TLDR: Not your keys, not your Bitcoin. Don't trust. Verify.

(image from Google image search, credit goes to mumbrella.asia)

Here is the man: https://twitter.com/APompliano/status/1207629353112285185

1️⃣ eToro

2️⃣ BlockFi

3️⃣ Crypto.com

4️⃣ Coinmine

1️⃣ eToro is 💩

https://www.etoro.com/trading/free-stocks/

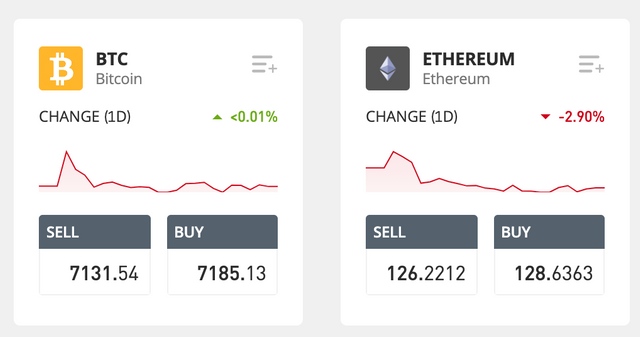

No fees. Just a massive spread. Make "no fees" your marketing tagline and earn on the spread. Make it look like a social game to make people click more. Fucking clever.

1092 employees on LinkedIn: https://www.linkedin.com/company/etoro/

2️⃣ BlockFi is DYOR

(do you own research and know your appetite for risk)

https://blockfi.com/securely-stored-assets

BlockFi operates under Article 9 of the Uniform Commercial Code, which governs secured lending and file a UCC-1 with the state you reside in. The UCC-1 document is simply a legal form which informs your home state that BlockFi is in possession of your collateral. This is done as a fall back in the rare event BlockFi were to become insolvent. This regulation only applies to residents of the United States, international applicants do not follow this process. Additionally, we work with a 3rd party loan servicer that is set up to guarantee execution of loan contracts.

What does it mean exactly? It's a common technique used by scammers - throw a lot of technical information so that it is impossible to analyze everything by yourself.

guarantee execution of loan contracts

If you go out of business (exit scam) who do I ask for money, I'm an international applicant BTW?

I need to verify with Gemini (Winklevoss twins) if they really use their custody.

6% of interest for BTC?

If something is too good to be true, it probably is.

- I don't trust institutions

- I don't trust US jurisdiction (Seychelles would sound more legit)

- Counterparty risk, fraud, theft...

- ...mostly the human factor, insider threat

51 employees on LinkedIn: https://www.linkedin.com/company/blockfi/ -

(I and my buddy spent 5 years at uni, just messaged him on FB)

Sun 22 Dec 2019 UPDATE:

I agree with the sentiment in this article: https://coinrivet.com/is-the-6-interest-on-blockfi-too-good-to-be-true/

BlockFi claims it can “immediately halt deposits and withdrawals of cryptocurrency either temporarily or permanently. BlockFi is not and will not be responsible or liable for any loss or damage of any sort incurred.”

The company goes on to state: “Your Crypto Interest Account is not a checking or savings account, and it is not covered by insurance against losses.”

I have also asked the customer service why I do not see the loan rates: https://blockfi.com/rates

We expose the interest rates in the loan application work flow because at that point we know the customer's jurisdiction and LTV. We don't expose the rates on our general site because they vary jurisdiction to jurisdiction based on local regulations and LTV options available and there are way too many combinations to list.

Being an international customer some of the terms/restrictions may not apply to you.

One more snippet from that article:

They are not in the same mould of a typical cryptocurrency scam. This is a legitimate business.

Despite this, there is certainly a risk associated with what BlockFi is offering, so like Pomp says: make sure you do your own research!

DYOR

3️⃣ Crypto.com is doing interesting tricks with staking

It's $12m domain name, well done.

Use my referral link https://platinum.crypto.com/r/4szduxs5kh to sign up for Crypto.com and we both get $50 USD :)

You'll need to stake 50 MCO for 180 days. I am aware that is not ideal but I thought - reasonable risk-reward ratio. Once I did it, I also staked 10k CRO and purchased another 32k CRO to participate in the "syndicate": https://twitter.com/cryptocom/status/1207235448566734848

Across all the companies, they seem the most legitimate to me.

202 employees on LinkedIn: https://www.linkedin.com/company/cryptocom/

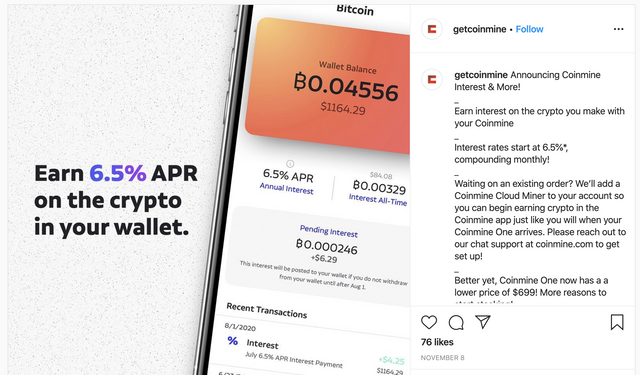

4️⃣ Coinmine is total 💩

Pinned tweet: https://twitter.com/coinmine/status/1142152716141023232

You can check the Instagram feed and notice that the thing on the right looks exactly like a GPU:

GPU is not ASIC. You mine Bitcoin with ASIC, not GPU. See the FAQ: https://coinmine.com/pages/faq

RX580 (or similar) 8GB GPU, Intel Celeron CPU, 8GB RAM

Can you mine Bitcoin with that? Of course, you can. You can also use pencil and paper: http://www.righto.com/2014/09/mining-bitcoin-with-pencil-and-paper.html

Just don't expect any profits.

If you want to have a full node try Node Launcher: https://medium.com/lightning-power-users/windows-macos-lightning-network-284bd5034340

I would categorize Coinmine as home decoration, not mining equipment. It is marketed as such - lifestyle design as opposed to raw power parameters. On top of that, they offer 6.5% interest on BTC, which is even more than 6% offered by BlockFi. Took a screenshot in case it will be used evidence in the court of law: https://archive.is/clp9l

9 employees on LinkedIn: https://www.linkedin.com/company/coinmine-inc

(that should be home decor in IKEA, not marketed as mining equipment)

➡️ Don't trust. Verify.

My family stopped liking me (I hope they still love me) when every discussion was ending with:

- how did you verify that

- how can you prove it

- how can I trust you

- how can you trust them

- what was their incentive

After some time we agreed that there are more important things to do in life, Bitcoin principles are not always applicable.

Not your keys. Not your coins.

https://twitter.com/lightcoin/status/1098406616347697154

[Jan/3➞₿🔑∎]

Personally I'm OK to hold 5% of total BTC value in various custodial services or a hot wallet. Pure convenience and usability.

Here is a decent video by Andreas

Use your own brain

I was thinking about expressing my disagreement by saying:

"shilling frauds and accepting money from frauds makes you a fraud"

There are various considerations of the word "fraud" and I'm genuinely concerned that someone could sue me, just like CSW - https://steemit.com/bitcoin/@genesisre/craig-wright-is-a-fraud-as-anyone-can-see

Is selling overpriced and unsuitable products due to clever marketing and branding a valuable / noble / worthy thing?

(totally unsure)

🤑 FREE MONEY

If you like this post - https://docs.google.com/document/d/1rdOkzBGCCi9KEYnkYTjElH1ZAXWQWZ6vVZR7AuUlPfM/edit - here is a bunch of referral links, you can help me earn 1000 supercharger miles for my Tesla ⚡️⚡️⚡️