Over the past few weeks, many people have noticed that bitcoin core network fees and transactions times have been a lot better than two months ago when fees reached highs of 1,000 satoshis per byte or $30-40 per transaction. Many people are wondering why these issues have subsided, and some people believe it is due to a practice called ‘transaction batching.’

Is Bitcoin Transaction Batching Lowering the Network Fees?

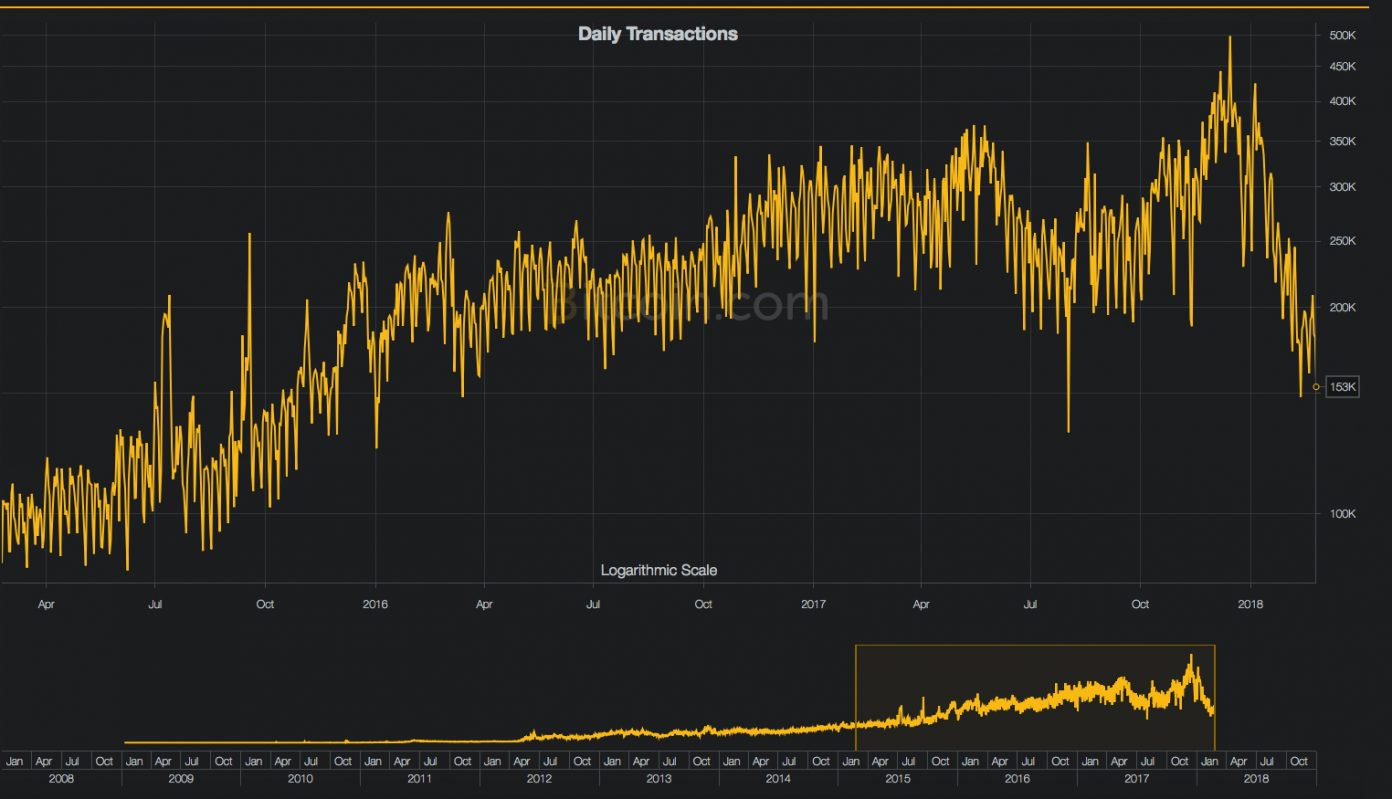

For about two weeks or so bitcoin core fees have dropped significantly after reaching all-time highs a few weeks prior. Multiple theories are being discussed across the web on why the fees and transaction confirmation times have decreased. Some individuals believe the drop is due to the number of daily transactions, as BTC now appears to be used less. Currently, the amount of transactions per day is over 154,000, but during the last quarter of 2017 daily transactions were between 250,000 to 450,000. Another theory is the adoption of Segregated Witness (Segwit) may have helped, but Segwit use still only represents 15 percent of all BTC transactions. Lastly, another opinion of why BTC is operating smoother is because of a process called ‘transaction batching.’ The subject of transaction batching is a hot topic that is being discussed throughout social media and forums right now.

Many Big Processors Are Batching Transactions

Transaction batching is a procedure that allows individuals and businesses the ability to group multiple transactions into one TXID. This maneuver essentially alleviates more space in processed blocks. Many companies, wallet providers, and exchanges including Coinbase, Shapeshift, Kraken, and others have begun to bundle multiple transactions. In the past individuals and businesses would send each transaction with its own unique TXID, but would have to pay fees for each one. This past week the peer-to-peer platform Shapeshift revealed it was batching transactions in order to save space on the chain and save customers money on network fees.

“If you’re a customer, you’ll notice significantly lower transaction fees, currently better than any other exchange in the industry,” explains the company.

The Downside to Transaction Batching — Less Privacy

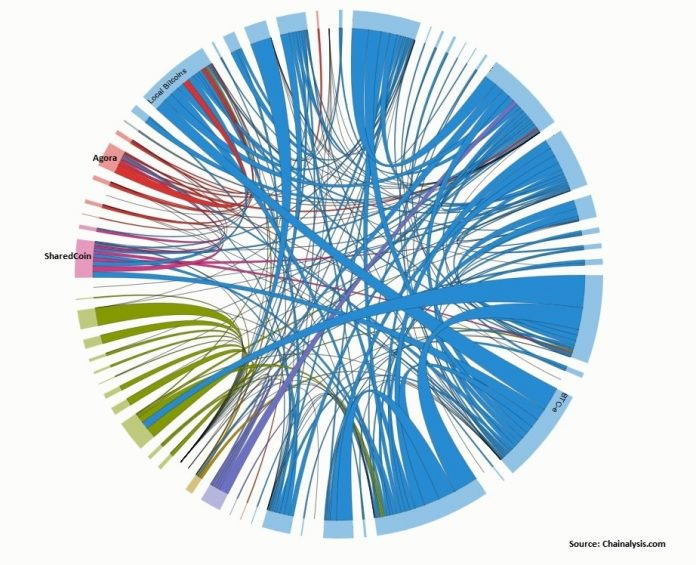

To some individuals the benefits of batching transactions can be seen with fees being lower and a less congested network. However, some people believe there are significant drawbacks — most notably centralization and a lack of privacy. Take for example if a made-up exchange called ‘Centrali’ decided it was going to batch transactions after realizing it was paying erroneous fees for every single transaction processed. Although, if a Centrali customer looks up his/her transaction they will notice their transaction would be combined with hundreds of other people using the same service; Centrali. Some people would have a hard time figuring out who these transactions belonged to using a simple blockchain explorer, but companies like Elliptic, Bitfury, and Chainalysis would likely have a field day with batched transactions. Because Centrali used a batching method, blockchain surveillance companies could easily be able to identify transactions with connected change outputs and other bonded spending habits.

Blockchain Surveillance Sifting Through Batches Would Likely Be Able to Figure Out Inputs and Outputs Tethered to Wallets More Easily

The controversial subject has been discussed quite a bit across forums, and social media on whether or not bitcoin transaction batching is a “disaster for privacy.” One particular post on r/bitcoin discusses this subject in great detail, but most of the commenters have a hard time agreeing on if batching is bad for privacy.

“So I hear people complaining that Coinbase does not batch transactions. But do we really want this? Anyone could easily make a lot of small transactions scattered and link anything in the batches with Coinbase,” the Reddit post states.

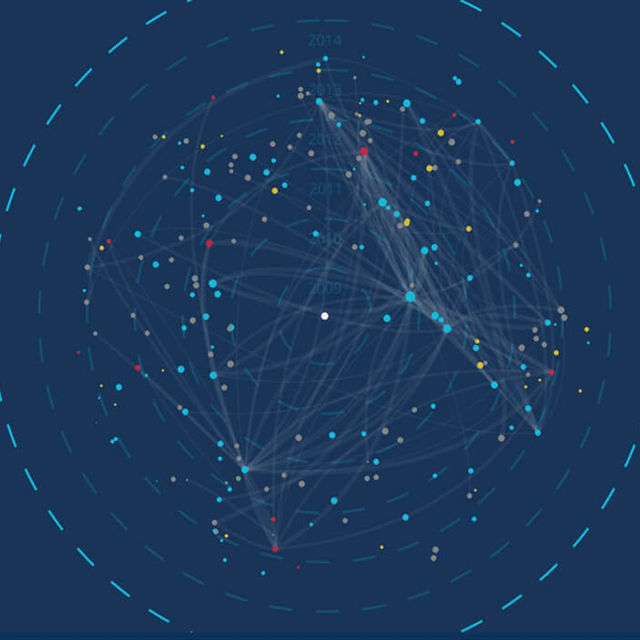

Blockchain surveillance companies use a lot more techniques than just a simple blockchain explorer. For instance, Chainalysis’ clustering algorithm for this data was intended to isolate sub-economies, and not see each individual trades (“hops”), so the number of hops between exchanges are removed, and you end up with the start and finish of a transaction, and a smooth chord that shows you where the transaction began and ended.

Back in August 2017, the bitcoin developer David Harding described transaction batching as mostly positive, and he explains it will help people save “80 percent on fees.” However, Harding also admits the process might not be very ideal for privacy in his Medium blog post stating:

“When you receive your withdrawal from Kraken, you can look up your transaction on a blockchain explorer and see the addresses of everyone else who received a payment in the same transaction — You don’t know who those recipients are, but you do know they received bitcoins from Kraken the same as you,” Harding explains.

That’s not good for privacy, but it’s also perhaps not the worst thing. If Kraken made each of those payments separately, they might still be connected together through the change outputs and perhaps also by certain other identifying characteristics that blockchain analysis companies and private individuals use to fingerprint particular spenders.

Do the Positives Outweigh the Negatives?

We don’t know if transaction batching is the root cause of the lower fees at the present time. What we do know is a lot of big companies are admitting to processing transactions in this manner leading people to speculate that it is the reason. There seems to be some benefits to the action, but the question is — do they outweigh the concerns over privacy?

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.coinroundup.com/transaction-batching-good-for-fees-bad-for-privacy/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit