Prohibit and prohibit.

The digital money market has been under a lot of pressure from the "big technology". At the end of January Facebook fired the first gun, banning all digital money related ads, ICO. Then in March, Google also confirmed that it would ban ads related to digital money, or token sales activities, ICO on all of its facilities, The ban will come into effect in June. Following the Facebook and Google steps, Twitter recently confirmed that it would ban digital money ads, especially ICOs, and offer tokens, and any activities with fraudulent signs would be removed.

Search for new land

Binance has announced that it will move its head office to Malta.

Bitfinex, one of the top five digital money exchanges currently headquartered in Hong Kong, recently planned to move its "headquarters" to Switzerland.

The digital money market has many deep adjustments

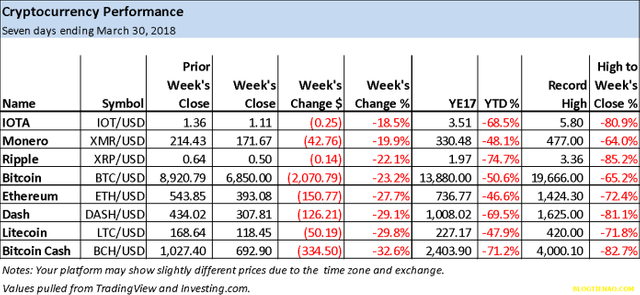

Over the past three months, the digital money market has had a lot of fluctuations. The downtrend dominated for several weeks, there are many tests to test low levels in the currency. Bitcoin, after several times up to $ 9,000, has shown signs of weakness and has since fallen back to $ 6,000, $ 6,500, $ 7,000, and is currently stuck at the threshold. support near 7000 USD. Ethereum has bottomed out below $ 400. Other Altcoin players such as Ripple, Litecoin, Bitcoin Cash, IOTA, Dash and Monero are also less fortunate, and are suffering the same fate as Bitcoin's "eldest brother."

The downward trend is still present in most of the current, short-term currency seems to be support and may have a rebound, but if you look at the overall picture, the downward trend will continue for the next few days.

At the same time, the top eight coin producers have reached record levels, which have fallen from highs near the end of last week, with low volatility, but the risk remains high. .

Bitcoin: seek short term support

So far, Bitcoin has found support at 88.6% Fibonacci level at a low of $ 6,550. This may trigger a breakout, the price may bounce back. However, it is likely that bitcoin will drop to $ 5,920, the risk of continuing to break the bottom is quite high. Note that the BTC / USD has recently tested the MA resistance of 200 days (brown line) and has reversed. In addition, prices are falling higher than the upward trend line.

Ripple: downward trend covering

Ripple overbought too much, the RSI index last week only 0.47 dollars. Just right around the support level of 88.6% Fibonacci extension of the long term uptrend, and although overbought is not a good signal, we are close to the lows at least once. , before the recovery.

XRP / USD ended last week at $ 0.53, so far the downside trend is still covering this currency, and $ 0.68 will be the strong resistance. If the ripple does not pass the $ 0.68 level, it will probably continue to fall deeper, and the bottom levels will be tested again.

done friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ok you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit