This article was posted on Wednesday, 08:00, UTC.

The smaller coins have been following the majors lower in the strong correction of the past few days, as the correlation between the coins jumped and the main swings were concerted in the different currencies. Yesterday’s re-test was slightly different, as some of the coins started diverging from Bitcoin and Ethereum, while the huge drops in Dollar terms provided buying opportunities for long-term investors in the case of the already consolidating small cap coins. The short-term trends remain negative and volatility will likely remain high on the coming days, but a less hectic environment would be a bullish sign.

// -- Discuss and ask questions in our community on Workplace. Don't have an account? Send Jonas Borchgrevink an email -- //

Stratis (STRAT)

Stratis/BTC, 4-Hour Chart AnalysisStratis held up well compared to Bitcoin during the sell-off, remaining inside the long-term consolidation pattern that we have been monitoring. The coin held above the 0.00215 level on the BTC chart, and the long-term support near $5.75 against the USD. The declining short-term trend remains intact and positions playing the bounce should be kept small, as volatility is still expected to stay rhigh.

Zcash (ZEC)

ZEC/BTC, 4-Hour Chart AnalysisZEC broke through several strong support levels during the correction on both the BTC chart and the more volatile USD chart. The long-term picture favors more consolidation, as the coin was hitting new highs just recently, and it entered the correction in an overbought state. Short-term traders should wait with new long positions while long-term investors could at to their existing positions if thecurrency re-tests its recent lows.

ZEC/USD, 4-Hour Chart Analysis

Bitshares (BTS)

BTS/BTC, 4-Hour Chart AnalysisBitshares slipped below the key 0.0001 level that acted as support before the correction, and it found support right at the 61.8% Fibonacci-retracement level, where it currently trades. The coin is still in its advancing long-term trend, with the trendline being slightly above 0.00008, providing a possible final target for the correction, and a good entry point for long-term investors.

Steem (STEEM)

Steem/BTC, 4-Hour Chart AnalysisSteem broke below the 0.00075 level during the correction, and dipped below the other crucial support near the 0.00066 level, but the coin rebounded strongly above that zone. The declining short-term trendline is intact and although Steem is below the long-term trend-line. a quick rally would trigger a new buy signal.

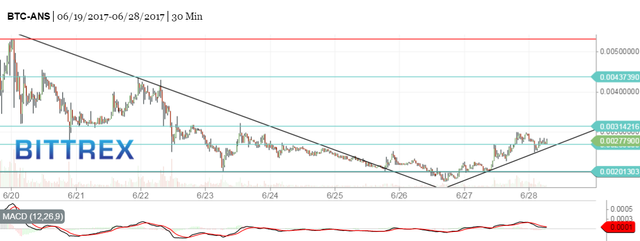

Antshares (ANS)

ANS/BTC, 30-Min Chart AnalysisAntshares was already in a steep short-term downtrend when the correction began, and it dipped below the 0.002 level two days ago, but remained well above the lows yesterday. The 30-min chart is already on a buy signal, and a break above the 0.003 level would further confirm the uptrend. The 0.00315 and 0.004375 levels serve as targets for the rally, while a break below the short-term trendline at 0.0025 would warn of further consolidation.

Cheeta !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/price-analysis-stratis-zcash-bitshares-steem-antshares/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit