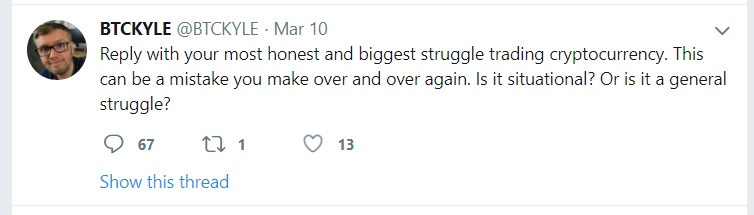

Recently, @BTCKyle asked a simple and 'profound question on twitter' -

"Reply with your most honest and biggest struggle trading cryptocurrency. This can be a mistake you make over and over again. Is it situational? Or is it a general struggle?"

Read the many answers below, followed by a conclusion about the true risks of trading.

@R00sterKing

Not knowing how to get into it 😂

The informations are not in order or complete, I don't know what are the fundamental parts or skills that you need to develop.

I love the crypto that I hold, so not being able to get rid of it for profit. I need help! 😫

Don’t know how to start. I’m just a hodler. Would like to trade but can’t put 1000 hours in to TA. Biggest struggle is wishing I could get in to trading. Kind of a FOMO feeling.

Greed/over-leverage

Man the market is causing heart palpations that almost feel like constant anxiety attacks (even though I in winning trades) any Rec?

@Lord_Kebo

Overtrading

Doing a TA myself been seeing somebody else's that contradicts mine and trying to hold to my own research

I’ve found the opposite to be most effective. On every trade I try to find more reasons not to do it. If still nothing convinced me otherwise I will be more certain on my position.

readying everybody's struggle actually helps, im not the only one, i think we all have a little bit of everything. But in this volatile market who knows what happens tomorrow,you can have trading plan and then some shit happens and you down 10% so..its all about how lucky y ar

TA is almost useless sometimes. Chaos is a good way to describe these markets.

Buying at proper point, realizing resistance is up ahead, selling some profit....and then not having confidence that price will come down and test support again. As a result, I buy back in near top of range and end up having a heavy bag once it inevitably does test support.

OMG was perfect example last night, FWIW. Bought in low 1400s, rode all the way up to ~1630, sold half, and then, when it hung around 1600, i bought back in thinking there was more run left. Now, it's down at former resistance (~1500) and my bag is as heavy as I am. Damn.

Not selling at top

My biggest struggles would be

- False Tops

- False Bottoms

- Fibbonacci Extension

- Fibbonacci Retracement

When a break out happens,

I cant tell how long to stay in

or when to take profit and when to get back in

Stop loss is my biggest struggle. Not sure how to set stop losses. Videos I watched were confusing for binance, gdax, bittrex. If not at screen I miss selling at right moment. Would be very helpful if u made a video on stop loss how to and strategies.

Setting a cut-loss strategy in a volatile market where it often bounces 30% down before rising. It leaves me hodling coins on a runaway downwards trend because I fear that we’ve reached the bottom constantly

Selling too soon and missing larger profits.

My vision happens too fast i keep tricking and lying to myself. I think greed is the biggest problem.

@m_sairaghava

I'm good at HODLing, but not sure when to trade or sell to make profits. When, my bags are green, I'm greed. When my bags are red, I'm confident enough to HODL them till they become green.

I have coins I bought that I really like, I bought at premium and now being down 50-60% on them, not knowing what I should do, hold? Sell? Consolidate?

it is a general struggle between greed and fear. Best to buy and HOLD for dear life. Short term trading is something I never mastered.

living on social security and borrowed time, hopefully nothing more needs mentioning even though i'm not sure i want to say that so someone doesn't accuse me of fishing for sympathy

Buy at a price I thought was low enough and after buying, the price go down even further. End up HODLing the coins and waiting indefinitely for price to go up

Managing all coins in wallets and being able to get them in the right place to sell and or have stops to prevent loss... everyone always says don’t enter a trade without a stop and to not keep money on exchanges. It’s difficult to do both.

While Bitcoin is diving, am unsure if I should short. Joined this world since early Feb and have been making wrong moves one after another

Limit setting and patience.

Feeling like you have to do something all the time.... I stopped the day trading, thankfully breaking even.

Taxes

Becoming a fanboy of a coin

I think for most people it's going to be emotions making you trade too early or too late. For me? I'm very cautious, often avoiding pump and dumps. I don't lose, but I miss out on some giant gains.

Hardest part in the start is taking emotion away from your bags. Sometimes you have to learn to let go even if its your favorite projects

Impulsive trading

My biggest struggle is trying to understand the market cycles. I don't want to hold forever, so like everyone, I don't want to buy in too early to draw out the slow accumulation phases.

@K4Louw

If you could give some insight into this advice I always hear from experienced traders - “know your strategy when entering the trade” ...should you have fixed % profit in mind , and if this doesn’t play out as you planned, how quickly do you get out ?

‘When to buy or when to sell’ maybe setting myself up with a standard percentage to accumulate profit for myself

@29Das29

General, I don't have the skill to day trade or swing trade and I don't have patience to HODL! So that leaves me with one option impatiently HODL'ing

It is when you know you should buy and you don't. Gotta trust your gut.

not being able to identify the bottom as well

@gains_zsolt

Closing a position

Position sizing and risk management..

Not being able to predict when Mt Gox guy decides to dump sucks too. My big problem is that I am still searching for a way(s) to make easy money.

I wish I had a skill that I could use as leverage. Instead of working hard to impress my manager, I wish I had the power (or a skill) where my manager, company, etc would feel stress if I were to leave. Not just be another number in the books. Have true value.

Sell for a profit, but usually way too prematurely,. as in it will go up for quite a while after i sell

Trying to figure out what portion of my holdings to trade with and trying to balance regular work with the time needed for learning and trading.

@c_ethe

Not selling the top.

Hedging / USDT / FIAT

Fear and greed. But i‘m getting better... thanks to you too 😉

placing market orders

Knowing when to cut losses

When you bought the dip on some alt coins and they kept dipping 🙃

not being able to identify the top and not taking profits

viacoin buy at top big desaster from myself

Right now this market has me to confused to even trade

Is it really possible to become a full time trader without having accumulated 100s-1000s of bitcoin years ago? I feel like a lot of these "OGs" started crypto trading years ago when everything was cheap and now have 100s-1000s of bitcoin they manage with low-risk trading??

Not taking profit

Hyper focus leading to tunnel vision 😞

having no patience at all. But really working on that!

Conclusions About The Biggest Struggles Trading Cryptocurrency

Sadly 90% of traders started trading cryptos because the barriers to entry are so low. It is so easy to start, that most Altcoin traders are drastically unskilled and have no plan in their approach to trading.

Many of the answers to BTCKyle's question reveal a lack of preparation for the dangers of trading, lack of a plan for entries and exits, and only one person even mentioned they need to learn risk control rules.

Learning To Fly A Plane

What if we were to learn to fly an airplane with the same amount of training... we can easily predict a catastrophe. And what of learning to sky dive without learning and practicing emergency procedures? What of a physician going into her first surgical procedure with the same preparation as most of these traders? How about a weekend athlete entering a UFC match against a professional fighter?

We know that any of these high risk activities require an enormous amount of training with qualified trainers - long before the plane takes off, before we jump out of the airplane with our parachute, or step into the operating room, or into the octagon.

And we know that, with practice and training - millions of commercial and private planes land every day without any crashes. Pilots are trained on routine landings, and they study every emergency situation that any other plane has faced - and then practice them over and over again so the correct response to the given emergency becomes second nature.

Trading too requires repetitive, intentional practice in order to have the skills to handle the unexpected.

Trading Is Never A Mystery

A skilled trader will never go into a trade and leave the outcome to chance. They have procedures for every contingency... both a trading plan for entries and profit taking as well as a risk control plan - assuming the unexpected can and will occur.

The airplane pilot cannot learn from his crashes, and improve his flying - he must improve and test his flying before he leaves the ground. They learn by studying the mistakes, failures and successes of other pilots - and then they begin their first flights with an experienced co-pilot in the cockpit!

After every learning flight, the pilot and co-pilot review every second of the flight - emphasizing the correct procedures and identifying any hesitations or mistakes. Only after many hours of rigorous training will the new pilot go on their first solo flight. So it is with surgeons, parachuters and competitive fighters... and so it must be to ensure successful trading.

Lets address some specific troubles from the list above

'not being able to identify when to take profits' is a common thread, and many mention the negative emotions of impatience, anxiety, doubt, fear and greed.

Lets tackle the second point - when negative emotions dominate your thinking... even the best trading strategy will not produce the profits it should.

Nothing is more important than that you feel good while you are trading, for then you can act on the signals that your trading method provides.

There is a gap between knowledge and action. You may have all the correct knowledge, but if you are feeling anxious, the gap between your knowledge and your actions becomes too wide; you will act too soon, or too late - pushing hard to 'make' your trades profitable - and holding when it's time to liquidate.

Simple Plans, Small Positions, Risk Control Rules

Lets assume that trading cryptos is difficult and dangerous. Day trading and swing trading are getting MORE difficult as the Artificial Intelligence (AI) BOTS are becoming more sophisticated, and making the price moves more volatile.

Assuming these points, then we need to anticipate and plan for them as though they are going to occur - we need to trade in small enough positions that a single loss will not be a significant effect on our trading equity. This takes the pressure off - and reduces the negative emotions that can cloud our thinking and judgement.

We need to use simple trendlines and moving averages using 12 hour bars or 1 day bars for entries and exits - so that we are speculating on the overall trend of the market over a period of several weeks to several months.

And most of all, we need to a) reduce our risks if the market does not prove us correct and b), at the same time we must INCREASE our risk when the market does prove us correct. This way we have smaller losses when we are wrong, and we have bigger winners when we are correct.

Write Your Rules, Back-test and Paper Trade

Just as modern pilots use flight simulators to practice their skills before they take to the air, so too can we traders simulate how our trading plan would interact with historical markets. After hours of review and analysis as though the trades were real, then we are ready to start 'paper trading' the live markets.

Paper Trading is great for planning your trade, and trading your plan - yet it lacks the emotion of real trading.

Think of performing your favorite guitar solo at home when you are alone - vs performing before a live audience of hundreds of people. The very same activity - but very different emotional responses have profound effect on our performace, wouldn't you agree?

When to take your losses

If the market does not prove your small initial trade correct within a few hours - close the position and wait for a better entry. To hold a trade at a small loss, or to hold a trade that is going sideways - only increases your risks of bigger losses. Never hold a position until the market proves you wrong. Take the loss fast and only hold trades that prove you correct.

Once that thinking is deeply ingrained, you will close those questionable entries more quickly and save yourself from the unexpected moves that cost more money, and you'll save yourself from the demoralizing emotional effects of losing money.

When to take your profits

'You can't lose money taking profits' - may be partly true, but if you take profits too soon, you miss out on potential for the market to keep proving you correct. Many new traders are quick to take their profits to show their winnings - they are fearful that the market will reverse and take away their profit.

Identify the price point or the chart pattern that is YOUR exit signal - before you put on the trade.

Change Your Thinking With New Information

Most of us start out with negative emotions connected to money - and so I always recommend two short books that dramatically changed my perspectives and feeling about money. If you have had a string of losing trades - then I recommend you take the time to order and read these two books:

Money Is My Friend - by Phil Laut

and

Reminiscences of a Stock Operator - by Edwin Lefervie

'Money is my friend' will help you understand and change the way you feel about money, and 'Reminiscences of a Stock Operator' will provide you with a deeper perspective about how experienced traders approach the art of trading.

Consider each of these books as a text book a surgeon would study in Med School - take notes, underline important passages - and read these books several times so the new information can change your beliefs - your feelings - and your success.

Do you have answers or questions?

I would love to hear your perspective on any of the difficulties listed above -

Do you share some of these concerns? Which ones?

Have you overcome any of these common beginner problems? If so, how did you do it?

Do you have advice or tips that help to better answer these struggles common to trading cryptocurrencies?

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

now that is sweet - I'm learning more than just crypto thinking from your example!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit