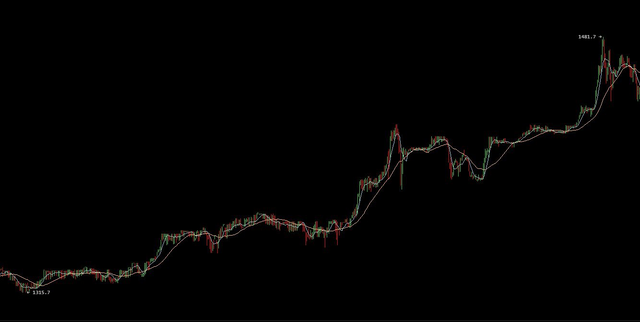

Bitcoin began trading above $1,400 in May and those gains have continued sharpish during the second day of the month. BPI data shows prices breaking beyond the previous all-time high of $1,350 on Sunday evening (UTC). At 17:00 on Monday, bitcoin was trading above $1,400 for the first time in history.

// Get exclusive analysis of bitcoin and learn from our tutorials. Join Hacked.com for just $39 now. //

Prices below $1,400 in the early hours leading into Tuesday, ultimately proving to be a minor drop rather than a correction. Instead, the bullish run resumed as prices jumped from $1,390 at 01:00 to $1,414.62 within the hour. A sustained run of trading saw a steady climb, gaining $20 near 10:40. The bigger spike was yet to come.

Trading around $1,435 mark at 11:00, yet another all-time high, prices jumped over 3% to scale a new unprecedented high of $1,481.7 within 20 minutes of midday, on Bitstamp.

At the time of publishing, that momentum has hit the brakes with prices trailing off to fall toward $1,440.

A closer look into today’s rapid rise in value shows a surge in trading activity, nearly $700 million in bitcoin according to CoinMarketCap. The trading is markedly led by Japanese markets where the yen contributed to over half of the global trading volume over the last 24 hours.

The Yen-Bitcoin trading is all the more notable given that Japan continues to impose an 8% consumption rate tax on purchasing bitcoin through exchanges. Toward the end of 2016, Japanese officials took the call to formally end this tax tariff, a move that will go into effect in July this year.

A report from prominent Japanese financial publication Nikkei today revealed that up to 18 companies are planning to apply for a special license (details here) to operate bitcoin and digital currency exchanges in Japan. Over 10 of the 18 companies are new entrants into the local bitcoin ecosystem in Japan, underlining the opportunistic interest among companies to tap into demand for the cryptocurrency which gained recognition as a legal method of payment last month.

Speaking to Reuters, Cryptocompare founder Charles Hayter stated:

The Japanese have recently warmed their approach towards bitcoin by treating it legally as a form of payment – a ratification and bringing into the regulatory fold.

These legislations that include legal changes and a move to regulate digital currency exchanges can be seen as the pillars toward Japan becoming one of the world’s leading economies to take a friendly stance toward digital currencies. Over a quarter of a million retail Japanese storefronts are set to accept bitcoin by this year’s summer.

Another factor that could have helped trigger bitcoin’s bullish run in recent days is the US Securities and Exchange Commission’s announcement to review its March decision that rejected the bitcoin exchange-traded fund (ETF) proposed by the Winklevoss brothers.

At its all-time high of $1,481 today, bitcoin has gained nearly 50% in value since the turn of 2017. The strong gains made over the last week has helped push bitcoin’s total market cap to scale above $24 billion for the first time in its history, the equivalent of nearly half of the market capitalization of automaking giant General Motors.

Souce: https://www.cryptocoinsnews.com/bitcoin-price-continues-historic-highs-toward-1500/

What a pretty chart!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit