Join the social network, AlpsSocial(bitly.com/alpssocial), to connect with entrepreneurs, professionals, traders, investors and high-net-worth individuals to discuss similar topics.

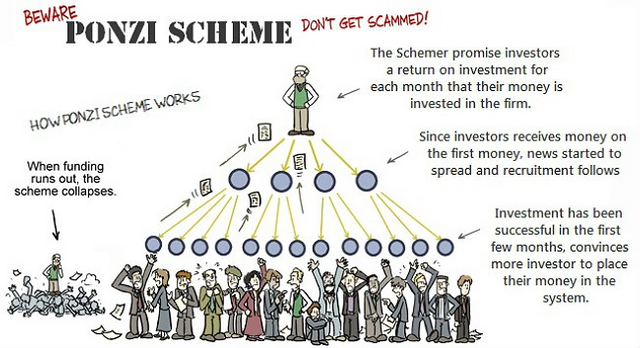

What is a ‘Ponzi Scheme’, you ask?

“A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers. For both Ponzi schemes and pyramid schemes, eventually there isn’t enough money to go around, and the schemes unravel.” — Investopedia

Other than using the Tulip analogy, if you want to let the world know that you are completely ignorant about Bitcoin Technology, saying “Bitcoin is a ponzi!” is your best bet. It shows a fundamental lack of ability to do basic research into something you don’t understand, before making any broad assertions about it.

When you understand the technology behind Bitcoin and the reason it was invented, you will see that it is actually the total opposite of a Ponzi scheme.

Let’s break it down:

“A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors.”

If you have not read the original proposal paper of Satoshi Nakamoto published in late 2008, you should. It’s eight pages long, quite technical, but is not too hard to digest. You’ll notice that never in that paper does it mention any kind of return on an “Investment” in Bitcoin. It never even mentions a price for one Bitcoin. It simply practically solved one of the oldest problems in computer science, the byzantine general’s problem, and thus established its value in the process. Bitcoin’s value proposition was never profit-driven, and holding Bitcoins in the early years was seen as “just for geeks” or “magic internet money”, sarcasm included.

Absolutely nothing about Bitcoin is a secret. It is one of the most open technologies in the world. It’s open source, anyone can review the code, anyone can contribute to the code, anyone can run the software voluntarily and participate in the network, and anyone can use the network without permission. The entire history of all Bitcoin transactions is visible to anyone in the world too.

It’s a total paradigm shift from any kind of financial system in the history of mankind. It’s the total opposite of a fraudulent investing scam, which is shrouded in vague promises of high returns with capital inflows and outflows that are kept in a secret ledger.

“The Ponzi scheme generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers.”

Bitcoin doesn’t generate returns. It’s just software. The price of Bitcoin is directly correlated to its scarcity and demand. The demand is not forced on others, nor do Bitcoin’s biggest proponents go around asking people for money and telling them to invest more into Bitcoin. New users that join the Bitcoin network don’t fund the older users with new money. Not at all. It’s just plain lazy to make this assertion.

In typical pyramid scheme, the founders will be the richest ones, guaranteed. The more people join, the bigger they’ll earn, as all the money flows to the top. They give their initial investment, and then they entice others to invest as well, funneling these funds into their pockets. This is the only way they can make money. In a ponzi scheme, the value for early investors rely solely on new entrants coming in with fresh capital, and their earnings come directly from this capital.

With Bitcoin, the opposite is true. A lot of people who got in early on Bitcoin are not around today to enjoy their 50,000 % returns on their investments. I know many people who bought thousands of Bitcoins and spent them on things like Pizza, mining rigs, gambling sites, video games, and even weed or other drugs. Hell, I lost several dozen Bitcoins back in 2014 playing Blackjack on stupid gambling sites and Satoshi Dice! I also gave away a lot of Bitcoins to people whenever I did talks in universities and the like, just small amounts that today would be worth 50 to 60 times its value.

Old Bitcoin “Hodlers”, the ones that truly held onto their Bitcoins after all these years, are few and far between. Some of them are insanely wealthy today due to the market price of Bitcoin skyrocketing, but their net worth is not realized in fiat currency terms, just accounted for using them for convenient accounting purposes. They measure their net worth in the amount of Bitcoins they hold, not in its fiat value.

They didn’t “cash out” and get rich. In fact, it’s the opposite. Old Bitcoin hodlers are the ones who will never sell their Bitcoins. Maybe some will sell a small fraction of their holdings to support themselves, but usually this is done not in a cash out but in a value exchange using Bitcoins as the medium i.e. they will pay for their new house, car, or investment using the Bitcoins themselves, to someone who wants the Bitcoins. The people that want the Bitcoins are in no way coerced or fooled into doing so — in fact, they seek people who are willing to pay them with Bitcoins. And believe me, most people don’t want to easily part with their Bitcons. People spend bad money before they spend good money, and Bitcoin is far superior than any kind of money in the world today.

In a Ponzi, the oldest members will one day dump it all for cash, leaving new entrants holding the bag, so to speak.

In Bitcoin, new “investors” who are in it to get-rich-quick are actually the weakest hands. They will dump their Bitcoins at a loss with the slightest sign of a downturn in price.

Their Bitcoins eventually end up with someone like me, and many others I know, who understands the technology and finds utility in it as a superior store of value or as a permissionless, censorship resistant, and secure transfer protocol. We are the people who will never dump our Bitcoins one day in some imaginary future so we can profit, but we will gladly use it as a medium of exchange for something we want or need, or to give back to the world either by investing it in worthwhile projects or helping others. Obtaining cash is not a goal, it never will be.

Unlike other financial systems out there fueled by pure greed, some of the old Bitcoin holders are also some of the most generous people on earth. Recently, an early Bitcoin adopter donated over $1 Million to Andreas Antonopoulos (she donated 37 BTC and then another 42 BTC shortly after). Andreas, one of Bitcoin’s most selfless proponents, recently told people that although he got into Bitcoin in 2012, his advocacy of teaching people about Bitcoin around the world made him spend a lot of his early holdings, putting him in a position that made him unable to enjoy the price gains of 2017. She then said that, without him, she would not have started in Bitcoin — and then promptly sent over $1 Million to his Bitcoin address to show her gratitude.

There are many more examples of this, the most recent one being the Pineapple Fund — a 5,057 BTC fund made by one guy who wanted to give back to the world with his Bitcoin earnings. That’s over $90 Million to be given to many charities and organizations that need it.

For us, Bitcoin is the end game. We cashed out, alright. We cashed out of the old system, the one we were using only because there was no alternative.

Now we have a choice.

“For both Ponzi schemes and pyramid schemes, eventually there isn’t enough money to go around, and the schemes unravel.”

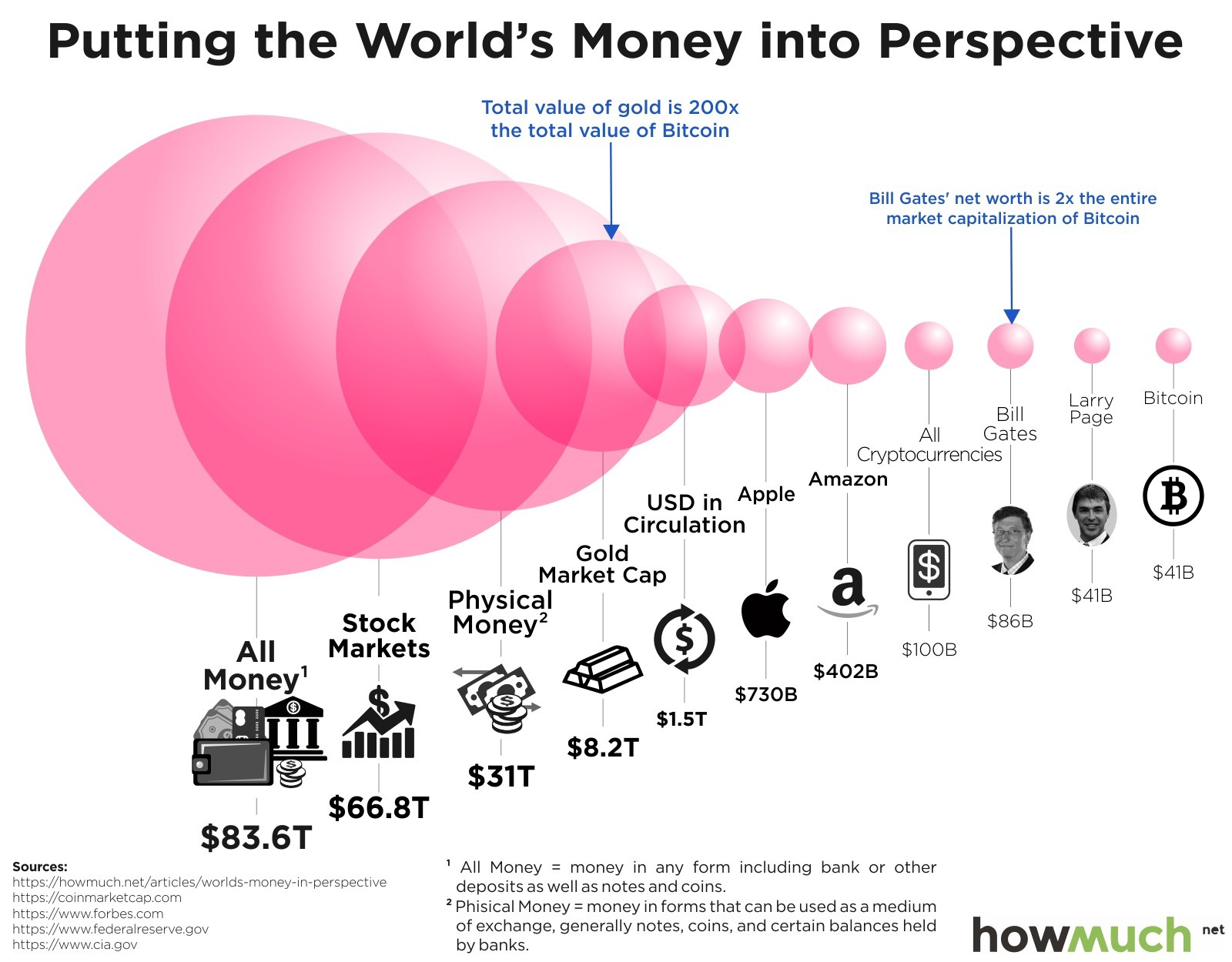

The image above is a bit outdated, but gives a nice perspective of the size of Bitcoin compared to the rest of the world’s wealth. Check out this visualization for a better view of all the world’s money, including Bitcoin.

For the “not enough money to go around” argument to happen with Bitcoin, it would literally mean that the $7.6 Trillion coins and notes of all countries, the $7.7 trillion dollars in Gold, the $74 Trillion in stock markets, and the $90 Trillion dollars in the global broad money supply would have to flow into Bitcoin.

Using these examples, Bitcoin’s has a maximum upside of around $180 Trillion, not including the $217 Trillion real estate market and $544 Trillion derivatives market. At $180 Trillion, the price of one Bitcoin will be, at the maximum of 21 million Bitcoins, about $8,500,000. Will it ever happen? Probably not. Will Bitcoin take a big bite out of these markets? It already started.

Bitcoin today, called a ponzi and bubble by “experts” are worth a grand total of $200 Billion, a drop in the ocean of global commerce.

“Experts Hate Them!”

Several so-called economic experts have called Bitcoin a ponzi or a bubble, just like how some experts called the internet a worthless idea. They are not evil, nor are they our enemies. They are just ignorant and short sighted. It’s not our job to try to convince them and argue with them about it — our job is to keep building value for the network, putting in the hours of work, and developing the ecosystem for future generations.

Bitcoin opened up a pandora’s box of new innovation that has spawned a $500 Billion market and an even bigger global industry in just eight years, with no signs of stopping, creating immense value on a global scale. This value is there not because new investors bought into the system. It’s the thousands of startups and businesses built on this technology creating tens of thousands of jobs, services that provide value in the savings they provide to users, infrastructure, hardware, software and applications, and much more that bring value to the table.

The market’s determination of what one Bitcoin is worth has nothing to do with greater fools getting in the system, but an after effect of the it’s true value proposition, one that it already had even when it was worth nothing.

Bitcoin will not unravel because the ones that truly understand it will never cash out. We don’t want cash, we want Bitcoin. Why would we trade a finite, scarce, and valuable asset for infintely printable pieces of paper?

Bitcoin is not a bubble — It’s the pin.

For us and many thousands of others, we are not waiting for exit. Bitcoin is the exit.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://decentralize.today/bitcoin-is-the-total-opposite-of-a-ponzi-scheme-heres-why-4d795f0ed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @junkai! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @junkai! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit