.jpg)

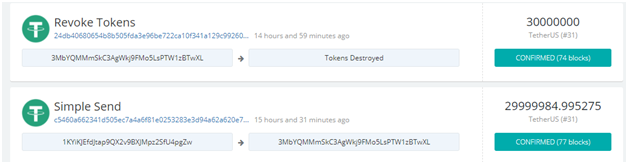

After heightened printing activity, the Tether mint wallet saw a strange transaction, a return of nearly 30 million tokens. After that, in a second transaction, "Revoke Tokens" were burned.

This brings down the total supply of USDT to 2.8 billion, and the circulating supply to around 2.1 billion.

So far, there has been no official statement from Tether on why the tokens were destroyed, or if the amount has any relationship to the 30 billion heist at the end of last year. It is possible that the burning of tokens is a move undertaken in response to the accusations of injecting fake liquidity to prop up the price of Bitcoin.

A Tether first. Tokens destroyed.

Let's get all of them destroyed. pic.twitter.com/f5m2WLqA8M

— Bitfinex'ed 🔥 (@Bitfinexed) 31 січня 2018 р.

While the USDT token has managed to keep its level steady surprisingly well, the accusations also include the potential for insider trading, spoof orders, or artificial buying, to prop up the price of Bitcoin. Even mainstream publications like the New York Times are now paying attention to the effect of Tethers on the Bitcoin price:

"It could mean that a lot of the rally over December and January might not have been real," said Joey Krug, the co-chief investment officer at Pantera Capital, one of the leading crypto investment funds.

Skepticism about Tethers rose to a new peak as it became clear that Bitfinex got a subpoena from Commodity Futures Trading Commission. Without further details on whether the event was a technicality, the crypto community became even more wary. Closely connected, Bitfinex and Tether have already distributed USDT tokens to a multitude of exchanges.

Tether tokens represent a risk in many ways. At the moment, they are a convenient way to transfer assets between exchanges, without relying on fiat and bank transfers.

But as a store of value, it is unknown how long the community would trust the token, instead of moving into another type of asset. Currently, there are new exchange-related tokens, but the USDT is much more widespread and covers more trading pairs.