Bitcoin has slightly moved up by the news that a ETF is in reach.

But if we draw the main lines in the BTC price chart, we see there is no bull run, and dropping back to $3150 may happen again.

If we zoom in, we see the main line almost overlaps the current consolidation line.

The Bitcoin price is still following the hash rate, and the BTC hash rate is going up, so that is some good news :

Why $3170 is the bottom, because the cost to mine 1 bitcoin depends on the mining cost in China, and lies around $3170

If the BTC price falls below this, miners will stop selling or mining.

https://www.elitefixtures.com/blog/post/2683/bitcoin-mining-costs-by-country/

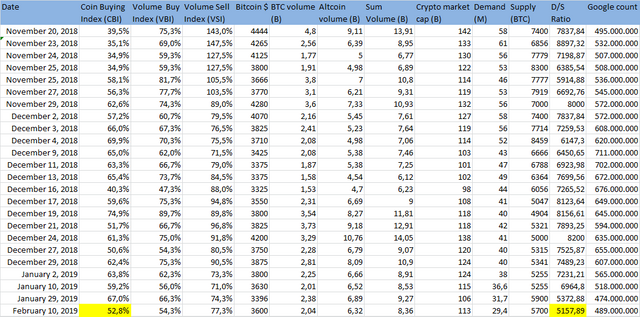

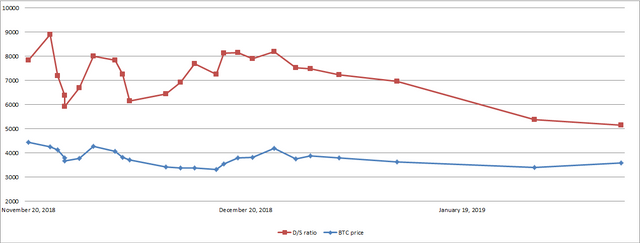

But as we know there are more numbers to take into account, and the most important is the D/S ratio.

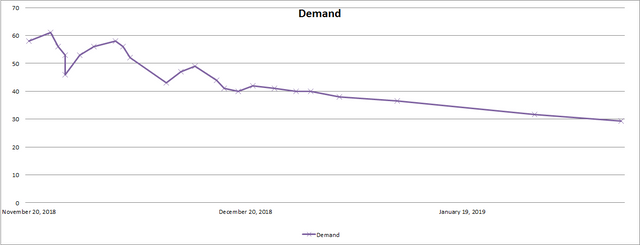

The demand is still at the the lowest value 29 Million and supply is high around 5700 BTC, so not good.

The Coin Buying Index (CBI) is at 52% and volumes are much to low.

The D/S Ratio is at his lowest point 5158.

Demand:

Probably around Februari 14, 2019 at Valentine's Day, Ripple will anounce his official deeper Partnership with Amazon

The Ethereum hard fork around February 25 will bring some boost

https://steemit.com/bitcoin/@goldmine2018/ethereum-hard-fork-around-february-25

And maybe Bakkt will be approved or delayed again ;-)

https://coingape.com/bitcoin-bakkt-new-launch-date-now-later-this-year/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit