This is a comprehensive guideline on the best options of Bitcoin debit cards you should look out for in 2019. The article further explains the features, price, fees, benefits and challenges of these debit cards to allow you to chose the best option.

Since the advent of cryptocurrencies and blockchain technology a decade ago, the financial world has been revolutionized and challenged to better standards. However, adoption of the technology is yet to take off as the use of these digital assets has been limited to few merchants and retailers around the world.

Cryptocurrency Debit cards around the world

Bitcoin debit cards were introduced to allow users to easily spend their bitcoins in any acceptable merchant and retail shop. The adoption rate among retailers and merchants is growing slowly but is set to pick up with the increase in options of bitcoin debit cards. The best bitcoin debit cards include Cryptopay, Wirex crypto card, Uquid, Bitpay and Shift from Coinbase exchange.

The sections below explain in detail these bitcoin debit cards offering the features, fees, advantages, and disadvantages of each card.

1. CryptoPay cryptocurrency debit card

CryptoPay is one of the oldest bitcoin credit cards. The physical and virtual debit card was launched in late 2013 offering merchants, retailers, and consumers an easier option to transact using Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) or Litecoin (LTC). The platform is currently available in the United Kingdom, Russia, and Europe with negotiations to be added in Singapore ongoing.

Cryptopay’s bitcoin debit card

Cryptopay prepaid card works online and offline, making it simple for customers to use at millions of businesses around the world. Furthermore, users around the world can order the physical card and will receive it in 5-7 business days.

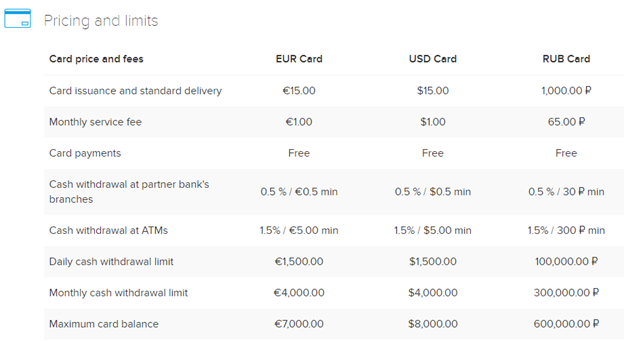

Card prices and fees charged by Cryptopay.me

CryptoPay is a VISA card and is acceptable anywhere VISA debit cards are allowed.

(Images from Cryptopay.me)

2. Wirex Cryptocurrency card

The Wirex bitcoin debit card offers a multicoin wallet supporting BTC, ETH, LTC and XRP

Wirex is a card company that offers its users USD, EUR and GBP and cryptocurrency debit cards to ease the use of traditional and digital money. The cryptocurrency debit card allows BTC, ETH, XRP and LTC deposits which can be converted to fiat currencies at live rates. The cards are delivered free worldwide on order, users will pay $1.50 USD management fee per month afterwards to cater for the operational costs.

Other Wirex debit card fees include $2.50 USD for any ATM withdrawal within Europe and $3.50 USD for withdrawals outside of Europe. Online and offline payment for goods and services is not charged.

Bitcoin users are eligible to the Cryptoback program that returns 0.5% of your Bitcoin every time you punch in your pin, swipe, or use contactless pay with the Wirex VISA debit card. The Wirex cryptocurrency card can be accepted around the world anywhere VISA is accepted.

Pros

-The availability of many options of cryptocurrency and fiat payment systems.

-Wirex is an established card company.

-The Wirex app offers efficient transactions to users. The app can be downloaded from Google Play Store, Apple Store or open an online account with Wirex.

Cons

-Only available in Europe locking out other investors worldwide.

-The management fee is quite high.

3. Uquid Cryptocurrency debit card

Uquid cryptocurrency debit card (Image: UQUID)

The U.K based crypto debit card, Uquid, is one of the most efficient debit cards in the world today. The company takes 2-3 days to ship your free debit card anywhere in the world which is considerably faster and cheaper than its peers. Notwithstanding, Uquid has an unlimited ATM withdrawal limits and unlimited lifetime purchases.

The card is available across Europe with other regions in North America and Asia to be added in future. Users can select the virtual or physical Uquid debit cards to make online and offline transactions while purchasing in any “VISA–accepted” shop around the world.

Users can purchase Uquid cryptocurrency debit cards starting at $16.99 USD. Monthly management fees are set at a flat rate of $1 USD with ATM withdrawals set at $2.50 USD and $3.50 USD within Europe and other countries respectively.

Pros

-Shorter delivery period for the physical cards

-Wide range of cryptocurrencies are offered on Uquid. Over 75 cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Monero (XMR) and Ripple (XRP) can be exchanged to fiat currencies including USD, GBP and EUR.

Cons

-The physical and virtual Uquid debit card are expensive.

-Only available in Europe.

4. BitPay bitcoin debit card

Bitpay bitcoin debit card (Image: Bitpay)

Most of the coins mentioned in this article are based in Europe. The cheap and efficient nature of Europe financial systems play a huge role in this. However, other American based cryptocurrency firms have taken up the challenge with Bitpay offering a cryptocurrency debit card accessible to all 50 states of the U.S. The physical debit cards are shipped in 7-10 days after you place an order.

Bitpay accepts Bitcoin transactions across the world in any store that accepts Visa payments. The Bitpay card costs $9.95 and has a $5 USD management fee per month. Fees for domestic ATM withdrawals are charged at $2 USD while international withdrawals are charged at $3 USD and a 3% conversion fee for the transaction.

Pros

-Available in all 50 states in the U.S.

-Bitpay is an established and trusted company.

Cons

-Only available in the U.S

-Charges expensive fees for their international ATM withdrawals.

5. SHIFT Cryptocurrency card

2SHIFT payments debit card is integrated to Coinbase exchange

SHIFT crypto debit card is a creation by Coinbase cryptocurrency exchange, the largest in United States. The VISA debit card allows users to transact across the world in any acceptable store using VISA payments. The SHIFT card is available in only 46 states and limits the physical cards to the U.S alone.

The ATM withdrawals within the country are charged at $2.50 USD with the international withdrawals charged at $3.50 USD. The card costs a flat rate of $20 USD and no monthly maintenance fees.

Pros

-The card is pricey but saves the user money in the long run as it has no maintenance fees.

-Connected to your Coinbase account directly.

-Has no conversion fees for international withdrawals.

Cons

-Only available in the U.S locking out other investors from across the world.

-Coinbase is also geographically limited to only 32 states in Europe and North America.

Conclusion

The increase of cryptocurrency debit and credit card options will spark mass adoption as people use these assets to make transactions. More options exist but do your own research before buying any crypto debit card as some are scams and fake websites.

This is a great start to being able to integrate crypto payments into the legacy ecosystem. I'd like to see a card with lower fees or that waived the fees if a certain number of payment transactions were completed per month.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed! Crypto debit cards are a great way to gradually ease everyone into the system and used to the idea of cryptocurrency via familiar systems. Hopefully with further advancement, the fees will get lower and new incentives added with more competition among providers on the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I use the Bitpay and Shift cards. I love them both.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Both excellent choices!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! @adam3030

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit