We all have seen over the years how bitcoin has evolved. It has silenced many of its critics, paved way for a revolutionary economic system with the help of blockchain technology but not all has been good with Bitcoin.

Scandals

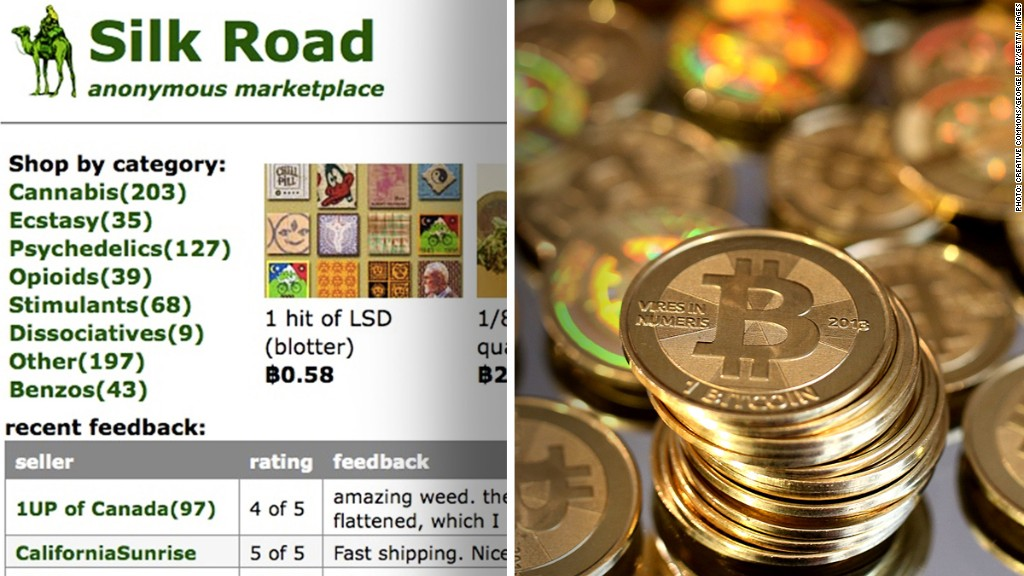

Silk Road

I am sure you all have heard of the Silk Road, if not then here is the brief ( by all means an incomplete) story.

Silk Road was an online black market and the first modern darknet market, best known as a platform for selling illegal drugs. As part of the dark web, it was operated as a Tor hidden service, such that online users were able to browse it anonymously and securely without potential traffic monitoring. The website was launched in February 2011; development had begun six months prior. Initially there were a limited number of new seller accounts available; new sellers had to purchase an account in an auction. Later, a fixed fee was charged for each new seller account.

In October 2013, the Federal Bureau of Investigation (FBI) shut down the website and arrested Ross William Ulbricht under charges of being the site's pseudonymous founder "Dread Pirate Roberts". On 6 November 2013, Silk Road 2.0 came online, run by former administrators of Silk Road. It too was shut down, and the alleged operator was arrested on 6 November 2014 as part of the so-called "Operation Onymous".

Ulbricht was convicted of eight charges related to Silk Road in the U.S. Federal Court in Manhattan and was sentenced to life in prison without possibility of parole.

Source:https://en.wikipedia.org/wiki/Silk_Road_(marketplace)

Mt. Gox

Mt. Gox was a bitcoin exchange based in Shibuya, Tokyo, Japan. Launched in July 2010, by 2013 and into 2014 it was handling over 70% of all bitcoin transactions worldwide, as the largest bitcoin intermediary and the world's leading bitcoin exchange.

In February 2014, Mt. Gox suspended trading, closed its website and exchange service, and filed for bankruptcy protection from creditors. In April 2014, the company began liquidation proceedings.

Mt. Gox announced that approximately 850,000 bitcoins belonging to customers and the company were missing and likely stolen, an amount valued at more than $450 million at the time. Although 200,000 bitcoins have since been "found", the reason(s) for the disappearance—theft, fraud, mismanagement, or a combination of these—were initially unclear. New evidence presented in April 2015 by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late 2011."

Source: https://en.wikipedia.org/wiki/Mt._Gox

- There have been other scandals but my focus was on the two big ones in my opinion that created a sort of "dark cloud" on bitcoin and cryptocurrency leading to the Bitcoin regulations here in the U.S and cryptocurrency business downfalls in general.

Bitfinex The Next Big Scandal

A growing number of virtual currency investors are worried that the prices of Bitcoin and other digital tokens have been artificially propped up by a widely used exchange called Bitfinex, which has a checkered history of hacks and opaque business practices.

In December, Bitfinex was subpoenaed by the Commodity Futures Trading Commission, a United States regulatory agency. The news, first reported by Bloomberg on Tuesday and confirmed by a source familiar with the subpoena but not allowed to publicly discuss an ongoing investigation, led to a sell-off in most virtual currencies.

The people behind Bitfinex issue a virtual currency called Tether. Unlike most digitals tokens, every Tether is supposed to be backed by traditional money — the United States dollar. New Tether tokens are issued when investors give them dollars. One dollar is worth one token.

Because of the credibility that comes with that tie to the dollar, Tether are often used to buy other virtual currencies like Bitcoin.

In recent months, however, many investors have been raising alarm bells about Tether. Hundreds of millions of dollars worth of new Tether were created; almost always when the prices of other virtual currencies were heading down. The Tether were used on the Bitfinex exchange to make big purchases of Bitcoin and other tokens, helping push their prices back up, according to multiple analyses of data from Bitfinex.

“This became more and more concerning, because every time the markets went down, you have seen the same thing happen,” said Joey Krug, the co-chief investment officer at Pantera Capital, which runs several virtual currency hedge funds. “It could mean that a lot of the rally over December and January might not have been real.”

Source:

Read full article here: https://www.nytimes.com/2018/01/31/technology/bitfinex-bitcoin-price.html?smid=fb-nytimes&smtyp=cur

My Say

Bitcoin has seen it all, " the Good, the Bad and the Ugly" and that is why I am bullish towards Bitcoin. Overcoming the hurdles and the difficulties has and will in future make this technology better, secure and (more) revolutionary. Bitcoin is not going anywhere guys, having said that, it is true that "Hard times are coming , but only for the betterment".

Congratulations @jalalshams! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jalalshams! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit