This morning the SEC suspended trading in shares of First Bitcoin Capital.

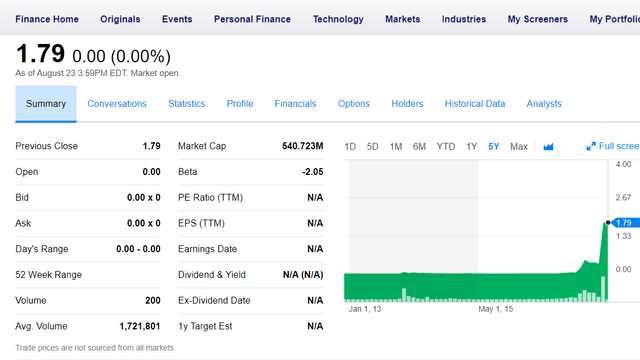

If you are not familiar, First Bitcoin Capital is a penny stock with a $541 million dollar market cap traded on the OTC market place.

Ah yes, the good ol OTC penny stock market place.

I remember it fondly, well actually not that fondly as the majority of the companies listed on there never amount to more than share selling schemes intended to enrich the insiders with little hopes of actually growing a business and creating wealth for their share holders.

That being said, let me also counter that with saying there are indeed some real legitimate businesses on there that aren't able to list on larger exchanges for whatever reasons, with the majority of those being foreign companies.

Why did the SEC step in today?

The SEC said that they are moving to suspend trading because of concerns over the information published by First Bitcoin Capital (BITCF), specifically the value of the assets BITCF claims to own.

The actual notice form the SEC reads as follows:

"The Commission temporarily suspended trading in the securities of BITCF because of concerns regarding the accuracy and adequacy of publicly available information about the company including, among other things, the value of BITCF's assets and its capital structure. This order was entered pursuant to Section 12(k) of the Exchange Act."

The suspension is set to last until at least September 7th.

That would make it a two week suspension, pretty standard practice for these kind of things.

What does this mean for BITCF?

This is pretty much the death blow to BITCF and it's stock price.

A suspension doesn't sound all that bad on the surface but in reality it pretty much just killed the stock.

When it reopens for trading it will open roughly 80-90% lower than where it was today ($1.79), and then it will go down from there.

It will most likely be delisted from the OTC exchange and move down to the Grey Sheets.

The Grey Sheets market is where stocks go to die. There is no liquidity and no investors. A stock graveyard if you will.

Innocent until proven guilty?

No, not really.

These guys are guilty.

The SEC doesn't suspend trading in a stock until they have found evidence of wrong doing. They don't suspend trading just to do an investigation.

If they are suspending trading in the stock, it means they have already found evidence of wrong doing.

They don't have the resources to do it any other way.

Unfortunately, I have seen this all too often.

Any time there is some asset that is doing very well price wise, penny stocks shoot up all over the place claiming to have large amounts of said asset.

You see it when gold prices shoot up, or when lithium prices soared, or the price of oil, and now Bitcoin prices...

Most of them have charts that look something like this:

Worthless, until moon shot.

Basically these people are most likely scammers looking to make a quick buck off of the attention being placed on the real asset.

Sort of a "popular by association" type of thing.

I feel for anyone that got duped into buying this stock hoping to catch a ride with Bitcoin's climb.

Remember, if want to invest in Bitcoin, the best thing you can do is actually buy one on an exchange and then store it in an offline wallet.

Stay safe and stay informed my friends.

Sources:

https://www.coindesk.com/sec-suspends-trading-publicly-listed-bitcoin-firm/

Image Sources:

https://iowaworkcomplaw.com/tag/fraud/

https://finance.yahoo.com/quote/BITCF/

Follow me: @jrcornel

The SEC cant stop this train

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Forget the penny stocks and stocks! Buy the decentralized crypto currencies directly!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

obviously the best answer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is a real shame for people to buy stocks as a way of getting involved in bitcoin.. all it takes is a Coinbase account and a bank account and you can purchase your own bitcoins. It's not hard to do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Slightly harder than using an existing equity account. So for the lazy, GBTC is an easy way to go, and particularly easy if you already your equity trading account up and running.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I didnt say GBTC was a smart way to go. Coinbase is much smarter. My only point is coinbase does have some start-up overhead which is a touch annoying, given how poor they are on customer service and attention to any questions you might have at sign-up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There are always gonna be scammers out there and unfortunately there are a lot of uniformed people too! Thanks for keeping us informed. I wonder if the SEC has gotten wind of Bitconnect! A lot of their citizens are getting sucked in and gonna be hurting when that house of cards falls - but I guess they don't have jurisdiction yet?!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had GM stock - what a scam that was, and not its back on the stock market again - SEC is worthless

Now so many people say shit about Bitconnect like its a sure thing that its a scam - and what if its not ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I agree, bankruptcy and too big to fail is another scam. I have looked into Bitconnect and there is no logical way that they can continue to make the payouts they are promising. But I believe they have a mechanism to control this by requiring investors to exchange everything into BCC tokens. When the money stops coming in and the momentum shifts they can flood the market with BCC they held back and devalue the tokens. Investors will only receive fractions of pennies on the dollar for the value of what they put into BCC. It's a game of musical chairs with a lot of people and very few chairs so if you are invested best to get out as soon as you can. By the way, if you think about it, "What if its not a scam?", is probably the worst endorsement of an investment you could ever make.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitconnect is a risk, but they can't just get out of the game like others, because they have their very own blockchain and "COIN", that can't just vanish like a simple HTML website.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right. This is a much more sophisticated operation with their own token but when redemptions start pouring in they can still block transactions and devalue BCC almost to zero. So the result will be the same and it will be dropped from all the exchanges. I think part of their marketing success has been allowing people to think it might be a scam but that they can beat the house. I never hear any of their promoters say that they ran the numbers and checked the technology and this is a solid investment. But it's definitely not worth the risk and even if you get out with some money there's always the risk of clawbacks from lawsuits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If they do what they say they do then numbers will work and this is a business making great profits like Renaissance Technologies making profit 40% a year after expanses for years for their investors however still no evidence of all the things they say they have and do makes it kind of shady looking

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WOW, before you send any BTC to these dudes, can I offer you a better deal? If you send me your BTCs, I'll promise you a 580% return per year, which is 100% better than what the BCC grifters are promising.

Let me know if you want my BTC address.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

sure and you have people who can prove you did it for them as well and you pay them daily interest of 1.6% for at least one year looking back

then send me your BTC address

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Who would buy this crap anyways? Why not just buy some btc at the hundreds of ATMs that already exist all over the country? the USA has the most BTMs (Bitcoin ATMs) in the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Probably people who don't know how to buy Bitcoin and already have an equity account. They see this is a way to catch some of the move in Bitcoin using traditional investment vehicles.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They could also buy the Silbert's GBTC, no?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You nailed it I threw $100 at it a month ago just to see if anything would happen and all of a sudden it quadrupled two weeks later, and I was like wtf; I checked the web site and SEC reports on there, the company had minimal assets and insane market cap, so I luckily got out a week ago.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ditto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It amazes me how some of these "companies" flit from one business to the next. Depleted gold mines, ostrich farms, Jatropha plantations - I've seen it all. Bitcoin is just the latest stock pumping vehicle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you saying there is a chance for me to get back into Jatropha? Do tell? What do I buy? LOL

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another one you want to avoid is Bitconnect. It's a pyramid scheme. When it hits the fan, it's top promoters like Trevon James will be looking at jail time. Always stay familiar with the law, ponzi schemes before investing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jrcornel The sad part is that the traditional markets would be an amazing conduit for investors to get introduced to crypto. Once there have been fat returns on crypto-backed trusts/funds, and tepid ones on traditional stocks, there would be an exodus.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It could be for sure. The derivatives market is already coming to Bitcoin in a big way over the next couple months. There will be futures and options very soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Futures and options are for the more savvy investors. I am talking about "IRA Joe", who can put 2% in without risking the farm.

Btw, love the "Fommy" title in your description.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha are you also a Fommy?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not a single dad, but I am quite domesticated. lol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Neither am I, I just say at home with our just turned 2 year old for the time being. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Enjoy it! People talk about the terrible twos, but 3 is harder than 2, and 4 is harder than 3! The more you get to know that big personality, the better off you are, period.

In the meantime, learn how to make French toast using legit french brioche bread. Pretty much Disneyland on a dinner plate, every time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh good, so I have things to look forward to. Haha I will have to get that recipe a try, the Mrs. is a major French Toast fan!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The shame of it all there is always someone waiting to take your money whether it's legal or not these sods have no morals

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Feed the government!

Or was I looking for a different f word?

Upvoted, resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha I see what you did there. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think that the big banks are trying to surpress crypto by making moves like this? I suspect they are.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Honestly I doubt it. They might be, but not with moves like this. This had nothing to do with big banks. It had to do with the SEC protecting naive investors from supporting scammers...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope you are right. I don't know much about crypto, although I am learning. I just hope it will get us out of fiat currency and the fed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Michael, I was looking for you, or your comment. I am always skeptical, always. Most people have no idea what crypto currencies mean for the powers that be. They are freaking out!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

For sure! We'll see what happens. I hope it is good?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a masterpiece.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

GBTC is the best "stock" on the market if you want to get into Bitcoin through a ROTH IRA. The only reason to buy this instead of bitcoin directly from Coinbase is because a ROTH IRA is tax-free gains (in other words, don't buy GBTC outside of a ROTH IRA or other tax-free account).

Every share of GBTC is .09 of a bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bit isn't buying that stock like paying $8,000 valuation on BTC? I prefer Coinbase to own it directly!

Edit: I do see your point if BTC goes to the moon regarding ROTH option:, although I would want to verify if there is taxation at the entity level of the public company. Also management fee on the holdings. ROTHs can be powerful tools though!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, it's better to buy the bitcoin direct to avoid that premium. You're right.

GBTC is only a good play if you purchase in a tax-free channel like a ROTH IRA. not sure about your point about the entity level of the PC. And yes, there is a management fee; but that's consistent with any mutual fund (albeit a bit higher than most at 2%)

Also, GBTC has actually performed better than BTC over the last year

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your thoughts.

My point is, we are relying on the tax opinion of the structure of this Over the Counter Legal Entity. We generally take these at face value for larger companies/funds, but I read the tax section of the public filings and just wanted to share that GBTC tells us if the entity was characterized as a C Corporation, all of the earnings in the BTC would be taxed at the corporate level. This is similar RE: Yahoo and Alibaba conundrum. Corporate level tax at GBTC would erode the value of the stock (to a NAV discount instead of a NAV premium!). And it's in their filing that they don't have an IRS ruling on their tax structure (this was as of January 20th, it's possible they now have a ruling but I haven't researched it).

Just so you see where I am coming from, please see below a quote from the GBTC SEC S-1 registration filing:

"In that event, the Trust would be subject to entity-level U.S. federal income tax (currently at a maximum rate of 35%) on its net taxable income and certain distributions made by the Trust to Shareholders would be taxable as dividends to the extent of the Trust’s current and accumulated earnings and profits (which, in the case of Non-U.S. Holders (as defined below), generally would be subject to U.S. federal withholding tax at a 30% rate (or a lower rate provided by an applicable income tax treaty)). "

https://www.sec.gov/Archives/edgar/data/1588489/000119312517013693/d157414ds1.htm#tx157414_24

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting...

I am pretty sure if you own it in a ROTH, you are not liable for the tax regardless of their structure. That being said, this doesn't protect you from potential loss in value of the stock as a result of their pending classification (which I don't know either). BUT if you believe bitcoin will rise, the stock will never be below the value of the .092 bitcoin that each share is worth.

So if you buy today at $775, you are basically buying bitcoin at a value of $8k. Regardless of the classification, the stock will never be below $775 as long at the value continues to rise and eventually hits $8k+ (which most believe will happen by next year).

Nonetheless, like anything, it's got a lot of risk and you are right to consider the other options. It's important to research the pros and cons of investing through any means.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They need to carve out more of the pie for themselves first!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the info! Being relatively new to Steem and Crypto for that matter I really enjoy reading articles like this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tnx to share a nice post

I upvote and follow back upvote

i am following you.

upvote and follow me @pramodbarmunda together we can succeed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is too much money in crypto for the SEC and IRS to turn a blind eye.... Look for stories like this to continue!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really enjoyed your post, thank you for sharing with us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm genuinely excited to see that news like this isn't being used to extrapolate that Bitcoin itself is a scam.

Definitely serves as a testament to the legitimacy crypto-markets have begun to earn.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've got an incredible gift.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the update cryptocurrency.

Upvoted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey, buddy thank you so much for keeping us update about ongoing scams. Really I quite got fade up with ponzi scemes and scams. There is always a fear to lose my bitcoin on these networks. So please be update us on regular basis, specially I shall be so thankful to yoy... Good job

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This action is seen as very negative.How the exact amount of time for suspension will be determined?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I got a comment on here today from someone wanting me to invest in something called WCEX offering me 50 free tokens and a percentage (of something). I thought I'd look at it to see if it was legit and Malwarebytes wouldn't let the site open... Long story short- Malwarebytes, I trust (that's why I pay them) The guy that sent me the comment, I never heard of! The crypto sea is teeming with scammers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Jrcornel, glad the Sec is steeping to clean this space up. Waiting for LedgerX options and winklevoss futures for Bitcoin and Etherium. Want to go bigger but will not do it if I can not hedge to avoid the dips. Thanks again

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is top-notch!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the update.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There will always be scammers. We must do our own research and stay updated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is the only crypto thing the SEC can regulate lol.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

cheers for the info!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good article for myself i don't believe in penny stocks or any market that has a direct connection to down jones market because this market have been made to keep us slaves of the world economic system , but bitcoin has bring a new hope to make us free and do push us to reach our financial freedom

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting post thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article took me a while to read it and grasp it but its great keep em coming :0)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your post. I enjoyed reading it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope for my own sake you are wrong about the SEC shutting BITCF down. They company even state that they would be presenting their current dividends to FIRNA. This is a quote from their website.

" The Board has set the record date for September 12, 2017, with the payment date of September 29, 2017, to complete this historic dividend event. The company is notifying FINRA ten days in advance of the record date and anticipates that FINRA will set an x-dividend date based on the record date. Owners of our common shares that they own on the OMNI Bitcoin blockchain will be automatically credited with TESLA as both BITCF and TESLA ride on the rails of the Bitcoin blockchain and can share the same wallet addresses. In order to avoid confusion with outside exchanges, it is best to hold your BITCF when in crypto form, in your private OMNI wallet."

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good post

follow me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The SEC said that it was moving to suspend trading because of concerns over the information published by First Bitcoin Capital, including the value of the assets it claims to possess.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a great article! Thank you for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really enjoyed your post, thank you for sharing with us. Enjoy the vote!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had a couple thousand in BITCF, without having done due diligence. Sounded good to play around a bit. Price popped. I made a good decision (for once) at that point.

What the heck am I doing in this stock? What do I know about it? Do I have the faintest idea why the price just popped?

Answers were - I'm not sure, not much, and no.

So I sold everything a few days ago.

Probably would have learned a stronger lesson by losing everything.

Got lucky on this one

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit