Over the last couple of months, the worldwide DeFi market has been in full swing. Multiple high-potential projects have been announced, many of which will undoubtedly yield great results.

While many DeFi projects have made very high profits since March, many DeFi projects have reached new ATHs, breaking a record in price-performance means this craze does not over yet.

But considering the state of the market we are in now, the DeFi hype seems to have slowed. Despite this, most analysts think the DeFi era is just beginning. Because while DeFis brings a brand new use case to the cryptocurrency industry, they appear to be an alternative to a hundred billion dollar industry, banking.

For this reason, it can be very profitable to research new DeFi projects and invest in these promising projects during the ICO process, which would be a brilliant investment choice.

Over the last couple of months, the worldwide DeFi market has been in full swing. Multiple high-potential projects have been announced, many of which will undoubtedly yield great results.

While many DeFi projects have made very high profits since March, many DeFi projects have reached new ATHs, breaking a record in price-performance means this craze does not over yet.

But considering the state of the market we are in now, the DeFi hype seems to have slowed. Despite this, most analysts think the DeFi era is just beginning. Because while DeFis brings a brand new use case to the cryptocurrency industry, they appear to be an alternative to a hundred billion dollar industry, banking.

For this reason, it can be very profitable to research new DeFi projects and invest in these promising projects during the ICO process, which would be a brilliant investment choice.

Source: Defipulse

PS:Statistics prove that interest in DeFi's is slowing but never decreasing

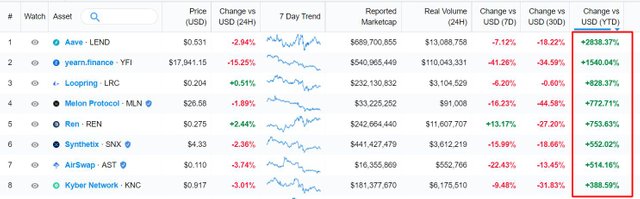

While the amount locked in DeFi platforms reaches tens of billions of dollars in just months, the prices of DeFi-focused projects are still quite profitable when viewed cumulatively.

Source:Messari

It seems that statistics and the market cycle prove that this new use case adds real value to the market. On the other hand, some influencers discuss whether the bull run in 2017 will repeat by comparing DeFi and ICOs.

These discussions continue, but while DeFi craze is still ongoing, we'll take a closer look at a few DeFi projects that will be entering the market in this article.

This article serves the purpose of highlighting three of the top DeFi projects that you should consider – PlotX, DeFiner, and Skale Network.

PlotX

PlotX represents a community-governed and decentralized project that aims to facilitate high reward yields when trading on crypto price prediction markets. It is generally believed that prediction markets showcase the wisdom of the many; consequently, smart trading can lead to considerable pay-offs. However, standard prediction markets lead to counterparty risks, expensive fees, and a lack of provably fair settlements.

With this in mind, as a non-custodian prediction protocol, the project is capable of rapidly creating markets that are provably fair and decentralized. Thus, users are free to take bearish, bullish, and neutral stances when trading via the platform, thereby earning high yields on their price predictions. Similarly, high profitability is also facilitated through the introduction of leverage-based exposure alongside the no-limit reward policy.

The PlotX markets provide a quick turnaround of one hour, one day, or one week, thus ensuring that user funds remain unlocked. Furthermore, PlotX is built on the Ethereum blockchain. This means that users can expect lightning-quick reward settlement, directly on-chain, without having to access the services of a third party. Odds are automatically calculated via an algorithm that thoroughly understands probability. Rewards are constantly given out to PlotX users who stake their coins or participate in predictions.

As such, PlotX customers can expect access to a highly-potent network infrastructure that allows high yield prediction market trading with a considerable profitability potential.

Key Metrics of the Project:

- Focussed Crypto Native Markets

- Short Market Cycles and Instant Rewards

- Participation Mining, inspired by Liquidity Mining

- Risk Spread Mechanism

- Community Governance

- Built on Ethereum

- Has a working MVP already

Notable Partners

Token Sale: Ongoing

DeFiner

With DeFiner, cryptocurrency owners gain access to a peer-to-peer and non-custodial platform that allows them to earn interest on digital asset deposits. Similarly, DeFiner also serves as a lending and borrowing service, thereby granting users the possibility of quickly securing loans or becoming creditors. The service supports multiple cryptocurrencies, including but not limited to Bitcoin, Ether, Tether, BNB, and DAI.

When it comes down to earning via DeFiner, customers can expect an interest rate situated between 6% and 12%. for their cryptocurrency deposits. Withdrawals can be made at any time - thus, unlike some of the competition, there’s no mandatory fixed deposit term. In fact, even lending terms are flexible. Furthermore, customers are also given the possibility of borrowing against their savings.

The platform’s peer-to-peer marketplace does not entail the presence of a middlemen. Contracts are signed on-chain and transparency is assured, as the platform integrates the best of what blockchain technology has to offer.

Lastly, the DeFi project has invested considerable resources into providing financial security - loans are over collateralized, deposits are insured, and a deposit fund is always ready to reimburse users in case something goes wrong.

As such, DeFiner represents a great choice for cryptocurrency owners looking to lend, borrow, or earn interest on their digital asset holdings.

Key Metrics of the Project:

- Assurance of DeFi Value with Chainlink

- Has a working MVP

- Auto-Insured Assets

- Supports Trading

- Has a user-managed liquidation system

- %10 interest sharing of Protocol Revenue

- Microsoft-backed

Token Sale: Ongoing

Skale Network

Unlike the two other projects mentioned above, Skale Network is not a DeFi project per se, but rather a technical infrastructure that’s designed to allow the creation of powerful Ethereum dApps, in a decentralized and modular cloud interface. However, the area of use brings a solution to the scalability of DeFi's and therefore high gas fees.

Until now, multiple blockchain developers have talked about the limitations associated with standard non-configurable blockchain networks. Skale aims to completely remove all limitations, by granting developers access to highly-configurable blockchains that make no compromise when it comes down to ensuring security, storage needs, or sufficient computation requirements.

From a technical standpoint, Skale Network adopts several innovative mechanisms and protocols. Firstly, it has integrated a Byzantine fault tolerance protocol - in other words, consensus is attainable even when ⅓ of market participants are ill-willed. Skale’s asynchronous protocol makes sure that blockchain message delivery time is configurable based on network and node latency. Interchain communication is assured through the integration of the BLS threshold signature protocol. Last but not least, network participants are equal through the deployment of the leaderless consensus protocol, which helps avoid collusion, thereby ensuring that participants are equal when committing to new blocks.

Skale-based dApps can easily run thousands of smart contract iterations simultaneously on flexible side-chains, at considerably lower costs when compared to the mainnet.

Interested users can become network validators by setting up a node that will allocate resources across the network of Ethereum-compatible elastic blockchains. Token-based rewards are distributed according to the technical performance of each validator.

As such, the Skale Network will likely revolutionize DeFi development, by providing project developers with a highly-elastic network infrastructure capable of handling incredible smart contract deployment.

Key Metrics of the Project:

- Fast, secure, and fully decentralized

- Collusion-resistant leaderless network

- Innovative application of containerization, virtualization, and BLS Threshold cryptography

- Mathematically provably secure ABBA-based consensus

- Fully compatible with Solidity and the Ethereum ecosystem

- Frictionless UX for both the developer and the end-user

- ConsenSyS-backed

Notable Investors

Token Sale: Ended

Conclusion

Based on everything that has been outlined so far, PlotX, DeFiner, and Skale Network will certainly play an important role in further revolutionizing the DeFi market and encouraging cryptocurrency usage and adoption.

Although trading is not profitable every time, being an early-stage investor by participating in the community sales of projects can earn you a fair amount of money. It would be a smart choice to invest in projects in this area, especially as the DeFi craze continues.

It may also be the right investment tool for you to examine projects with a low market cap in the DeFi ecosystem and invest in projects according to this may be a useful investment tool.

Thanks for sharing @kadjar

#resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing! In my opinion, the best projects at the moment are things like rarible. True real world purpose and solving problems we artists had a long time when it comes to selling digital art. See my first NFT : https://app.rarible.com/token/0xd07dc4262bcdbf85190c01c996b4c06a461d2430:39339:0xea6eb54332815bba635beaec5f4e33cf1ff226cc Another project I am testing is opus audio. Any thoughts and opinions on the latter? Greetings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit