As we saw in 2017, crypto markets could create unprecedented opportunities. The question is: how to catch them properly? Well, there is a whole galaxy of different methods: from simple holding to day-gambling on 1-minute charts.

But one particular approach is so well-known that everyone almost forgot it.

Yes, I'm talking about trivial moving average method. Only with one little nuance: I use EMA instead of SMA. The nature of crypto markets seems more dynamic, so the indicator should be more responsible. I'll show you how effective this "prehistorical" techniques can be in a well-trending markets.

Disclaimer: this is not financial advice. I'm not your financial adviser, I'm just a guy who loves markets and data.

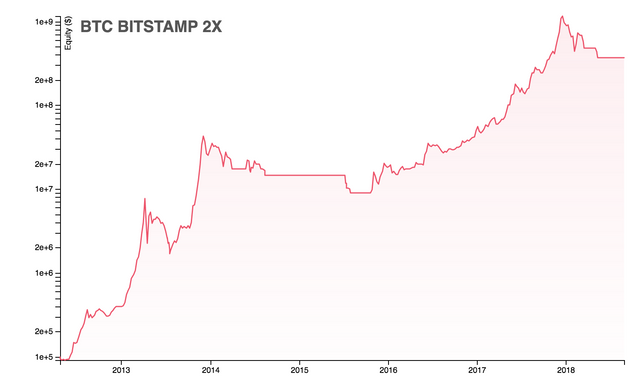

Bitcoin

Let's assume that we are in the year 2012 and luckily we know about Bitcoin.

From today's perspective it sounds awesome, right? But there is one little obstacle: we know absolutely nothing about the future. Maybe we just feel that something big is coming.

To execute this investment idea, we need a simple bulletproof method. And here it is:

* Buy when: EMA(9) - EMA(200) > T

* Sell when: EMA(9) - EMA(200) < -T

* Stop: buy_price - price > T_stop

where:

T = threshold for buying/selling, %

T_stop = threshold for a stop, %

Looks too simple, isn't it? Let's test.

I’ve built an emulator which starts with $100,000 of initial capital and uses 15-minute data to update daily candlestick chart. Also, it incorporates some of the best back-testing practises (such as methods preventing look-ahead bias).

With randomly selected constants T = T_stop = 5.0 we got 1000x return:

Trades: 32

Performance: 1107.19

Drawdown: 0.72

It performs almost like "buy and hold", which gives us (in today's prices): $6700 / $5 = 1340x. But here is the trick: why not to add a reasonable level of leverage? Even with modest 2:1 we get this:

Trades: 32

Performance: 3678.66

Drawdown: 0.79

Because of the tight stop we got an opportunity to use borrowed money without much risk. Obviously, we can't easily do the same with usual Buy-N-Hodl strategy (risk of liquidation will be pretty high).

But hey, lets be realists, in 2012 Bitcoin was almost a free money, let's check more recent entries:

| January of ... | Profit |

|---|---|

| 2012 | 1107x |

| 2013 | 641x |

| 2014 | 9x |

| 2015 | 24x |

| 2016 | 15x |

| 2017 | 7x |

One note about 2014: in January the price was almost near the peak, so it is not very smart to enter the market in such conditions

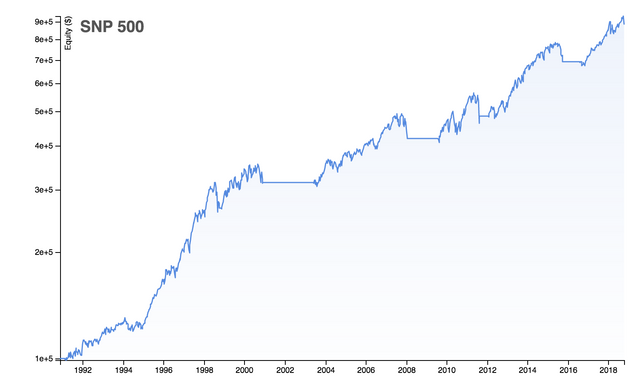

S&P500

Running the exact same algorithm on S&P500 sounds like a lame idea, but we'll give it a try.

Trades: 11

Performance: 8.92

Drawdown: 0.18

Simple Buy-N-Hodl since 1990 will make for us 2790/332 = 8.4x - slightly worse result with a much bigger drawdown 50% vs 18% (!). Do you have a feeling that we just opened some kind of secret?

Last, but not least:

GOLD

Trades: 14

Performance: 3.0

Drawdown: 0.32

Since 1th January of 2000 the algorithm showed not-so-good performance: 3x vs 1226$/283$ = 4.33x, but again with better drawdown characteristics. I think we can make a discount: it hasn't been changed or optimized at all.

Conclusion

Robustness of this approach got me thinking there is a dirty secret behind the markets. My theory states that banks and hedge funds still actively use similar approaches to spot the trends. Although some articles tell us that the era of trend-following is ended, I don't see that happening anytime soon.

Could I feel FOMO after that discovery? Do I need to know where the price will go? No. I'm just patiently waiting for good old 200-day crossover.

Thanks for reading!

Congratulations @guest2888! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @guest2888! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @guest2888! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit