The bitcoin has again exceeded $ 11,000 per unit. The most important digital cryptocurrency did not reach this level since the end of January this year. The roller coaster is still active: after having lost $ 6,000 this February, bitcoin already adds a revaluation of 85% from those minimums. This rise occurs despite warnings from the European Central Bank (ECB) or the rating agency Standard & Poor's, which today has published a note stating that cryptocurrency is not an asset, but "a speculative bet".

In the current session, the bitcoin rises around 6% and is placed in the environment of 11,100 dollars per unit, while ethereum advances 2.84% and is already close to 1,000 dollars, according to Coindesk data. On the other hand, litecoin also adds to the party and reaches $ 223 with increases of more than 3%.

Although this type of asset is gaining weight in the world of finance, its implementation is still in its infancy and its global weight is scarce. Since S & P believe its influence on global markets is low, so a breakdown of cryptocurrency would have "an insignificant effect on the stability of financial markets."

The siege of the institutions

The criptodivisas are still alive despite the hostility shown by the agencies in charge of financial regulation such as the ECB, which last week published a note on its website in which they highlighted that these digital assets "are virtual, but not foreign currency."

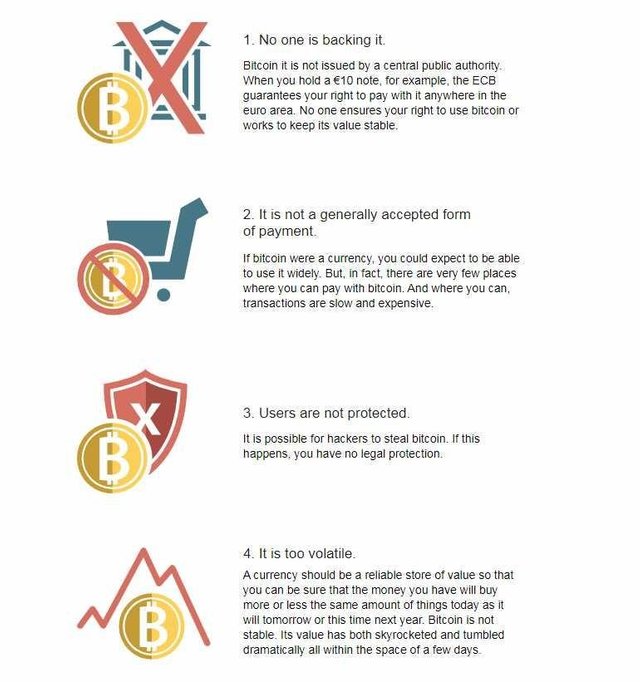

The central bank's economists stress that "nobody supports cryptocurrency, no public authority issues bitcoins.When you have a ten-euro bill, for example, the ECB guarantees the right to pay with it in any country in the Eurozone. , no one guarantees the use of bitcoin or that it will preserve its value ".

The ECB ends by noting that it is not a generally accepted means of payment, that users are not protected, "it is possible that hackers steal bitcoins, if this happens, you will not enjoy legal protection." It is also a very volatile asset so it can not be a good value deposit tool, "its price skyrockets and sinks dramatically in very short periods of time".

Warnings from the ECB.

S & P have published today a note that defines cryptocurrency as "a speculative bet". In line with the ECB, the economists of the rating agency insist that digital currencies do not meet the requirements for a currency, "neither are a means of effective exchange nor a deposit of stable value."

In addition, "cryptocurrency presents many of the traditional characteristics of a bubble." However, it is still very difficult to resolve the future of cryptocurrency.

Dozens of central banks and regulators have warned about the dangers of cryptocurrency. However, these assets are still alive and remain the focus of attention of many investors who intend to make money quickly or who rely on cryptocurrency as a future means of payment, thanks to decentralization and the technology that underlies these assets. blockchain.

This post has received a 1.12% upvote from thanks to: @jesussuareez.

thanks to: @jesussuareez.

For more information, click here!!!!

Send minimum 0.010 SBD|STEEM to bid for votes.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to @minnowhelper by clicking following links: 10SP, 100SP, 500SP, 1000SP or Another amount

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit