Greetings fellow cryptonians. The crypto space is an ever-growing exciting place which contains its fair share of bulls. These tend to belong to a younger demographic and also include a few forward thinking mid-life adults . However, we don't see many older people on this space and often these are the ones that are treating Bitcoin as a bubble and refuse to even look at it. Warren Buffet is one of such examples, he has been quoted saying that "Bitcoin is a mirage."

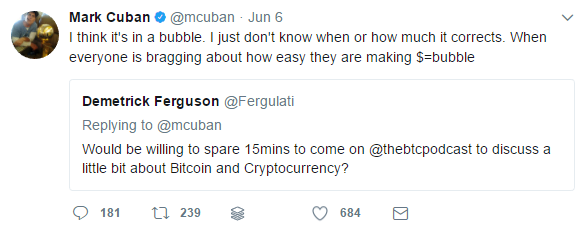

Onto Mark Cuban. He has also been one of those celebrities that mentioned that Bitcoin is in a bubble:

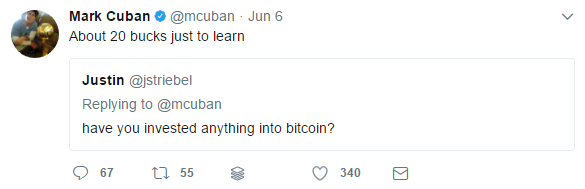

Note that the billionaire investor is getting his feet wet on it with $20 though:

Crazy laws have emerged in a few countries that have banned Bitcoin and other crypto-currencies, in the case of Bolivia, authorities have regarded Bitcoin as a multi-layered pyramid scheme. A remark that I found quite interesting.

Also, before I delve into it more, I'd like to say that I myself am a well seasoned Forex trader who also dabbed in all kinds of derivatives. Stocks, bonds, commodities, indices, precious metals, you name it, I've likely traded it. Recently about 2 months ago I've got my feet wet with cryptos, and I started moving fast to get into Ethereum. I am also a gold-bug. I'm actually more bullish on gold than Peter Schiff himself for reasons I will highlight in this article. Mind you, I don't know it all, and recently as I've been witnessing the amazing crypto gains, I've been pondering about a much bigger game being played here. The real game, not the fake game. The fake game everyone knows about and has 2 facets:

-Bitcoin is going to the moon because it's a new disruptive technology that will change how industry x and y operate etc.

-Bitcoin is going to tank because it's a tulip mania, it has happened before, it will happen again. Nothing is different this time.

Look, what if Bitcoin is a scam? what if Bitcoin is really a multi-layered pyramid scheme?

It has been known for some time that the global elite desires a global currency, a new world order currency if you will, and here we have something that pretty much has all the characteristics of a global currency and despite us all knowing how the new world order conspiracy goes, we are adopting Bitcoin like nothing else exists whilst naively thinking we are giving the banks the finger on this one. We are geniuses!

Ok, but here's what I'm looking at, and also the reason why I've been quite unsettled for the past few days. If Bitcoin reaches the value of 1M usd, then that means that people would still be able to get into this market with something as low as 100$, sure they'd get 0.00010000 btc, but if the fees at that time, with further development, can remain low, then that means that people would still be doubling their money by investing into bitcoin. Just let it top 2M, and your $100 investment is now worth $200. That means that Bitcoin wouldn't be expensive to invest in then. But when would it start getting expensive? Hmm, let's disregard transaction costs for now and say that 500$ = 0.00000001 btc (satoshi). Then the minimum investable amount would now be $500 and that already starts driving up the cost of investing in bitcoin. You no longer can buy 10$ worth of Bitcoin but you straight up have to put $500 down.

But by then how much 1 btc would be worth? That's 5Bn usd per Bitcoin! And the total market would be worth 105,000,000,000,000,000! That's only 105 quadrillions! I know I know, that's a ridiculous amount but did you know that the daily turnover for the forex market is over $4Trillion? Who knows how much money there really is in circulation!? Heck, at the height of Pablo's Escobar "career" the famous drug lord was turning over $21.9 billions per year that would go off the record. Who was accounting for that. That's an example of how events here and there can lead to high discrepancies in the total volume of currency in circulation. Simple Chaos Theory.

Now clearly the fees have to come in here at some point and kickstart this process sooner than this simplistic and idealistic extrapolation, so the total value would likely be less than 105Qn, but you get the problem, right? It is still there.

Now, facing this scenario, there are a few pertinent questions. Satoshi reportedly holds 1M bitcoins, and if 1btc = 5Bn, then 1M btc = 5 Qn! And we are unlikely to know if more buying was done until now through other funds/addresses to the same person/entity. So really, who is Satoshi!? Could Satoshi be part of the invisible hand? Rothschild maybe? They're big enough! And surely this is a time-tested family who has been through the cycles of currency births and deaths. I know it sounds nuts, but think about it, here we are, making a few thousands to a few millions thinking we're all very smart and got it all figured out, but really we may just be the ones that are only faster than the last ones.

Other factor is that for bitcoin to get to such ridiculous value, Bitcoin would have to eat the entire world's money supply. It would likely be done with it before even reaching the idealistic 105Qn. Which poses an entire new set of questions! If Bitcoin starts devouring fiat to increase it's price, then at some point, fiat must start to appreciate due to a lower supply. What happens to Bitcoin when this change starts to happen? Could we actually see bitcoin starting to inflate midway towards the 105Qn mark? In this case we may indeed be in a tulip mania, but this one would be the very first global mega bubble!

![babbddf177dcc3accab37fa2e546144b[1].jpg](https://steemitimages.com/DQmYseYa5NvXMBk78krF5BXM2noTbjnbZWYoJHTX8v6AZ7h/babbddf177dcc3accab37fa2e546144b%5B1%5D.jpg)

Branching off to an alternative plan, who can tell if the whole Bitcoin plan is exactly to devour some supply of world fiat to somehow restore the damage done by quantitative easing? It could be possible that a chain of events would lead to Bitcoin becoming indeed a bubble that would see the price come to zero in a flash and all this wealth being lost.

Also, with all the money moving from fiat to Bitcoin, retail banks may soon witness a shortage of funds, at which point we could trigger a crisis where hyperinflation in certain countries could actually be a possibility. We could expect the price of gold to further evaluate and reach new highs.

So, these are 2 massive plots that go beyond the average crypto Joe's head as of today, 18th June 2017. I do genuinely think there's something more to the whole crypto sphere and that we're being gamed on a level of consciousness we haven't attained, hence, hard for us to be aware of whatever is going on at a higher level.

Call me crazy, but save this article and do check it in a few years. It may make a lot more sense than it does now.

Cheers,

If you see crypto's as money instead of as an investment, you want as many as you can get your hands on without ever cashing out to worthless fiat money again!

I want to get my paycheck in crypto's and pay my bills with crypto's!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I guess that I too would like that. But it could be the case of "be careful what you wish for" because for us who are accumulating now, everything seems great! But things can change very quickly. The example of declaring crypto at the airports can be a creeping way of capital controls we may see in the future.

But assuming that fiat would be nonexistent and only crypto would exist. Then what would be the real value of crypto? How many people are using Bitcoin as of now and if Bitcoin reaches out to everyone, then how much will 1btc be worth? My concern is that the fact that BTC is divisible is creating an illusion that inflation can't actually happen with BTC, I think dilution of BTC through the world populous would likely create said inflation. or maybe it's more accurate to say, perception of inflation in this case. And who says BTC says other cryptos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If we are talking hypothetical, if the world order felt threatened by crypto currencies, they would wait to let it build up and then rip it away. 1 EMP would do it and everyone would be back to gold. We are living in crazy times for sure and I totally understand where this article is going.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome comment! I feel I haven't articulated myself in my best in this article but I can see we are on the same page. I've been pondering about the idea of the NEMP as well, but you can only get so crazy within a single post. That is one of the most fragile points of failure within the blockchain tech and one of the many reasons why I'm still heavily bullish on gold, alongside with the damages of quantitative easing and a malthusian catastrophe leading to societal collapse. Paying attention to long generational cycles.

However I do see a higher likelihood of a new world order somehow taking hold of the tech rather than destroying it. I've posted a new article that has a nice audio file there at the end, the narrator starts by explaining the familiar points of blockchain but around midway he starts exploring how it could be used to enslave humanity. Wild thoughts for the average joe, but like you said, crazy times!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent article. Ill be analyzing it more in depth as soon as I get a chance, but like what I've read.

Keep up the good work- followed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cheers, Thanks a million @Crypt0. Looking very much forward to your hear your thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When you use FIAT to buy cryptocurrencies, you don't burn the FIAT.

It's possible that the same FIAT is used to buy bitcoins over and over again.

Imagine this scenario:

In our small city there's only 3 places:

A farm, a market and a Crypto Exchange.

I farm food, sell it to the market and buy BTC with the money.

The workers of the exchange need to buy food in the market.

Can you understand the loop here?

Now imagine this in a much higher scale.

Even if there's only $1 Quadrillion dollars in the world,

crypto market cap could reach much more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, you do raise a very valid point, you're right. The fiat doesn't simply disappear, so in that sense the fiat supply would remain the same, and with the same relative value.

When you say that the same fiat may be being used to buy bitcoins over again is also very valid point and a massive redflag. This is the sort of stuff that makes me uneasy. This process you've described is what's called money velocity. A high rate of money velocity is a major driver/early-symptom for periods of high inflation and even hyperinflation. Mike Maloney, a well known gold-bug, made this case a few months back that we were yet to see velocity picking up before inflation can really pick up and in turn make the gold price rise.

It's incredible to see that a connection between all the assets is forming. The issue is, in the face of such a massive disruption, what sort of chaos will we actually be subjected to?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is much to consider in this line of thought , much more to discuss and much more to meditate on. Still you have made many broad assumptions, such as BTC dominance going forward. That's not likely, it's decreasing every day.

Free market competition means anyone can enter the field of banking and innovation will continue apace. We don't just have "free banking" as we once did, pre Federal Reserve. Now just as everyone is a print Publisher and an audio-video Media Center, so everyone who wants to be, is a Bank.

Hyper, hyper-inflation is here and the market, public opinion will influence what kind of money we use. Still I don't doubt that we are always going to be gamed by higher consciousness.

One point of view is that Divine and Demonic forces are always battling within man and within society. The Demons want the world without God -- and they can't have it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your great comment, I absolutely agree with you. Reason why I wrote the article is that I'd love to see more discussion on the topic so we can really tap into the nitty gritty of where we're really headed. The exit out of this market can become a tricky topic as by then the world will likely be very different from today.

I agree about the broad assumptions in the article. It is true Bitcoin is losing dominance. In that particular example we could replace Bitcoin by whichever will be the dominant crypto at the end-game and/or even the whole crypto market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Truly we're on the same page. "We won't get fooled again" turns out to be the Cosmic Irony it was intended to be. "Say hello to the New Boss, same as the Old Boss." echoes and resounds over the decades.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was a good read, but most likely it won't happen because:

But I really appreciate Bitcoin as the first working crypto!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting, though in regards to your point:

#1: Even with the transaction limit (in this case for Bitcoin, but it can go for any other crypto), a price increase to ridiculous levels could happen. All that needs to continue is increasing adoption in the given crypto, combined with trading/speculation.

#2: Totally agree with you, though who says Bitcoin on my example can say the crypto that will end up being dominant at the end-game and/or the entire crypto market combined. Doesn't have to be strictly Bitcoin to pull such a scenario off.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup #1, "Nobody - Okay, if you're Warren Buffett or Jimmy Buffett - Nobody knows if the crypto's going to go up, down, sideways, or in fucking circles"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good article!!

In the meantime, what's going to happen the 1st August with BTC price?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good question, forks are something that also need to be considered in the context of this article.

I think that in regards to the price, it generally seems that forks are a "sell the news, buy the fact" kind of a thing. Normally we see the prices retrace before stabilising and heading higher stronger. Let's see.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every investment has peaks and valleys. BTC is no different and has already shown this time and time again. If you got in for pennies you're already very happy if you got in at $3k you'll be very happy in the future. Just hold on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The issue isn't so much the peaks and valleys, that's the short-game. The issue is more how much upward this market can go. Because if this market reaches just half way of its total potential, then the world you and I know will already be a very different place. The level of displacement/disruption/chaos we can get to see is hard to fathom at this point. I'd say that seeing a Venezuela like scenario around the world whilst the transition takes place is a very real possibility as the "last" ones to adopt cryptos and precious metals start to panic in the face of hyperinflation. But hey, Venezuela only has 31M population, with the capital Caracas at around 5.2M. London is 10M. It would be complete chaos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypt0, my account is active!! lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I dont see a way bitcoin will go to zero. Will everyone decide all the money they put into it is worthless? Like gold, someone will find value in it. And it has lost 90% of its value and surpassed its old high

https://en.m.wikipedia.org/wiki/History_of_bitcoin#Prices_and_value_history

Do you take out the whole internet? You do realize that the internet can withstand a nuclear attack.

https://en.m.wikipedia.org/wiki/ARPANET

And it's tested against hacking daily

Would a secret organization try to subvert it? Possible but people will simply move to another crytocurrency

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On BTC going to zero, on a very fundamental level, as much as we like cryptos we cannot disregard the possibility, if we do, we're bad traders. During the tulip mania people also thought their price would keep appreciating. It crashed pretty much down, not to zero, but to some cents...

Also, if bitcoin is to cryptos what the 386 was to computers, then can you imagine what the Pentium 4 of cryptos would do to Bitcoin? Be careful not to fall into the trap of permabull, which I think you are.

In terms of 1 nuke, true, the internet would survive, but if 1 nuke is released we'd surely not stop there. Do you really think that if US would nuke Russia or China that there wouldn't be a retalliation followed by global chaos? But read above in one of the comments, worse than a nuke, would be a NEMP, and that can take out the entire web indeed, in fact, the web would be one tiny fraction of what a NEMP would take out.

When people sit at the top complacency is killer, don't ever think for a moment we're above everyone else just because right now, this very moment, we're winning by being in cryptos. Change is fast approaching.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see. Better to be alert and not to be complacent

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit