I bought 500 BTC in 2011 for $3 a piece, and then I sold nearly all of it in 2012 for $6 a piece. For the full story click here to read all about it in my Steemit Introduction post. Needless to say, since 2011 I have been fine-tuning my Bitcoin investment strategy and have settled on something that I believe is fool-proof. I call it:

The Buy/Buy Strategy

In most investing situations the idea is to buy when the price is low, and then sell when the price is high. With Bitcoin I submit that the best strategy is to buy Bitcoin when the price is low, and to buy stuff with your Bitcoin when the price is high.

You can literally buy anything you want directly with your Bitcoin, even if the shop you are trying to purchase something from does not directly accept Bitcoin. Using Bitcoin Debit Cards such as Wirex Bitcoin Debit Cards you can buy stuff with your Bitcoin anywhere VISA is accepted.

(Note: This is my referral link, you will get a 25% discount on ALL available cards (USD/EUR/GBP) if you sign up using this link.)

Never "Cash Out" Of Bitcoin Because Bitcoin Is Cash

The idea is to invest "bad money" into "good money." Why would you ever reinvest your "good money" back into "bad money"? The only conceivable reason would be if you could not use your "good money" to purchase goods and services, but that is not the case with Bitcoin.

It took me about four years to finally understand the change in mindset necessary to get it right. Bitcoin is not just another investment, it is a new form of money. If you want to consider Bitcoin an investment, then you must also consider fiat currencies an investment. So "cashing out" of Bitcoin, is really the act of investing your Bitcoin into Federal Reserve Notes or whatever your local fiat currency happens to be.

Seen in this way, when the price of Bitcoin goes up, "cashing out", or selling your BTC for USD is still not a good idea because what you are really doing betting that the future of USD will outperform the future of BTC, and even the BTC price astronomically high I wouldn't bet that the future of USD is brighter than BTC.

Don't Buy at $3 And Sell At $6 Like I Did

Learn from my mistake, which I have made over and over again. Consider the fella that bought $1000 worth of Bitcoin in 2013 for $220 a piece. It would seem that the best possible strategy he could have employed would have been to sell at the peak of the price spike that occurred in 2014 at $1200, but that would be incorrect. Doing so would be the equivalent of the blunder I made buying at $3 and selling at $6, just on a larger scale.

Today the price of Bitcoin is hovering around $2200, so that fella would have missed out on further increases in value because he sold. And further, he sold for USD which has a current inflation rate of over 2%, so instead of gaining value, he's gradually losing value every year he keeps it stored in USD.

Instead of "cashing out" and "taking profits" by selling Bitcoin for USD in 2014, the best strategy would have been to just start buying goods and services with Bitcoin when the price was at $1200, and "take profits" that way instead. He could either support those merchants who accept Bitcoin, or use a Bitcoin Debit Card.

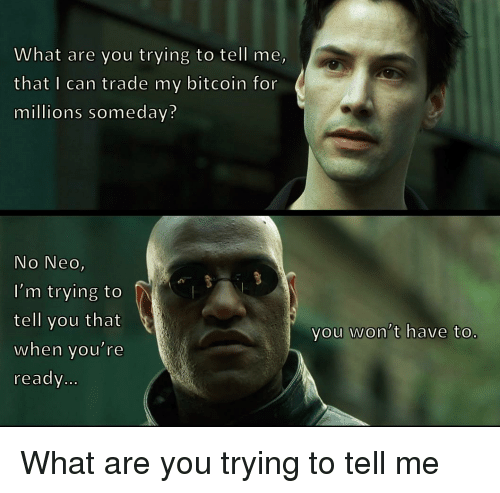

What I am trying to tell you is that it is best to stop thinking of USD as money and Bitcoin as an investment with which to make more money in USD. Instead, it is better to start thinking of them both as money, and both investments. USD is just as much of an investment as BTC is, therefore it is necessary to reconfigure your goal so that it is not to make as much USD as possible, but to invest as much inflationary, value-losing, fiat, "bad money" as you can into a sound, deflationary, value-storing, value-gaining, "good money."

In other words, convert your bad investment into a good investment.

And once you have converted bad money into good, don't ever go backwards. Don't ever reinvest your good money back into bad. There is no justification for it. I have been following this strategy since 2015 and it has been the most satisfying, easiest, and most profitable strategy so far.

The following is a youtube video I made in 2015 outlining first my Bitcoin price predictions at that time (when the price was hovering around $200), and then the Buy/Buy Investment Strategy towards the end.

My Bitcoin Strategy Since 2015

Say "Bye Bye" To Fiat

For an explanation of why I think Bitcoin is "good money" and why it has and stores value better than any fiat, check out my article called Why Bitcoin Is Not Fiat.

If you have any questions or comments, let me know below! Thanks for reading, hope you enjoyed!

- KG

P.S. If you enjoyed the content of this article, be sure to follow for more content like this!

Legal Disclaimer

The information provided in this article is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs.

This article and it's author do not make any guarantee or other promise as to any results that may be obtained from using the content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, the article and it's author disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

Content contained in this article is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Your use of the information is at your own risk.

Thanks for post! I agree in your arguments.Bitcoin/cryptos are to take over.

If interested I have just posted at BTCUSD EW Technical analysis ..check it out!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

will do, thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing. Agree 100 we need to change the way we think long term.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your post! Great thoughts pointed out. I have a question though. Why would you buy any products/services with bitcoin instead of USD? Those 0.0006 BTC an hamburger costs today and you're withdrawing from your investment could potentially be worth 50%(e.g.) more tomorrow. Isn't that pretty much the same as trading BTC for USD?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good points in this article. Same thoughts here. The coin market will be turbulent for the upcoming year(s) but I really believe in the blockchain as a technology. I was researching a way to do better investment analysis on the current cryptos. I really advice people to take a look at: https://www.coincheckup.com This site is really helpful in my coin research. I don't know any other sites with so much indepth analysis. Check for example: https://www.coincheckup.com/coins/Bitcoin#analysis To check Bitcoin Report

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit