In the past few weeks Bitcoin's price has been hanging around an area that has brought doubt to most people involved in the market. People split (more than ever) into the two distinct groups, the ones that think it's going down (bears) and the ones that think it's going up (bulls). We've been in a correction since the $20k all time on December 17th 2017, that brought us to $5.8k after almost two months zig-zagging up and down. This correction scared a lot of people out of the market, mostly those new comers that bought near the all time high.

At a critical point during the correction (at the beginning of February), everyone was talking about the $5k or $4k bottom and the daily RSI below 20, but neither came. Bitcoin bounced on $5.8k and went all the way back up to $11.8k, almost doubling in value. People that were bearish became bullish and the general market sentiment was that we were out of the correction.

A few days later, however, it bounced back on $11.8k and went straight down, hitting $7.8k a few days ago. We ended up in a place were no one really knows what's gonna happen. Some people believe the correction is over and we're going straight up from here. Others think we might go down, as much as in the long correction that happened on 2014.

I've been reading as much as I can and trying to get a conclusion for myself, but the fact is that no one really knows. Unless you have a few billion dollars worth of Bitcoin and you're able to influence the market, you don't know also. In times like these the best we can do is to take the opportunities we have and avoid losses. Alts have been low for a long time already and, although some of them have had nice 10-15% pumps, eventually they end up correcting down.

This article doesn't intend to reach a conclusion of what will happen, because that can't be done. What we can is analyze what's happening and prepare ourselves for the time when the conclusion to this troubled period will come. Make no mistake: we are still in downtrend, and knowing this is important as you read through the rest of the article.

I'll use the opinions of a few people I follow to show the arguments that most people are using to defend their ideas and also to include my ideas of what I think might happen.

General market sentiment

If you look for opinions online, you will see that the general market sentiment is bearish. Most people believe it is going down, aiming for all ranges of values in between $7k and $3k. Some even risk to point to a $2k value on the long run. Just open Twitter and search for "Bitcoin" or look at the BTCUSD ideas on TradingView. Most opinions are bearish or neutral ("if it breaks X, it will go up; if it breaks Y, it will go down"). A few people, however, are posting bullish ideas, trying to be the first ones to point to a reversal.

The fact is that people that are into Bitcoin right now are in doubt, most of them believing it can still go down a lot more. The ones that believe it is going up are still shaken every time a big drop comes. Also, the vast majority of people still in the market are bullish on the long term. Even the ones that believe it can go to $4k also believe that it will recover and make new all time highs in the future. But the further down it goes, the longer it will take to get back up.

Comparison to previous corrections

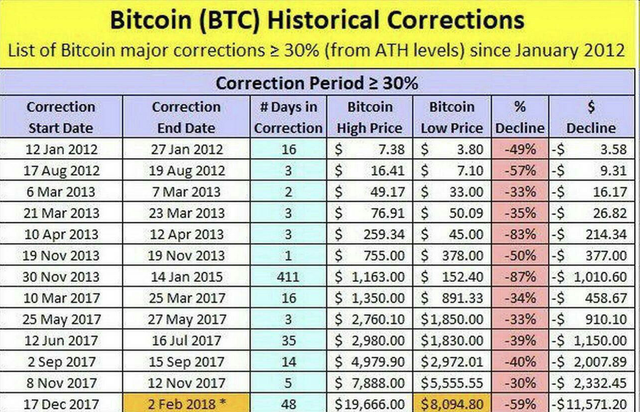

There have been several comparisons of the current correction with the previous all time highs and the corrections that followed them.

(Source -- at the time Bitcoin hadn't hit $5.8k yet)

Clearly there have been several big corrections in the past, so this is nothing new to Bitcoin. The interesting thing here is to figure out to which of the corrections this one will look more like when done. There are major corrections, like the one that started on November 30th 2013, and other "smaller" ones, like the corrections in 2017.

(Source)

This first idea compares the current scenarios with the corrections in 2013 (that lasted about 3 months) and with the correction in 2014 (the lasted about 2 years). This is the bleaker scenario.

Bitcoin has correct 70% so far (from $20k to $5.8k), which is less than the previous corrections. What we can take from this is that the 51 days it took from the last all time high to the last bottom is less than in those previous massive corrections, even though this parabolic rise to $20k was one of the biggest pumps in Bitcoin's history. If we were to make a lower bottom, it would point to a certain prolonged downtrend and slow recovery.

(Source)

More recent comparisons are made with the corrections from 2016 and 2017. They all show resistance lines (white lines in the chart above) that were hit three times before being broken. The current correction has hit its trendline thrice already, so it's just a matter of figuring out if it will make a lower bottom or just go for the trendline again. When compared to these corrections, it tells me is that it's near the point of turning up again and going for that trendline. If it turns around at $5.8k or higher, this trendline is the next target.

What do I understand from these comparisons:

- History repeats itself, but it always changes a little, it will always behave on its on way. We're in a unique moment, so it will never be exactly the same.

- If the current bottom was at $5.8k, the correction is already over and we should head for the trendline.

- If the price drops below $5.8k, it will very likely be a bigger and slower correction than most, comparable to the one from 2014, but in my opinion not so long.

Not very conclusive... let's see more ideas.

Discussing ideas

There are not that many bulls in my circles. There's two people I follow that have been more open about it: Junior and James.

Junior is a relatively new trader, he started at the end of 2017 and is known for using lots of Fibonacci indicators (colors and more colors) and Elliot Waves. He got some following after he called the $5.8k almost perfectly.

He was bearish for quite some time even after the bounce at $5.8k, calling for a $4k bottom, but changed his mind after Bitcoin hit $11k and he saw signs of a reversal. Now he continuously uses the tag "#thelastbullalive" on Twitter, as if being one of the first to predict a reversal. Either bullish or bearish, he takes pride in sticking to his analysis and to a single idea instead of making double predictions like most people ("if this than that, if not then..."). But that doesn't mean he can't be wrong.

He believes the big players will not let Bitcoin go down as much as $6k or lower, because there's a limit to how low it can go before... well, before it can't find a way up again. It's a valid thought, but is it really true? What would happen if Bitcoin hit $2k? My general felling is that a lot of people would already be out until then, but many, many more people would come after clear signs of a reversal. So many people wish they could go back in time to get Bitcoin at a lower price, which makes me wonder who wouldn't want to buy it at $2k knowing that it might just get to $20k (and way higher) again some day. The only way for people not want to is if they stop believing in it on the way down.

His analysis is solid and it's important to take it into account, but he seems to suffer a little every time Bitcoin goes against his waves, which has been happening quite a bit in the last few days. If you want ideas on how Bitcoin will look going up from here, take a look at his charts. You can also learn a look about technical analysis by listening to him.

Another person I've been following for a while is James, that is now claiming to be the only person calling the bottom. No James, you might be one of the few, but you're not the only one.

He's an interesting person. He doesn't really do technical analysis, he claims to be a good trader for knowing how to read people, so he knows where the market is going, specially as crypto is heavily influenced by people's sentiments, news and hypes.

He claims that people comparing the current trend to the one from 2014 are doing it solely based on technical analysis, without considering the human psychology. In part I agree: the moment now is very different from what it was in 2014. A lot more people know Bitcoin and big players are more interested in it than ever. However, history tends to repeat itself, so we can't ignore the idea that what happened in 2014 can happen again.

Another of his points is that the current price is at break-even for miners. Well, that really depends on where you live. In the US the estimated price is below $5k. In China, it's about $3k. These two countries have about 40% of the nodes mining Bitcoin at the moment. So it seems like we still have quite some way to go until break-even. And even if it reaches a point where it's not profitable to mine anymore, than what would happen? Probably some miners would stop or switch coins, but that would only make the life of those that are still mining easier, so it would be worth for them to still mine. Also, note that the difficulty of mining Bitcoin is reduced if the number of miners is reduced (because it's taking too long to mine a block) and that miners receive transaction fees as a bonus for processing transactions. So, the way I see it, this is not a strong reason for the price not to drop more.

(Adapted image from Investopedia)

He quotes the "buy when people are fearful" idea (famous words by Warren Buffet), which is certainly good, but seems incredibly hard to time right. Are people fearful right now? I believe most of the people that were afraid are already out. The ones still in the market are the "insiders", people that either believe on Bitcoin in the long term or that are consistently trading it. I don't see panic yet. I see people predicting very low bottoms but trying to use it to make more Bitcoin on the way down. So honestly, it doesn't seem to me like this idea applies yet. When would it apply? Hmm, I would say that if we get below $4k or $3k then people will be more afraid of an incredibly long term correction or of a bottom from which Bitcoin will never recover. Before that, not really, as we already hit $5.8k and it bounced right back up. A double bottom there is actually what a lot of people want right now, specially those that want to see Bitcoin make a new all time high still this year.

Another thing that they have been pointing is that we are at a bullish divergence on the RSI of several timeframes, which points to a reversal soon. That can surely happen, but for now it hasn't done anything yet.

(RSI divergence. Source)

Bearish ideas are easier to find at the moment.

Dope Trades is a trader I look up to. He's very unconventional, I would say, and seems to do extremely simple things. But the fact is that he got his method down to a point where he barely needs indicators and all the stuff traders use, he bases his analysis on price action and support and resistance levels, and he is amazing at it. He's got a "scary" chart pointing to a possible $2k Bitcoin on the long term. Is it possible? Sure. But there are many, many levels of support to break until we get there. If it happens, it will not be in a week, maybe not even in a month. Should be a slow process, with ups and downs, before it gets there. I particularly think that's a little too low, a $4k would already be a big support, and $3k even more.

Various traders take it day by day and change their predictions as they go through them. Check haejin's latest update on Bitcoin here on Steemit and Eric Choe's updates on Twitter . They, and others, seem to think a bounce is expected at around $7.2k, going back to $9k-$10k. After that, it's something that they will figure out later on. Singleplayer, that streams on Crypto World News, is another trader that seems to believe the same idea of a bounce on $7.2k.

Market manipulation

I think it's important to add this section to the article because this is a topic that has been brought up several times in crypto. Whenever Bitcoin shoots up or down 5% in 15 minutes, people start screaming that it's being manipulated. There are articles on the internet talking about the possible manipulation related to Mt. Gox and videos relating the possible influence that Bitfinex and their Tether (USDT) coin have had in the price of Bitcoin (thanks to @dpl for recommending the video).

In this unregulated market of cryptocurrencies, there's no doubt that prices can be influenced (or manipulated, if you prefer it) by big players. Not only Bitcoin can be moved, but altcoins with low volume can very, very easily be pumped if someone with enough funds decides to do so. So there isn't anything new about it.

If you're into crypto, it's important that you know it. There are big players, there are influential people that follow their own interests. While there's no control over what happens, no regulation, people will do whatever they can to get more and more. When there's money involved there will always be crooked people doing whatever they can to take advantages of others. I've already written about a few scams that happened in crypto in my previous article, but those are just a few among a vast number of shady things that already happened.

I have little time of experience in crypto but I already had my share of experiences. I already had coins in the BitGrail exchange, that has recently been hacked, and I will likely not see these coins again. I've also seem massive (10 million dollars worth) buy/sell walls in exchanges moving the price of Bitcoin little by little. Was that natural or was that manipulated? I don't really know, and I'm not sure if it actually matters.

What can the average person do in a Wild West like this? Learn to protect yourself.

Some people defend the idea that if you learn how to read a chart you can protect yourself from just about anything. News, manipulations, external events, nothing matters if you can read the charts and if you know a few strategies to protect your funds.

News are always trying to find reasons for why a price change happened. Why is Bitcoin pumping? Why is it dumping now? Yes, things my happen for a reason, but does the reason really matters? You will probably only find out about it when it's already too late, when it has already affected the price, so there's really no point in trying to follow them.

Conclusion

So, having said all that, we get back to the question: has Bitcoin reached the bottom of this correction already? I certainly can't answered that, no one can. But I have two ideas: what I want to happen and what I think will happen.

My favorite scenario is the one depicted by Junior in his Bitcoin analysis. That would be a bounce at around $7k and then back up towards new all time highs. This would represent almost a double bottom, which would be very interesting for who is bullish towards Bitcoin. We would be near the end of the correction and a possible new great season for altcoins.

Now, as I write this I'm looking at Bitcoin dropping below $7.5k again after being there 40 days ago. I believe it will continue going down, bouncing on the way down. The next predicted bounce is at around $7k, but will it be enough to be called a bottom? I don't think so. I look towards at least $5k, but it could go lower. That remains to be seen.

Since we can't really know the future, these are some things that can be done to protect yourself and even profit on the way:

- Scale your sells and/or buys. I sold a big part of my coins at around $9.3k, but I don't plan on waiting for a bottom to buy again. I tried it in the past and lost the timing. Unless you are very experienced and know how to detect that we reached the bottom, don't do it, don't go all in. Accept that you will not buy at the absolute bottom unless you get lucky. Set a few targets and buy at them. For example, buy 20% back at $8k; then another 20% at %7k; and so on. Averaging is a strategy used by a lot of people to deal with uncertainty.

- If you're trading, short Bitcoin. We're in a downtrend, so detect your entry points and short, go with the trend.

- Know that Bitcoin will not just jump from a bottom all the way to $20k again, so you will have time to think about it.

- Focus on capital preservation, on not losing. If your plan is to make more dollars, keep your funds in dollars. If your plan is making more Bitcoin, keep it on Bitcoin. Unless you're actively trading, follow the big trends, don't follow pumps and dumps that will keep happening.

- Keep reading and listening to people you trust. But don't follow mass media, don't listen to television channels. When they start talking about Bitcoin is because it is already too late.

Disclaimer: This is not financial advice, this is for informational and educational purposes only. This is only my opinion, make of it what you wish.

I think everyone agrees that $7.2k is the highest probability target for a huge bounce.

i) another… twitter.com/i/web/status/9…

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow nice post. Keep em coming. will folloy you for more in the future :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a great read if you're interested in long term analysis of bitcoin https://steemit.com/trading/@anonymint/bitcoin-to-usd15k-in-march-usd8-5k-by-june-then-usd30-k-by-q1-2019

Make sure you read the last comments made by the author a few days after the post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit