USD 1.9 B Liquidated As Overexuberant Crypto Traders Get Overleveraged

Around USD 1.9 bn in 281,000 trading positions have been liquidated in a day as the marketplace fixed greatly, per bybt.com information. Around 90% of the liquidations were of long positions, recommending that extremely optimistic traders were utilizing margin trading to open large positions in the hope of bitcoin (BTC) striking USD 50,000 (and beyond).

The liquidations are mostly responsible for bitcoin's 3% fall over the past 24 hr, when its price dropped from around USD 49,500 to almost USD 46,000 (prior to recuperating to the USD 48,000 level). This correction likewise started a domino effect in altcoins-related positions and accelerating their sell-off.

February's crypto liquidation records

As things stand, USD 1.9 bn in trading positions have actually been liquidated over the past day. This is the greatest quantity since January 10, when around USD 2.5 bn in positions were unwinded.

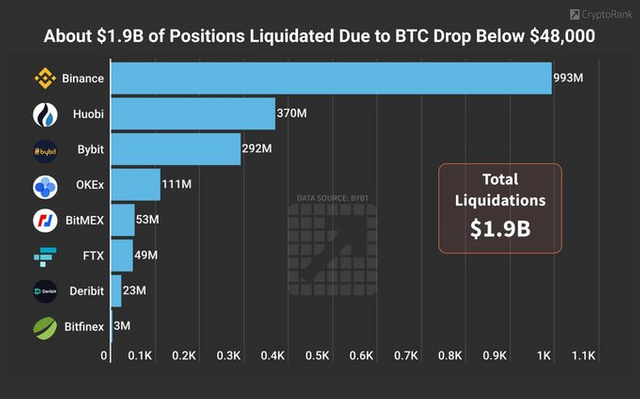

USD 1.7 bn of these positions were long, with Binance alone representing nearly a billion of them. Bitcoin was the most liquidated position, with positions worth around USD 550m being liquidated.

$993M on @Binance

$370M on @HuobiGlobal

$292M on @Bybit_Official

$111M on @OKEx

$53M on @BitMEX

$49M on @FTX_Official

$23M on @DeribitExchange

$3M on @Bitfinex

Taking a look at bitcoin's price chart, a drop over the past 24 hr-- especially at 02:00 UTC-- indicates that these liquidations have actually only accelerated the crypto's slide down from its latest all-time high.

And for many experts and commentators, there was actually only one significant cause for this rise in long-position liquidations. Namely, overleveraged traders, who were not able to manage the margin calls which followed the price of bitcoin dropped listed below USD 48,000, and who (as a result) had to liquidate their positions.

Some analysts blamed the liquidation wave in particular on excessively bullish and unskilled traders who naively presumed bitcoin's price was heading in a straight line upwards.

Overleveraged problem

While traders who don't utilize take advantage of can sit back and make fun of the misery of their peers who were 'rekt' in the most recent waterfall, its event signifies an increasingly serious problem within the cryptocurrency market.

Looking at the bybt.com chart above, it becomes apparent that long liquidations have become more many over the past month or so. With bitcoin (and other coins) breaking all-time highs almost every death week, some traders might feel unable to get significant exposure without margin trading.

It's clear that a growing number of traders can't pay for to keep their leveraged positions in the event of dips. For this reason, the growing frequency of huge liquidations.

While the increasing price of bitcoin might make leverage more appealing, more sober experts advise traders-- particularly unskilled traders-- to not "take the bait" and to merely build up a long spot position in time with your own funds.

As reported, leveraged trading is the biggest danger to the crypto market in regards to what could cause "something to pop down the line," according to Joey Krug, Co-chief Financial Investment Officer at US-based significant crypto investment firm Pantera Capital.

When they understand crypto is here to stay, he alerted that some people get contented. As a result, they lever up on it, believing it can't decrease that much because organizations will swoop in and buy, saving the day. But ultimately, when the cover blows off and bids are not there, liquidations of levered longs will drive the price down as simply took place once again.

Leveraged trading refers to obtaining funds so that you can take a bigger position than you would be able to with your existing funds so that you can potentially generate a higher profit. While margin trading makes it possible for traders to magnify their returns, it can likewise lead to increased liquidations and losses, which is why experienced traders tend to recommend newbies to remain away from leveraged trading.

At the time of writing (16:21 PM UTC), BTC trades at USD 48,401 and is down by 2% in a day after it reached its new all-time high of USD 49,532 yesterday. The price is up by 23% in a week and 30% in a month.

There are impressive amounts of money on Binance! Thanks for information @kingzofcrypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit