The progress I have made in the past 2 years has been wiped. I’m going to share my story here, and I hope it helps you make better decisions if you ever end up in the same spot as I did.

I fully entered the crypto market back in 2017, sold all my stocks, and went bonkers on ICO’s and falling in love with crypto projects. I took advantage of the many opportunities and went through the great bear market with flying colors, holding and increasing my crypto stack. I was a happy guy.

I fell in love with crypto.com. I have been a fan of their company since back in 2017, and I have watched them grow and work hard, while the naysayers have piled up over and over again. They kept launching products, improving and the amount of work I have seen them put out every day has been just staggering. I took advantage of the Syndicate, the Crypto Loan program and I used their offers to increase my MCO/CRO stack. I have been living the dream. I wasn’t getting rich overnight, but I could see how stacking 100–500$ here and there was adding up slowly. It would surely pay off in the long term.

Back in March, I took a 14.000$ loan, using as collateral 5.000 MCO (worth ~28.000$ at the time — 50% LTV). Here’s how it all went down (literally):

The Coronavirus came and the whales just saw this as an opportunity to crash the market to 3800$ in a couple of days. This is where the flaw in being human comes in. It just felt like all stars aligned against me:

- had tax coming up in 2 weeks and no government help has been announced.

- had a 14.000$ loan which was now at risk of being liquidated.

- I made the mistake of taking into consideration the sentiment everyone was having on Twitter/Telegram, I mean … if thousands of people are bearish — surely the sky must be falling right? (hint — wrong — there’s not a single Telegram group or Twitter person without an agenda and trying to swing things their way)

The tipping point was a bug in crypto.com’s systems that triggered my liquidation even though I had ~9000 MCO tokens as collateral (i added more to make sure I don’t get liquidated — worth ~18000$ (when BTC was at the lowest point) for a 14.000$ loan so I should have been safe). Mind you I have never gone through a liquidation before.

System bugged out — Liquidation triggered. Seeing that much money lost, with the market crashed, with everyone bearish, with the virus scare, I am ashamed to say but I hard panicked and I started doing bad decisions after bad decisions digging myself deeper and deeper into a hole. I just couldn’t process the situation properly.

Now here’s where grave mistakes were made:

1 — I end up getting refunded 4600 MCO from the liquidation. BTC did a bounce to 4900 something — everyone was calling it dead cat bounce, going under 3k, everybody was scared and bearish, so I ended up selling the absolute bottom. In hindsight, there was another drop 3 days later and I could have rebought, but EVERYONE was bearish and I stopped trusting my own judgment. I was thinking “I surely couldn’t be possibly the only one right and everyone is wrong. right? right?” I couldn’t have been more wrong. I just kept watching BTC creeping up while everyone was calling for more severe drops.

2 — This whole situation could have been avoided if crypto.com would have dealt with the liquidation bug and sorting out the funds faster, but it took them 2 weeks to initiate another full refund. However, they refunded the full amount I had as collateral — 9000 MCO.

I went ahead and the first thing I did was to sell MCO and pay back the loan and re-stake/lock 5000 MCO so I don’t get forced into selling again. For some idiotic reason, I was thinking in USD value instead of MCO amounts and still being underwater, I used the 4600 MCO that wasn’t mine to use to begin with, along with whatever else I had left — to trade some BTC and thinking I could make back some of the cash I wasted by not re-buying BTC at 4900$. Go figure — this didn’t go well (at all)

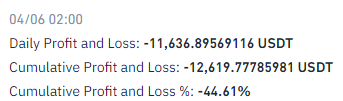

3 — Queue the Binance Futures trading: With Bitcoin having gone up from 4000 to ~7000 in a couple of weeks, in the middle of a pandemic, with the terrible economic outlook — millions of people out of work, I was thinking I have a decent chance that I could recover the cash shorting the dead cat bounce, till I can get back to break-even. Honestly, I wasn’t even interested in making profits. All I cared about is to recover what was lost. Thus, I made the biggest mistake of all — to try to trade in such an emotional timeframe — especially when you’re not really a full-time daytrader.

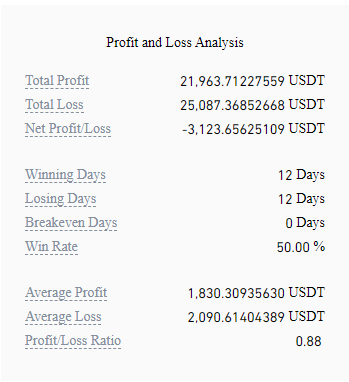

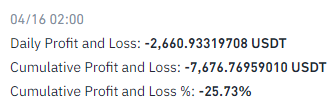

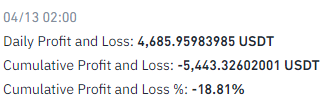

It went just about as you’d expect: loss, over a loss, with my biggest loss being the below. If I didn’t take that loss and kept holding onto it, I would have been liquidated and lost all ~30.000$ I was trading with.

4 — The mental toll.

This has had to be one of the most brain taxing periods of time in my life. I now realized what I had done — that I lost money that wasn’t mine and felt beyond stupid and embarrassed for doing so, but I also had a duty to make it back, so I had to play the game.

This turned me into a person I didn’t like at all:

- My work suffered as I couldn’t focus

- I was just feeling like I am caught in a meat grinding machine and every decision I make is wrong: went long — market went the other way, went short — the market goes the other way and I pile up loss after loss.

- I constantly felt gutted and under pressure to perform and I kept beating myself for making mistake after mistake.

- I hated what I was doing and even when I was making some wins — it wasn’t rewarding at all, because I just felt I am on a race to try to get everything at least back to break even.

- I was waking up 3 4 times a night, checking my position, doing even more bad decisions only to see in the morning that all I had to do was not do anything at those moments when I woke up. I was just too distressed to understand this and stop myself from making these mistakes over and over again.

- I was being a terrible father. Every time I took Alex out for walks, I was constantly checking my trades/positions. I knew I was behaving badly, I just couldn’t get myself to snap out of it and compartmentalize.

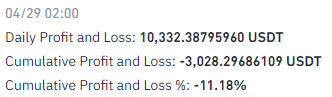

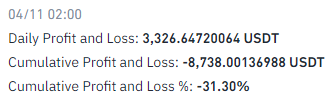

4 — The change:

It really happened once I started to understand that I have to stop listening to the public and just do what I think it’s right, take complete responsibility and control 100% otherwise I will always be looking for scapegoats — “I have been influenced by this and that, so it’s their fault”. Knowing I have to fully take responsibility I began doing a few radical things:

- Fully ignored Crypto Twitter. Full stop. I didn’t bother even remotely considering what anyone else is doing.

Exited all Telegram groups like Whalepool and other groups that apparently people get market sentiment from. Only kept a few groups with close friends that I trust they don’t really have an agenda. - I stopped trying to give out opinions on the market because I get biased in doing so.

- I asked a friend for help with finding an impartial market observer that could tell me some unbiased opinions, that had no agenda, that I wasn’t interested in following but to use it to augment my decisions moving forward.

- I knew I was lacking in the department of drawing channels, trend lines, and timeframes, so I took a little time to re-educate myself a little bit more, combined that with resistances and pivots, I started seeing a plan forward.

- I understood that I have to respect the no-trade zones — when everybody is piling up to make a move and they just end up getting mowed, so I started aiming for 3–4 days plays on the edges.

- I started forcing myself to work out at least 30 minutes. I didn’t want to work out long enough to get tired, but long enough for the brain to give me a spark of intelligence per day.

5 — The result:

I am still at a loss, but I have recovered the money I have to pay crypto.com back and I am taking a break for the time being. The total loss is ~30.000 $ because of selling the bottom but right now I am just keen on taking a little break to re-gain my sanity, focus on work, and being a good person once more.

Licking my wounds but regaining my sanity

6 — The lessons:

- I learned that when the sky is falling — the only people that make it are people that don’t make rash decisions. Cool heads prevail.

- When the sky is falling, there are opportunities to be had if the cool head has been preserved — at least in this case.

- Humanity doesn’t want to roll over that easily and when things get tough — people band together to help each other — at least in the areas where I live. I love this part.

- Less is WAY more. I was able to make some progress only when I started trusting myself and only a very restricted group of friends that are smarter than me, that I know 100% have no agenda.

- Take care of the brain and the brain will take care of you. I was about to go on the edge to despair, have a drink, have a smoke, but I chose working out instead and the brain rewarded me with a tiny set of good decisions that helped me recover the critical pieces.

- I have paid very expensive tuition — 30.000$ which is about all the progress I made in the past 2 years, but I hope this made me a better man in the end, and a bit smarter.

- When in doubt, go back and do a little bit of education. It helped me remove all the previous ideas I had about where I think the market is going, and make a few correct plays that got me to recover the critical part of the losses that I had to recover.

Can I place all the blame on crypto.com? Surely not. It’s such a mixed bag of feelings.

They liquidated wrongfully — their fault.

I panic sold the bottom — my fault

They refunded the collateral but with an excess of 4600MCO — their fault

It took them 2 weeks to sort out the situation — their fault.

I sold/traded MCO that wasn’t mine because my head was in the wrong place— my fault.

I can own my mistakes for sure, but I can’t expect them to compensate for theirs. It is what it is. What I can surely say is that if the liquidation never happened, things would be different.I stopped drinking back in September as a challenge. I think this was one INSANELY good thing that helped me cope with this situation. Been sober through all this time. If I had been drinking+lockdown+all this losses+all this compulsory trading — it would have been a recipe for disaster.

I started using a daily checklist that’s now always in my face to keep myself composed and obeying the rules.

If you think this article was worth it and helped you dodge some bullets or changed your life to the better, send a contribution via the means below:

Bitcoin Address: 1PEV3i6ozBnQCT7Z19cacKZ9z9SeoEVAua

ERC20: 0x3d3a920d1494d00fcce785d02ac3738db85133f4