Following a strong weekly Bitcoin Price advance by the Bulls, the Bears are back in control, rejecting price at the 50-week Moving Average, triggering six consecutive red candle days, breaking the price down towards the previous support at $7,300.

MARKET OVERVIEW

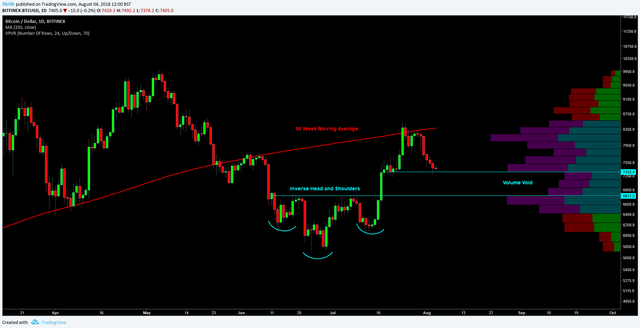

The Bulls will need to make a strong push over the weekend to rescue price from falling back towards the $6,800 range, where price initially broke out from an Inverse Head and Shoulders bottom.

The volume profile as shown on the right-hand side of the daily chart illustrates that there is a void in volume between $7,332 and $6,821 — meaning a breakdown from $7,300 will likely see a quick movement back towards $6,800, where previous resistance may turn into support.

The bulls have found some recent temporary support in the $7,300-$7500 price zone, from which price action broke out powerfully over ETF price speculation- After many Bulls took profits in the run-up to $8,500 and ahead of any news, this may be viewed as an opportunity to enter the market. The bulls will need to avoid a weekly close below $7,500 — which would represent a full retracement of the highs achieved in the last week of July.

In the immediate term, we expect the more conservative traders to look at prices above $7,700 for bullish entries and below $7,300 as bearish opportunities.

DAILY CHART

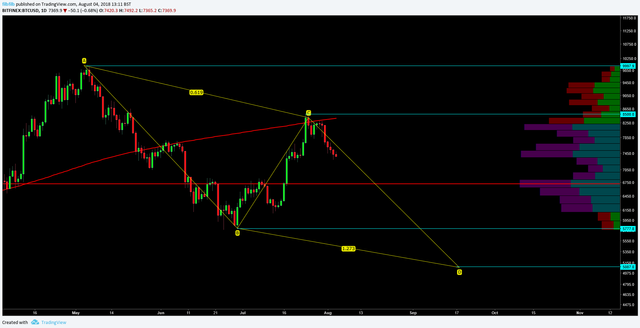

Another argument for a risk of a breakdown would be that a reversal back to the breakout level would represent a 61.8% Fibonacci retracement from the lows at $5,780.

A bounce from the $6,800 range may offer the bulls another attempt towards $9,000 and the completion of an AB=CD bullish advance, where the lines AB ($5,700-$8500) and CD ($6,820- $8,980) represent the bullish legs while BC ($8,500-$6820) is referred to as the retracement or correction.

A catalyst for this could be positive news by the SEC around the Cboe/VanEck/Solid X’s Bitcoin ETF decision expected sometime on August 10 — or simply a longer term bottom has been found.

LOOKING AHEAD

Failing a bullish advance, the bears may look to capitalize on their own AB=CD, which may have begun at the May highs of $10,000 and complete toward $5,000 — with the recent run up simply representing a correctionary phase in a larger bearish trend from December highs.

As we warned last week following a positive Weekly and Monthly close, nothing fundamental has changed. With ETF speculation-fueled price action, the fundamental narrative remains. It is important to remember that the bulls are attempting to recover from lower lows at $5,800. In order to confirm a bull market, a higher high over $10,000 followed by a lower low, must be found — otherwise, the bears will capitalize on any uncertainty and look to test $5,000.

Where do you think Bitcoin price will go this weekend? Let us know in the comments below!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcoinist.com/bears-capitalize-uncertainty-bitcoin-price-drops-below-7300/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit