via hac

At a glance, things don't seem so bad... but people are furious anyway. The Keynesian boom bust cycle machine has been churning out credit expansion harder and faster and longer than ever before, and yet still nobody is happy..

There's so many fallacies that you've been convinced to believe in I don't even know where to begin. The entire charade is nothing but a puppet show...and the show isn't for us....we're the puppets.

Despite the...

" record buybacks, record dividends, and record earnings but 89% of assets yield a negative return in US dollar terms?"

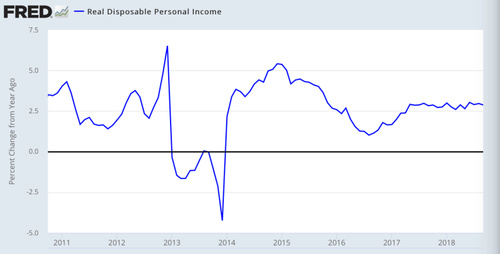

Were at the peak of a decade of cheap credit, a decade of monetary expansion, a decade of record stock prices...but people are no better off...

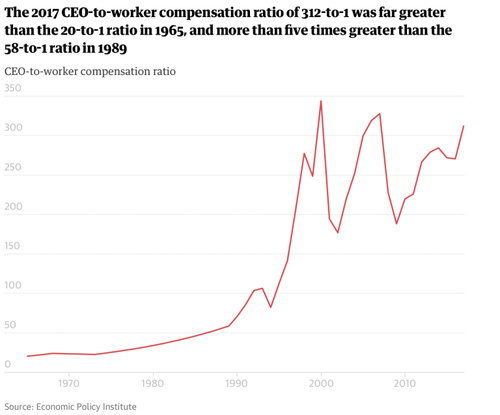

Maybe it stems from the fact that only half of American's own stocks and even then 81% of equity is owned by the wealthiest few

Record low unemployment...which if you watch Fox news just goes to show that God Emperor Trump can do no wrong. Touting record low unemployment like a badge of honor is laughable. The Keynesians and Chicagoans would have you believe that the path to economic prosperity is cheap credit and low unemployment. Loose monetary policy pumping its fresh green juices into every market on the planet is like the rat stuck hitting the dopamine bar until it starves to death.

First of all, it would take half of this article for me to unwind the fallacies behind the idea that the lowest possible employment is always a good thing for the economy. But let's just take a step back and look at it from a broader perspective. What does it mean to become more productive? To get the same end result (or more) for less work on the front end, right? Jobs are not an abstract.

Hazlitt once wrote that if it were true that technological progress and exponential leaps in productivity were destroying man's ability to earn a living wage, every railroad in the country should be ripped up and men should carry the freight cross country on their backs.

Our economic woes were never about a need for more low skill, low paying jobs. Our woes are from systematic theft...and the puppeteers have orchestrated the show in such a way that purports it to be in your best interests.

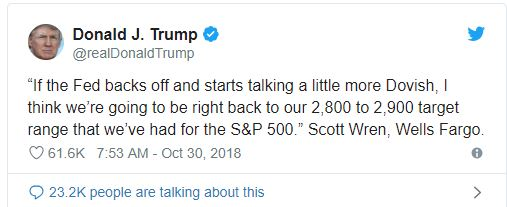

There's a global cry to keep the credit expansion going. Even Trump says the Fed is crazy for a rate hike in such a "booming economy".

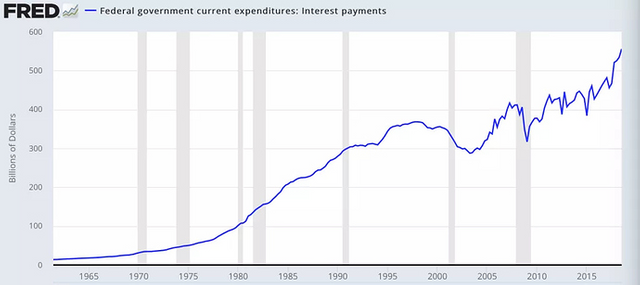

Market analysts across the board are screaming bloody murder at a federal reserve that has had RECORD low interest rates for RECORD high lengths of time. They have never let the free money motor run so hot nor so fast. And now that they want to start putting the dopamine addled beast down for a nap, more gently and softly than ever before, the greatest benefactors of the systematic oppression say that its not fair.

10 years of the largest longest loose money expansion ever, and now if we don't keep it up the Fed is out of their minds? Honeymoons weren't intended to last forever. But you can't keep up the charade forever, rolling with the Keynesian narrative there has to be some shrinkage now and again or this whole experiment was a colossal failure...so what's the big deal? We knew this had to happen eventually right?

It gets so much worse.

Where's the point of no return in this death spiral? I'd argue it's already long past.

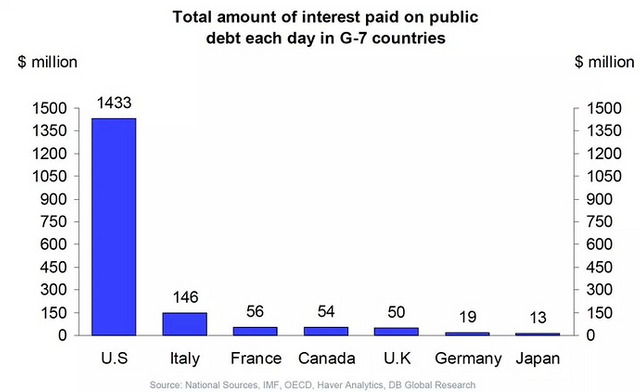

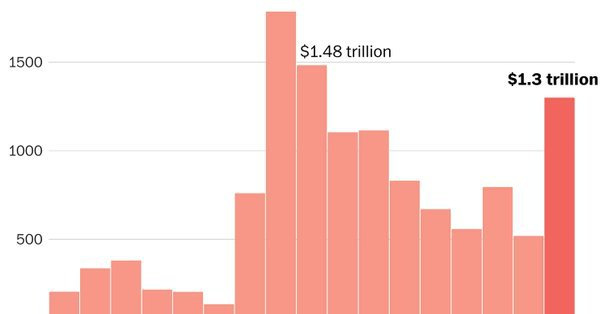

Just the amount of daily debt serviceability required to keep the US open for business is astounding. But spending can't slow down... The spending continues like a debt burden family who just got a credit transfer to a first 2 years, 0% APR mall kiosk credit card.

When will the pain stop?

No wait it gets better. What if I told you, a big part of what's driven such euphoric growth in equities markets, despite a seemingly global slow down in production is the central banks? Did you know the Swiss Central Bank holds over 20% of its assets in international equities? Did you know 10% of those are US equities? Up almost 15% from what it was a decade ago. Bank of Japan owns 75% of the Japanese ETF market. Central Bank holding of Mortgage Backed Securities rose from 0.7% to 5.4% just in the last 2 years!

But why? Why the same reason you would buy equities and securities of course, those sweet sweet gains! Gotta make up for those 10 trillion in negative yielding bonds somehow you know!

What are the ethical implications of organizations that can print new money out of thin air, with what is effectively a few strokes on a keyboard, driving growth in international equities?

What are the ethical implications of private industries becoming nationalized by central banking institutions?

Still think inflation isn't theft?

Here were back to the same old story of the entitled prince shaving gold off of the royal mints coins and stamping them with the original weight. For the sake of his own enrichment. The only difference between then and now is he wasn't trying to convince people it was for their own good.

This is a much more evil kind of alchemy. One so ingrained in a system of credit expansion, money creation, asset allocation, and top down control that's its a wonder it hasn't come crashing down like a game of jenga that's gone on 10 or 20 rounds longer than anyone expected.

The only question here is what will happen first, the slow absorption and nationalization of global private industry, or the debt death spiral of hyperinflation that's keeping the train begrudgingly moving forward.

This is why we buy Bitcoin.

Congratulations @heavilyarmdclown! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit