The Top 100 Holders of EOS Own 75%, or $11B Worth

By Rakesh Sharma | June 7, 2018 — 6:00 AM EDT

SHARE

MORE ON BLOCKCHAIN AND BITCOIN

Britcoin

What's the Vice Industry Token—A Crypto for Porn?

Governance: Why Crypto Investors Should Care

Blockchain-as-a-Service (BaaS)

The EOS initial coin offering (ICO) has generated news for a variety of reasons. Not least among them is the distribution of wealth among its token holders. (See also: What Is Wrong With EOS, the Cryptocurrency?)

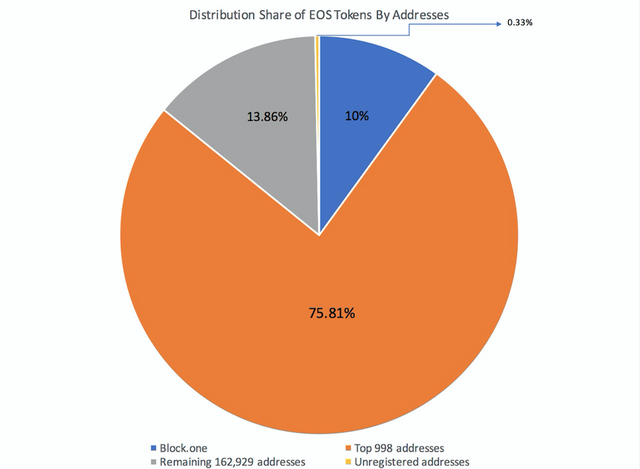

According to a post on the online platform Reddit, the top 100 addresses, which are used to identify holdings for nodes on the cryptocurrency’s blockchain, account for 75% of total distributed coins. At current prices for EOS, that figure translates to approximately $11 billion in monetary terms. The statistic for wealth distribution becomes even more skewed when you consider that the top 10 EOS holders own half of the total coins distributed during the ICO.

The largest holder of EOS tokens is the development firm Block.one, which owns approximately 10% (or 100 million) of all distributed tokens. If you remove Block.one’s share of the overall total, then the share of top 10 and 100 holders drops by 10%.

Those statistics, however, come with a caveat. During transition of the code from a test environment to mainnet—a production environment where the cryptocurrency’s code goes live—exchanges have banned withdrawal of EOS tokens. Effectively, crypto wallets with EOS tokens are frozen since the day that the ICO ended. It is likely that users will begin transacting and EOS token balances for addresses will change after the mainnet is live.

The Unequal Distribution Is Not News

The unequal distribution of wealth in the cryptocurrency ecosystem is not news. Bitcoin has a similarly skewed circulation. BitcoinPrivacy has estimated that 5,500 addresses, each containing at least $5 million each, account for half of the current stock in the cryptocurrency.

In the case of EOS, an unequal distribution of wealth has governance implications. This is because the cryptocurrency uses the delegated Proof of Stake (dPoS) system for governing its ecosystem. The system assigns votes based on stakes of cryptocurrency holdings for each node. This means that the top 10 (or even top 100) token holders can impose their diktat on the EOS ecosystem without any opposition. For a supposedly decentralized monetary instrument developed in response to the centralized nature of the existing finance ecosystem, the wheel has turned a full circle

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/news/top-100-holders-eos-own-75-or-11b-worth/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit