An inverted yield curve may be signaling a recession is on its way, but that may be good for bitcoin prices.

Typically, an inverted yield curve has signaled that a recession was on the way.

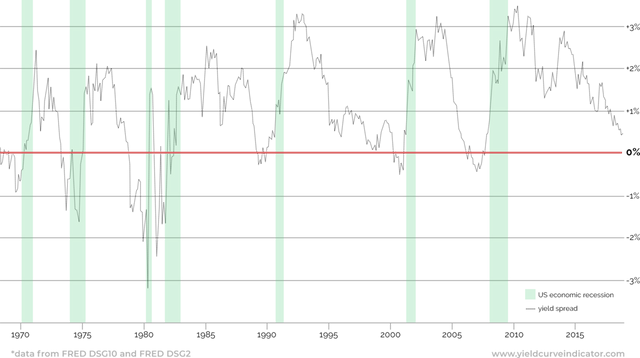

In fact, an inverted yield curve has predicted recession in the last 7 out of 7 times.

For those keeping score at home, that is 100% accuracy over the last 40 years!

Cool!

So, what's an inverted yield curve and why does that matter for bitcoin?

Typically, bonds yield higher interest rates the longer dated they are.

For example, a 3 month bond pays a lot less interest than say a 10 year bond.

An inverted yield curve happens when shorter dated bonds have higher yields than longer term ones.

Specially, the ones that are batting 100% for recessions are the 2 and 10 year bonds.

Just recently the yield on the 2 year treasury was higher than the 10 year treasury.

Something we haven't seen since...

The Great Recession.

(Source: https://yieldcurveindicator.com/#what)

When the spread (the difference between the 2 and 10 year treasuries) goes below "0", a recession is likely imminent.

Why does this matter?

Historically, these yield curve inversions have happened anywhere from 1 to 3 years before the economy officially enters a recession.

Well, the latest inversion happened at the end of March.

If history is any indicator, it means the clock is officially ticking as to when the next recession will be upon us.

This is interesting for bitcoin because it has never existed during a recession.

It was created shortly after the last one happened.

Will money flock to bitcoin as a safe haven or will bitcoin be seen as one of the riskiest assets of all on the risky asset spectrum?

Currently I would argue that bitcoin has behaved most similar to an extremely risky asset, mostly catching a bid in boom times and being sold off harder than most during times of uncertainty.

However, that was not always the case...

Bitcoin was once seen as a safe haven asset.

There was a period of years where bitcoin was mostly correlated with gold as opposed to risky assets.

It was seen as something that investors would flock to during times of uncertainty and global turmoil.

What is going to happen this time?

We will likely find out within the next year or so...

Stay informed my friends.

-Doc

I am no expert and I just got on SteemIt a few minutes ago, but I think that people would be pulling out of crypto during a crash and investing in precious metals. People still view crypto, Bitcoin especially, as risky.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, that is the feeling I get as well. Especially over the past few years. However, if you look at bitcoin prior to 2017, it actually was more closely correlated with gold and precious metals than it was any other asset class...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

well then welcome on the platform, here is a vote with some steem for free :-)

and I guess that the bitcoin will serve as a store of value but not by the common masses but by quite a few though

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could be. It could end up being a sovereign store of value where central banks are the largest holders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice analysis 🧐

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks corndog.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

6 to 12 months if history repeats itself from when the inverted yeild curve happens. I'm curious if Bitcoin will actually lag along with stocks

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some think it will do well in a recession. I am not so sure...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

both at once?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is the theory for some yes. A time of uncertainty and risk off will cause some to put money into bitcoin. I don't share that belief, but some do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it will depend on how agencies and the economy responds to the recession. If it is led by austerity and cash hoarding then bitcoin being a risk asset would suffer as it get a lower allocation in portfolios. If it is met by stimulus (money printing) then it should be in high demand to retain value for investors.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good point. If the uncertainty, turmoil, and unrest is due to a lack of trust and disdain for governments due to failing currencies, then yes bitcoin probably does well. If it is just a general, run of the mill economic slowdown... I don't think that helps bitcoin much at all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, though I think it might happen before that, for both. I think there may be an incentive to tank the US economy right around the time the president is up for re-election. I also think that bitcoin could start it's major run around then too as it will be roughly 6 months post block reward halving... that would time it around end of 2020 or so for both a recession and bitcoin taking off.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The powers that be will do what they can anyways.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit