Bitcoin is a cryptocurrency, a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than relying on central authorities.The presumed pseudonymous Satoshi Nakamoto integrated many existing ideas from the cypherpunk community when creating bitcoin.

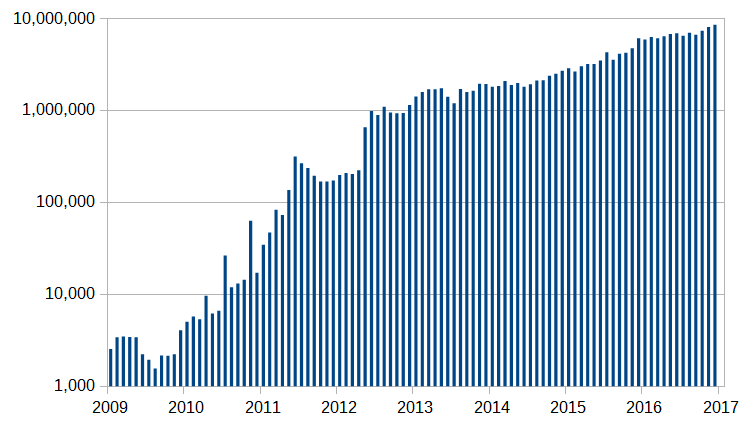

Number of bitcoin transactions per month

Pre-history[edit]

Prior to the release of bitcoin there were a number of digital cash technologies starting with the issuer based ecash protocols of David Chaum [2] and Stefan Brands. Adam Back developed hashcash, a proof-of-work scheme for spam control. The first proposals for distributed digital scarcity based cryptocurrencies were Wei Dai's b-money[3] and Nick Szabo's bit gold.[4][5] Hal Finney developed reusable proof of work (RPOW) using hashcash as its proof of work algorithm.[6]

In the bit gold proposal which proposed a collectible market based mechanism for inflation control, Nick Szabo also investigated some additional enabling aspects including a Byzantine fault-tolerant asset registry to store and transfer the chained proof-of-work solutions.[5]

There has been much speculation as to the identity of Satoshi Nakamoto with suspects including Wei Dai, Hal Finney and accompanying denials.[7][8] The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been bruited.[9]

Creation[edit]

In November 2008, a paper was posted to a cryptography mailing list[10] under the name Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System. This paper detailed methods of using a peer-to-peer network to generate what was described as "a system for electronic transactions without relying on trust".[11][12][13][14] In January 2009, the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins,[12][15][16][17] with Satoshi Nakamoto mining the first block of bitcoins ever (known as the genesis block), which had a reward of 50 bitcoins.

One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. Finney downloaded the bitcoin software the day it was released, and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction.[18][19] Other early supporters were Wei Dai, creator of bitcoin predecessor b-money, and Nick Szabo, creator of bitcoin predecessor bit gold.[20]

In the early days, Nakamoto is estimated to have mined 1 million bitcoins.[21] Before disappearing from any involvement in bitcoin, Nakamoto in a sense handed over the reins to developer Gavin Andresen, who then became the bitcoin lead developer at the Bitcoin Foundation, the 'anarchic' bitcoin community's closest thing to an official public face.[22]

The value of the first bitcoin transactions were negotiated by individuals on the bitcointalk forums with one notable transaction of 10,000 BTC used to indirectly purchase two pizzas delivered by Papa John's.[12]

On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted. Transactions weren't properly verified before they were included in the transaction log or blockchain, which let users bypass bitcoin's economic restrictions and create an indefinite number of bitcoins.[23][24] On 15 August, the vulnerability was exploited; over 184 billion bitcoins were generated in a transaction, and sent to two addresses on the network. Within hours, the transaction was spotted and erased from the transaction log after the bug was fixed and the network forked to an updated version of the bitcoin protocol.[25][26] This was the only major security flaw found and exploited in bitcoin's history.[23][24]

Growth[edit]

2011[edit]

Based on bitcoin's open source code, other cryptocurrencies started to emerge.[27]

The Electronic Frontier Foundation, a non-profit group, started accepting bitcoins in January 2011,[28] stopped accepting them in June 2011,[29] and began again in May 2013.[30]

In June 2011 Wikileaks[31] and other organizations began to accept bitcoins for donations. The Electronic Frontier Foundation began, and then temporarily suspended, bitcoin acceptance, citing concerns about a lack of legal precedent about new currency systems.[32] The EFF's decision was reversed on 17 May 2013 when they resumed accepting bitcoin.[33]

On 22 March 2011 WeUseCoins published the first viral video [34] which has had over 6.4 million views. In September 2011 Vitalik Buterin co-founded Bitcoin Magazine. On 23 December 2011, Douglas Feigelson of BitBills filed a patent application for "Creating And Using Digital Currency" with the United States Patent and Trademark Office, an action which was contested based on prior art in June 2013.[35][36]

2012[edit]

In January 2012, bitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode "Bitcoin for Dummies". The host of CNBC's Mad Money, Jim Cramer, played himself in a courtroom scene where he testifies that he doesn't consider bitcoin a true currency, saying "There's no central bank to regulate it; it's digital and functions completely peer to peer".[37]

In September 2012, the Bitcoin Foundation was launched to "accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol". The founders were Gavin Andresen, Jon Matonis, Patrick Murck, Charlie Shrem, and Peter Vessenes.[38]

In October 2012, BitPay reported having over 1,000 merchants accepting bitcoin under its payment processing service.[39] In November 2012, WordPress had started accepting bitcoins.[40]

2013[edit]

In February 2013 the bitcoin-based payment processor Coinbase reported selling US$1 million worth of bitcoins in a single month at over $22 per bitcoin.[41] The Internet Archive announced that it was ready to accept donations as bitcoins and that it intends to give employees the option to receive portions of their salaries in bitcoin currency.[42]

In March the bitcoin transaction log called the blockchain temporarily split into two independent chains with differing rules on how transactions were accepted. For six hours two bitcoin networks operated at the same time, each with its own version of the transaction history. The core developers called for a temporary halt to transactions, sparking a sharp sell-off.[43] Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software.[43] The Mt. Gox exchange briefly halted bitcoin deposits and the exchange rate briefly dipped by 23% to $37 as the event occurred[44][45] before recovering to previous level of approximately $48 in the following hours.[46] In the US, the Financial Crimes Enforcement Network (FinCEN) established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American "bitcoin miners" who sell their generated bitcoins as Money Service Businesses (or MSBs), that may be subject to registration and other legal obligations.[47][48][49]

In April, payment processors BitInstant and Mt. Gox experienced processing delays due to insufficient capacity[50] resulting in the bitcoin exchange rate dropping from $266 to $76 before returning to $160 within six hours.[51] Bitcoin gained greater recognition when services such as OkCupid and Foodler began accepting it for payment.[52]

On 15 May 2013, the US authorities seized accounts associated with Mt. Gox after discovering that it had not registered as a money transmitter with FinCEN in the US.[53][54]

On 17 May 2013, it was reported that BitInstant processed approximately 30 percent of the money going into and out of bitcoin, and in April alone facilitated 30,000 transactions,[55]

On 23 June 2013, it was reported that the US Drug Enforcement Administration listed 11.02 bitcoins as a seized asset in a United States Department of Justice seizure notice pursuant to 21 U.S.C. § 881.[56] It is the first time a government agency has claimed to have seized bitcoin.[57][58]

In July 2013 a project began in Kenya linking bitcoin with M-Pesa, a popular mobile payments system, in an experiment designed to spur innovative payments in Africa.[59] During the same month the Foreign Exchange Administration and Policy Department in Thailand stated that bitcoin lacks any legal framework and would therefore be illegal, which effectively banned trading on bitcoin exchanges in the country.[60][61] According to Vitalik Buterin, a writer for Bitcoin Magazine, "bitcoin's fate in Thailand may give the electronic currency more credibility in some circles", but he was concerned it didn't bode well for bitcoin in China.[62]

On 6 August 2013, Federal Judge Amos Mazzant of the Eastern District of Texas of the Fifth Circuit ruled that bitcoins are "a currency or a form of money" (specifically securities as defined by Federal Securities Laws), and as such were subject to the court's jurisdiction,[63][64] and Germany's Finance Ministry subsumed bitcoins under the term "unit of account"—a financial instrument—though not as e-money or a functional currency, a classification nonetheless having legal and tax implications.[65]

In October 2013, the FBI seized roughly 26,000 BTC from website Silk Road during the arrest of alleged owner Ross William Ulbricht.[66][67][68] Two companies, Robocoin and Bitcoiniacs launched the world's first bitcoin ATM on 29 October 2013 in Vancouver, BC, Canada, allowing clients to sell or purchase bitcoin currency at a downtown coffee shop.[69][70][71] Chinese internet giant Baidu had allowed clients of website security services to pay with bitcoins.[72]

In November 2013, the University of Nicosia announced that it would be accepting bitcoin as payment for tuition fees, with the university's chief financial officer calling it the "gold of tomorrow".[73] During November 2013, the China-based bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest bitcoin trading exchange by trade volume.[74]

In December 2013, Overstock.com[75] announced plans to accept bitcoin in the second half of 2014. On 5 December 2013, the People's Bank of China prohibited Chinese financial institutions from using bitcoins.[76] After the announcement, the value of bitcoins dropped,[77] and Baidu no longer accepted bitcoins for certain services.[78] Buying real-world goods with any virtual currency has been illegal in China since at least 2009.[79]

2014[edit]

In January 2014, Zynga[80] announced it was testing bitcoin for purchasing in-game assets in seven of its games. That same month, The D Las Vegas Casino Hotel and Golden Gate Hotel & Casino properties in downtown Las Vegas announced they would also begin accepting bitcoin, according to an article by USA Today. The article also stated the currency would be accepted in five locations, including the front desk and certain restaurants.[81] The network rate exceeded 10 petahash/sec.[82] TigerDirect[83] and Overstock.com[84] started accepting bitcoin.

In early February 2014, one of the largest bitcoin exchanges, Mt. Gox,[85] suspended withdrawals citing technical issues.[86] By the end of the month, Mt. Gox had filed for bankruptcy protection in Japan amid reports that 744,000 bitcoins had been stolen.[87] Months before the filing, the popularity of Mt. Gox had waned as users experienced difficulties withdrawing funds.[88]

In June 2014 the network exceeded 100 petahash/sec.[89] On 18 June 2014, it was announced that bitcoin payment service provider BitPay would become the new sponsor of St. Petersburg Bowl under a two-year deal, renamed the Bitcoin St. Petersburg Bowl. Bitcoin was to be accepted for ticket and concession sales at the game as part of the sponsorship, and the sponsorship itself was also paid for using bitcoin.[90]

In July 2014 Newegg and Dell[91] started accepting bitcoin.

In September 2014 TeraExchange, LLC, received approval from the U.S.Commodity Futures Trading Commission "CFTC" to begin listing an over-the-counter swap product based on the price of a bitcoin. The CFTC swap product approval marks the first time a U.S. regulatory agency approved a bitcoin financial product.[92]

In December 2014 Microsoft began to accept bitcoin to buy Xbox games and Windows apps.[93]

2015[edit]

In January 2015 Coinbase raised 75 million USD as part of a Series C funding round, smashing the previous record for a bitcoin company.[94] Less than one year after the collapse of Mt. Gox, United Kingdom-based exchange Bitstamp announced that their exchange would be taken offline while they investigate a hack which resulted in about 19,000 bitcoins (equivalent to roughly US$5 million at that time) being stolen from their hot wallet.[95] The exchange remained offline for several days amid speculation that customers had lost their funds. Bitstamp resumed trading on 9 January after increasing security measures and assuring customers that their account balances would not be impacted.[96]

In March 2015 21 LLC announced it had raised 116 million USD in venture funding, the largest amount for any digital currency-related companies.[97]

As of August 2015 it was estimated that 160,000 merchants accept bitcoin payments.[98] Barclays announced that they would become the first UK high street bank to start accepting bitcoin, with a plan to facilitate users to make charitable donations using the cryptocurrency outside their systems.[99] They partnered in April 2016 with mobile payment startup Circle Internet Financial.[100]

In October 2015, a proposal was submitted to the Unicode Consortium to add a codepoint for the bitcoin symbol.[101]

2016[edit]

In January 2016, the network rate exceeded 1 exahash/sec.[102]

In March 2016, the Cabinet of Japan recognized virtual currencies like bitcoin as having a function similar to real money.[103] Bidorbuy, the largest South African online marketplace, launched bitcoin payments for both buyers and sellers.[104]

In April 2016, Steam started accepting bitcoin as payment for video games and other online media.[105]

In July 2016, researchers published a paper showing that by November 2013 bitcoin commerce was no longer driven by "sin" activities but instead by legitimate enterprises.[106] Uber switched to bitcoin in Argentina after the government blocked credit card companies from dealing with Uber.[107]

In August 2016, a major bitcoin exchange, Bitfinex, was hacked and nearly 120,000 BTC (around $60m) was stolen.[108]

In September 2016, the number of bitcoin ATMs had doubled over the last 18 months and reached 771 ATMs worldwide.[109]

In November 2016, the Swiss Railway operator SBB (CFF) upgraded all their automated ticket machines so that bitcoin could be bought from them using the scanner on the ticket machine to scan the bitcoin address on a phone app.[110]

Bitcoin generates more academic interest year after year; the number of Google Scholar articles published mentioning bitcoin grew from 83 in 2009, to 424 in 2012, and 3580 in 2016.[111] Also, the academic Ledger (journal) published its first issue. It is edited by Peter Rizun.

2017[edit]

The number of businesses accepting bitcoin continues to increase. In January 2017, NHK reported the number of online stores accepting bitcoin in Japan had increased 4.6 times over the past year.[112] BitPay CEO Stephen Pair declared the company's transaction rate grew 3× from January 2016 to February 2017, and explained usage of bitcoin is growing in B2B supply chain payments.[113]

Bitcoin gains more legitimacy among lawmakers and legacy financial companies. For example Japan passed a law to accept bitcoin as a legal payment method,[114] and Russia has announced that it will legalize the use of cryptocurrencies such as bitcoin.[115] And Norway’s largest online bank, Skandiabanken, integrate bitcoin accounts.[116]

In the first half of 2017, 1 bitcoin surpassed the spot price of an ounce of gold for the first time,[117] and subsequently broke its all-time high, reaching US$1,402.03 on 1 May 2017,[118] and over US$1,800 on 11 May 2017.[119] On 20 May 2017, the price of one Bitcoin passed US$2,000 for the first time.

In March 2017, the number of GitHub projects related to bitcoin passed 10,000.[120]

Exchange trading volumes continue to increase. For the 6-month period ending March 2017, Mexican exchange Bitso saw trading volume increase 1500%.[121] Between January and May 2017 Poloniex saw an increase of more than 600% active traders online and regularly processed 640% more transactions.[122]

In June 2017, the bitcoin symbol was encoded in Unicode version 10.0 at position U+20BF (₿) in the Currency Symbols block.[123]

Upvoted and followed. Nice first image! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://en.wikipedia.org/wiki/History_of_bitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit