I’m new to the Crypto world, but as someone with a background in the banking / hedge fund world I find it very fascinating. There’s so much potential in the underlying technology as well as significant investment opportunities.

However, I’ve seen numerous new tokens / coins that I find highly questionable and ripe for a contrarian point of view. One that specifically sticks out to me is SALT Lending, which is currently sitting at #43 on coinmarketcap.com.

Here are my general thoughts on the token and why it should be avoided as a potential investment.

Management

As with any investment, it’s important to examine the experience of the leadership team and their perceived ability to execute on their business plan. This is the first issue I see with SALT, starting at the top with the CEO:

Shawn Owens, CEO – Shawn’s profile on the SALT Lending website describes him as a “serial entrepreneur” with experience in several buzzworthy areas such as enterprise operations, business operations, and product delivery. All good, but very generic and unspecified.

Digging a little deeper (searching Google), an informed investor is able to find Shawn’s LinkedIn page and additional relevant information. Shawn’s entire 20yr career prior to founding SALT was spent in the restaurant and hospitality industry, including time as a chef and general manager.

Nothing against the restaurant industry, but does this inspire confidence for someone starting a consumer loan business?

Distribution Method

The second concern I have with SALT lending is the ethics surrounding the distribution of pre-sale tokens and subsequent sale of membership units. As many will recall, the company held a number of presale levels, starting as low as $0.25 (at least to my knowledge) and going as high as $15 before closing the presale and immediately selling at a retail price of $25. However, as many presale investors know, the token never got anywhere near this price and since breaking for trading has mainly been hovering below $5.

I understand the logic behind giving pre-sale investors the chance to buy at a discount, but allowing for so many levels of pre-investment seems like a money grab. And it only gets worse when you factor in the fact they immediately started selling it for $25, hoping that someone who actually wants to use their service would unknowingly pay well above market rates for their membership tokens. (I know SALT legal team - “it’s not meant to be traded as a security”).

Why the Need for a Token?

SALT Lending is an internet-based asset-backed lender masquerading as a blockchain company, specifically capitalizing on investors who are blinded by the idea of post-ICO returns and an easily understood use case.

Reading through the company’s white paper, its abundantly clear that there is no need for the SALT token other than to raise cash without having to give up equity in the business. Admittedly, it does provide the token holder with the ability to purchase a “membership” and get access to crypto-backed loans, but why do I need a token for this? It doesn’t serve as a reward to power some distributed blockchain ledger, but is rather a de-facto upfront fee for a crypto-backed loan.

Total Addressable Market

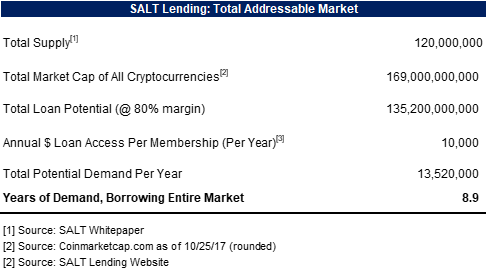

And last, but certainly not least, my concern surrounding the true of size of SALT’s addressable market and the fundamental demand for its services. Let’s start with the overall total size of SALT membership tokens, which according to the company will be 120 million and currently stands at 46.7 million according to coinmarketcap.com. And what does one membership token get you? It gets you access to a crypto-backed loan for up to $10,000, per year. i.e. it costs 1 token to borrow up to $10,000 for a year.

Now that we’ve defined the supply of tokens, let’s do a couple of thought experiments to define the potential size of SALT’s market. First, let’s assume the entire market cap of cryptocurrencies is borrowed against ($169bn as of 10/25/17), how many years of full market borrow does this get us?

As shown below, the total supply of tokens allows us to borrow the entire market for 8 years. Not bad, shows some degree of scarcity, presuming this company will be around that long.

Now, let’s refine our market a little more by looking at the example of margin loans. For those of you unfamiliar with a margin loan, it is essentially an asset-backed loan which allows investors to borrow against the value of their securities bond (stock or bond) portfolio. i.e. it is analogous to the product being offered by SALT, except for traditional securities.

As of August 2017, the total value of all US-based margins loans was $490bn and total market capitalization of the US stock market was $27.4tn (value at FYE16), per www.nxydata.com. This equates to ~1.8% margin lending to market capitalization. (This is VERY conservative as bonds are also available for margin loans).

Now let’s apply this percentage to the market value of cryptocurrencies and see what our supply looks like. To be conservative, I’ll increase the hypothetical size of the crypto market cap to $1 trillion (i.e like 6x from current size).

Turns out we now have 67 years of supply to satiate this demand! This means if crypto-loans are approximately the relative market size of margin loans, it would take 67 years to meet the annual demand of $10,000 loans.

If I’m wrong and demand is much more significant than I assume, how long until a traditional bank or broker/dealer provides this service? This example assumes they get 100% of all crypto-loans!

Conclusion

For those looking for a specific valuation or price target, I don’t have one. But looking at the facts of the SALT membership token, it is fairly clear to me that it has VERY little value when you take into account the fact that current / future supply FAR outstrips demand.

Even if you think the idea of crypto-lending is a good one (which I do), you must remember that doesn’t mean it’s a good investment. Own it if you plan on using the service, trade it if you like the technicals, but don’t own it as a fundamental long-term investment.

DISCLOSURE: This represents my opinion and I have no position in SALT.

Welcome to steemit! You will enjoy it! Continue doing good post.

I wish you the best! Hope you gonna have fun with our community and see you soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice analysis. I would recommend to remove the introduceyourself tag and replace it with salt (the post is not really about yourself). Using relevant tags helps interested users find the content that interests them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @lbould, welcome to Steemit!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @lbould, welcome to Steemit!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I found stating your background to be helpful.

Great article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I found stating your background to be helpful.

Great article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice read! I saw that you joined recently so I thought I'd say hi and welcome you. This post was nice so I upvoted it and don't forget to upvote others!

As you are new to steemit and it can be hard for newcomers to boost their steem power so I suggest you to try out @MinnowPowerUp as you can earn up to 30% more steem power than just powering up with steem directly! It's a subscription based daily upvote bot that draws its power from a delegation pool. I also recently made this post explaining my experience with it in more depth while earning over $1 per day in upvotes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you sure you're not committing a flaw here by assuming that lenders need to borrow the maximum allowed amounts? Why not just borrow $500 or $1000? Also, I would say that (at least for now) the demand for loans against cryptos is likely to be higher than it would otherwise be, due to higher reluctance to sell crypto for various reasons. (Anticipation of rising prices, not wanting to sell at that moment for tax reasons, ensuring they have enough of a certain token to stake (w/proof of stake), etc.)

The $25 thing might be off and need to change I agree, but I'm not sure if any of this means that the business itself won't be successful. They're also among the first to the market, which usually counts for something. Are the tokens themselves necessary? I'm not so sure about that either, but I'm also not sure that it matters at the stage the industry is at now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lbould! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lbould! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit