at the end of 2018 — It easily could

Novogratz and Partners Do Not Like Current Market Conditions and Decide to Shelve Cryptocurrency Hedge Fund

However, after bitcoin’s value lost over a third of its value in less than a week, Novogratz is far less confident in the price. Novogratz has detailed to the financial publication, Bloomberg, that he plans to “shelve the cryptocurrency hedge fund” as he sees bitcoin’s price dropping further. The former macro trader believes the price could drop to the $8,000 range in the short term.

“We didn’t like market conditions, and we wanted to re-evaluate what we’re doing,” Novogratz explains during a phone conversation.

I look pretty smart pressing the pause button right now.

Traders, Bitcoin-Based ETF Applicants, and Crypto-Enthusiasts Are Not Sweating the Recent Drop in Value

The decision Novogratz made coincides the recent launch of mainstream futures options connected to bitcoin by the firm’s Cboe and CME Group. Further many firms are more optimistic about the launch of bitcoin-based exchange-traded funds (ETF) now that bitcoin futures products are here. Speculators believe the U.S. Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) will soon approve ETFs recently filed by Rex, Vaneck, Protoshares, and the NYSE. Novogratz’ decision to put the hedge fund on the shelf shows the recent dip has shaken mainstream investors. However, the current BTC price decline has not stirred long-term bitcoin proponents as one enthusiast.

Bitcoin has “crashed” 30 percent six times in 2017 — Each “crash” has been followed by an increase of: 76%, 237%, 183%, 165%, 152% — Bitcoin takes seven steps forward, two steps back, seven steps forward, two steps back — Every two steps back is heralded as the end of bitcoin…Relax!

What do you think about Michael Novogratz putting his cryptocurrency hedge fund on hiatus and now predicting bitcoin’s price will drop to $8,000?

Comment and Upvote!

could you please share your source bud

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit