Unless your name is Wikipedia, admit that you do not know everything.

I know why Bitcoin is in a bear market. We can talk about self-aware irony afterward.

Price action responds to supply and demand. Regardless of the current demand function of Bitcoin, whether it is smart money, dumb money, or early adopters, there is not sufficient demand to overcome the supply needed to reverse this bear market.

Therefore, do not wait for the smart money to save the day, be it the entrance of an ETF, or new institutional trading desks, because as of right now smart money is flowing in yet the bear market continues. And this is because public sentiment has been and remains skeptical and trepidation reigns.

When bears growl and bulls charge, the spirits of these animals permeate into society and affect the way that we think and act; and this is when we can make irrational decisions. Because, finance is not exempt from wild emotional extremes. Contrariwise, it is a reflection of the collective consciousness of all participants.

There is only one diamond and it is d-flawless. It is Bitcoin. Everything else is charcoal. Right now, the diamond is still in the rough. The price will eventually rise, and I believe, one day, it will go to the moon. But this will only happen when the charcoal is recognized for what it is and has burnt into ash.

When chasing your dreams, don’t trip over reality and bust your head on the truth.

The trolls say that everyone who hasn’t jumped into the Bitcoin marketplace is stupid. These statements are simply mental masturbation.

A lot of people have recently lost a lot of money because they were enticed to speculate at the end of a bull market. They are being enticed again to jump in with more money because of opinions that the bear market is over.

Some of us have made huge paper profits, some turned those paper profits into realized gains, others gave back 75% of those paper profits.

Those of us that have been in the space for years have a distorted view. We took the red pill a while ago. We’ve weathered the early ups and downs. We are excited by the technological innovations. We embraced the brilliance of Satoshi’s vision. We believe that Bitcoin will gain mass adoption and that its price will soar.

We, the believers in this vision, must calibrate our enthusiasm, as reality demands. We have been in a bear market for six months. Our actions need to accept this fact.

You are entitled to your own opinions but you are not entitled to your own facts.

One reason for this is the media. The media has painted a narrative of the space, in broad strokes. They are incentivized to aggrandize themselves through misrepresenting the crypto environment; they only tell us about the trash. They report, almost daily, of criminal investigations, constant hacks, con artists, “anything goes” VCs, millions stolen off of exchanges; and it’s getting worse by the day. However, they do not differentiate Bitcoin from the junk and this has corrupted Bitcoin’s reputation.

Moreover, it leads to misinformed readers and regulators, thus creating a downward spiral of diminishing consumer confidence.

A woman reading a newspaper in Lake Mills, Iowa only hears negative information about the space¹. There is information asymmetry and currently the information that she is receiving tells her not to touch our world with a ten-foot rake. Ceteris paribus, she is making a smart and prudent decision.

People in sleeping bags are the soft tacos of the bear world.

Wake up.

We are yet to learn our lessons; we’ve let our minds go to sleep. The current situation with Bitcoin and the rest of the alt-coins is all to similar to the dot-com and mortgage crisis bubbles as well as the developing credit armageddon.

In the dot-com days, 1995–2003, everyone wrote beautiful soliloquies about absolute crap. Conferences galore with money flowing into everything, lavish parties, over-the-top dinners, events, trips and cruises, all paid for by dot-com promoters. It was spectacular. Investors, speculators and the public attended, feverishly taking notes, yet it was a mirage.

Sound like Consensus to you?

The similarities to our current ecosystem are painfully obvious. However, often, and unfortunately, it is these important realities that are the hardest to see.

When the dot-com bubble finally collapsed, everyone was shocked and embarrassed at how oblivious, misled, misinformed, and stupid they had been. 95% of the companies went to 0 and almost everyone were completely wiped out. These were not stupid people; they just acted stupid because of irrational exuberance.

The system cleansed itself.

The system always cleanses itself.

And after the correction, the great bull market ensued.

A historical doppelgänger appeared again with the mortgage crisis. The Federal Reserve, Congress, the banking industry all created policies whereby mortgages were ridiculously available to ridiculously unqualified buyers. This accelerated from 2003 to 2007. Then, the house of cards came crashing down.

In both cases, the collateral damage was catastrophic.

This was because so many were swept up by the hype and so few were looking at the bigger picture. It does not matter how smart you are. It has nothing to do with intelligence. The takeaway here is that it is human nature to reach for things that are not there because you’ve convinced yourself they are, because you want them to be, despite the facts.

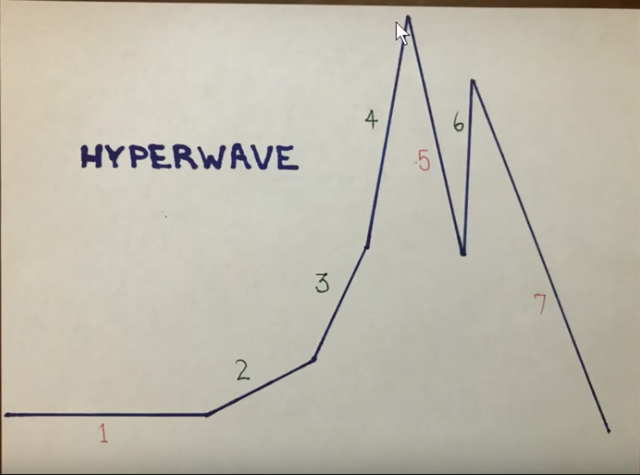

Surfing The Hyperwave

My partner Tyler Jenks developed the proprietary technical system of Hyperwave in 1979. On a psychological level, Hyperwave is a simple model to explain what happens when people refuse to allow the numbers to add up.

Phase One is an elongated period of inaction. With Bitcoin, this inaction occured at and beneath $1,000. Although the price swung wildly for many years, these price swings were between very few participants. The investing public had not yet entered the arena. This ended in 2017.

Phase Two begins with a penetration upward of the Phase One line. And price moves continually upward at a Phase Two angle. With Bitcoin, Phase Two began with the penetration of the $1,000 to the upside in late March of 2017, with prices climbing to almost $3,000 in June of 2017. At this point the public sat up and took notice. The media began to show interest. The Bitcoin Hyperwave had been conceived.

Phase Three is the point at which a Hyperwave is born. With Bitcoin, this occured with the acceleration of price in July 2017 to a steeper angle (Phase Three), which took prices up to almost $8,000 in November in 2017. During this period, the public, the media, and many previously uninvested speculators and investors became entranced with Bitcoin.

Phase Four is the final acceleration at a very steep angle where prices are pushed to unsustainable levels. With Bitcoin, this began in November of 2017 taking prices from the low $6,000s to the ultimate peak of $19,666² on December 16th, 2017. Bitcoin has been in a bear market ever since.

Phase Five, Six, and Seven, are all bear market phases. Phase Six is a counter-trend bounce in a bear market. For Bitcoin, the Phase Six bounce began on December 21st, 2017 at 11,060 and carried until January 5th, 2018 up to $17,235. Phase Seven for Bitcoin began on January 6th, 2018 at $17,150 and is still in force today, after dropping prices to $5,774 on June 28th, 2018.

As many of those that follow our channel know, the ultimate target for Bitcoin is back below the Phase One line at $1,000. As these followers also know, there is a one in four possibility the that Phase Two line, currently at $5,408 and increasing at approximately $80 per week, could stop the fall of Bitcoin prices.

In summary, Bitcoin completed its first four bullish phases through the natural progression of human emotions accepting fewer facts through each stage of acceleration. This is typical of the growth of all bubbles. When these stages of acceleration became overextended and unstable, as all Hyperwaves do, price could no longer be sustained by hope.

Hyperwave Archetype

Bitcoin Hyperwave

I’m not a loner. I just try to distance myself from BS.

I am a fundamental analyst. I used to advise trades by measuring a securities’ intrinsic value, taking into account economic and other qualitative and quantitative factors.

High-level, fundamental analysis attempts to discern if the market is pricing a company incorrectly; whereby an investor can take advantage of buying an undervalued or selling an overvalued company at the current market price.

Companies or investors that utilize fundamental analysis for their investments must remain on the sideline in analyzing the cryptospace. This is because they cannot model or analyze an alt-coin’s intrinsic value and determine if it provides an appropriate Internal Rate of Return (IRR) potential.

Over 1,000 coins or approximately half of all altcoins have gone to 0³. The vast majority of the remaining altcoins will probably go to 0. The reason for this is actually fundamental. But is extremely difficult, with the general lack of reliable data or fundamental analysts to discern. The fundamental flaw in the altcoin world is simply their inferiority to the Bitcoin model. But this differentiation has not yet been generally recognized.

It is important to understand that bitcoin and all other inferior cryptos are an asset class. It is incorrect to assume that this new asset class will or should behave any differently than all existing and previous asset classes.

Therefore, the cryptospace is competing for the attention of all investors who use both fundamental and technical analysis. When as asset class begins underperforming relative to other asset classes, it will be de-emphasized or ignored. When an asset class outperforming, it will be emphasized and adopted. It should be of little surprise that during the up-phase of a Hyperwave this asset class was embraced. And more importantly, when it entered the bear market, beginning in December of 2017, it quickly became de-emphasized and ignored. Money management demands the recognition of shifts between asset classes.

The Securities and Exchange Commission (SEC) act as the market watchdogs with the mission to protect investors, maintain fair, orderly and efficient markets and facilitate capital formation. The concept is that all investors, large institutions or private individuals, should have access to certain basic facts about an investment prior to buying it, while helping to eliminate comments or assertions which are not factual.

So, where are my EDGAR reports or financial statements in the cryptoworld? They do not exist. Why? Because the SEC, as well as all regulatory and policy making bodies, have been flummoxed by this new asset class. As we all know, they are all rapidly catching up with the truth, but have not yet grasped that truth.

That truth is that Bitcoin and its blockchain are unique.

That truth is that the vast majority of other projects are illegal securities that must be required to act and be regulated as securities, including filing EDGAR reports.

As previously stated, “money management demands the recognition of shifts between asset classes.” Institutional money will flow into this space as this space’s fundamentals improve and the confusion caused by altcoin proliferation diminishes. This is happening rapidly but not conclusively and will not while so many other asset classes are clearly superior investment vehicles.

This is the definition of any bear market, including the Bitcoin and the greater cryptocurrency bear market, which continues.

Let’s Get Funky

Tyler and I have spent hours talking to people who are not in the space. We have spoken to people from Wall Street to Main Street, economists, psychologists, farmers, and everyone in between. The biggest takeaway: most people still think of the entire ecosystem as a scam. Simply put, it does not make sense to them right now. Even the basic concept.

Hyperwave theory offers a relatively hopeful outcome for Bitcoin price action. This would occur with what is known as a Funky Hyperwave. This is a mutation off of the archetype Hyperwave shown above. It occurs when price finds ultimate support at either the old Phase Three or Phase Two line. Unfortunately, the Phase Three line did not hold. The Phase Two line has yet to be tested. As previously stated, the possibility exists that the Phase Two line will hold price at a approximately $5,300- $5,400. To do this, the fundamentals must be convincing to the investing public and institutions. We will probably soon be able to witness that test. If Phase Two holds we could begin a brand new Hyperwave going to much higher levels.

The future of Bitcoin price action is completely dependent on the character of the participants. We must continue to publicly proclaim truth from fiction. Many in the space are doing just that. Many more are not. Tyler and my contribution is small but we believe in Bitcoin and will continue to provide information and insight in an attempt to eventually realize Bitcoin’s true potential.

The article was written by Leah Wald

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@lucidfunds/the-bitcoin-hyperwave-the-bear-market-continues-to-growl-32cc723de95e

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit