SUMMARY

I want to emphasize my prior post on Aggressive Equity Portfolio. I don't think readers and followers truly understood the value and proven efficacy of this method. I have found no other, near hands off method that literally beats the SPX, every mutual fund and hedge fund manager, hands down! Sounds too good to be true? Let's test it live!

I will run a validation portfolio for six to twelve months by applying the exact method described for the Aggressive Equity Portfolio. Every Friday, the highest % gaining ETF will be selected and 100% of funds allocated to this ETF. Simple! Easy! But POWERFUL!! This type of actual validation will trump any backtests and doubts.

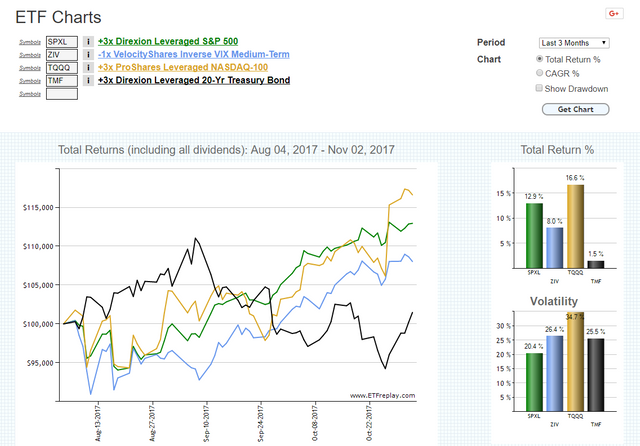

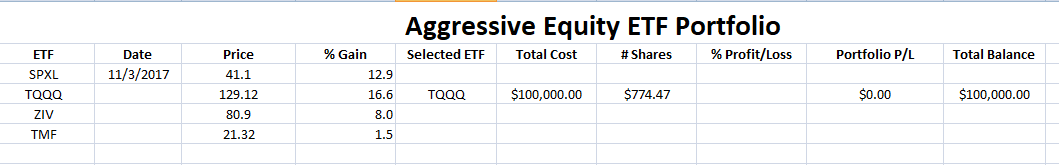

A beginning fund of $100,000 shall be used. The following ETFs (SPXL, ZIV, TQQQ, TMF) will also be applied and charts from ETF Replay. The chart below displays a running 3 months of performance and the highest % gaining ETF today is TQQQ (3x ProShares Leveraged NASDAQ100). So, $100,000 will be applied to this ETF and every Friday, 100% of portfolio funds will be allocated to the prevailing ETF.

The below table will keep a running tally of the performance of this Aggressive Equity ETF Portfolio. Weekly, this Portfolio will be updated per the above guidelines.

The video has more details:

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - d2e60e9856c36f34

BTC Wallet - 15ugC4U4k3qsxEXT5YF7ukz3pjtnw2im8B

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LefeWrQXumis3MzrsvxHWzpNBAAFDQbB66

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

If you could do the same with crypto portfolio! 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm testing it. WIll let you know.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@haejin Any update on your crypto portfolio assessment ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a really interesting approach. Thank you for sharing Haejin!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Haejin! As a newbie i would like to know where i can get an ETF portfolio?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Use Ameritrade. It is user-friendly and the fees are low

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you yetti38519845

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just bought myself some TQQQ to follow along. I am excited to see where this goes. Thanks @haejin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is so interesting. I wish I knew more about Equity ETF's and the terminology you utilize. But I am reading as you go and this has become an invaluable learning tool. Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are there any circumstances where this method fails i.e. loses money? If so, are there any signs that we can use to protect our capital by sitting on the sideline etc? Thank you. I am also testing this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I also notice that the volumes are low for TMF and ZIV. Will there be any liquidity problem when we try to buy and sell? Thanks again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This model will take you out and into TMF (tresaury) if there is a market crash. Why? TMF will suddenly have the highest % gain.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see. I have another question, it's about the 'entry'. Do we just pay the asking price? I usually prefer to bid lower than the asking. Is this different? I.e. buy high, sell higher?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the only one I don't ladder. I just buy at ask.The model itsel idifferent.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice work as always @haejin. Your time and effort are much appreciated.

I am curious about the inclusion of ZIV, specifically because the VIX is sitting at all time lows and the chances of volatility decreasing more from here seems quite low. On the other hand, a significant market drop could cause volatility to spike considerably which could lead to serious losses in ZIV if it was the current system pick. It therefore seems like:

In the case of #2, it could be a real problem if that initial volatility spike was just the opening round. If it was to be followed up with increased volatility, it could lead to massive losses.

This fund did not exist back in 2008 when volatility spiked in a huge way. The next closest was in Aug, 2015. In that case, the ZIV performed very similarly to the SPXL and TQQQ. It's likely that the system would have chosen TMF before the drop.

My question is, why include ZIV at all when often it matches the SPXL and TQQQ, but in the case of a market crash, the losses could be massive?

For additional information, I've linked a couple recent articles from Zero Hedge discussing the current state of the VIX. Thanks for your time.

http://www.zerohedge.com/news/2017-11-25/you-are-here-citis-stunning-vix-chart

http://www.zerohedge.com/news/2017-11-25/muir-traders-dont-understand-risks-shorting-vol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very nice and simple...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit