Readers of my blog have already seen my warnings about the potential for a Tether liquidation event disrupting the crypto market, particularly at Bitfinex. Nothing has changed on this front in a positive sense, but the increasing turmoil in the mainstream financial markets, as well as crypto, increases the likelihood of an "incident".

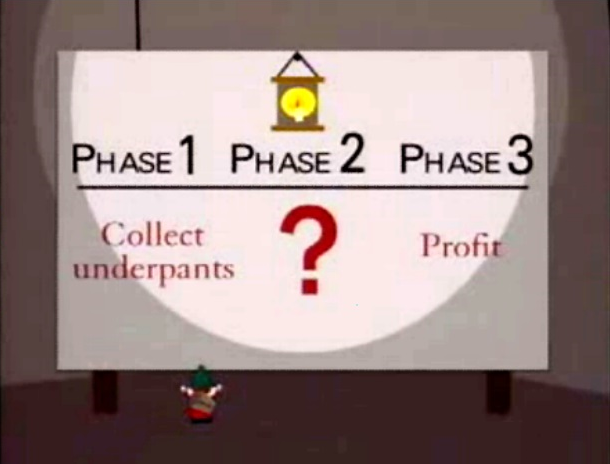

The basic formula goes something like this:

#1. Issue Tether you refuse to prove is backed, violating your own auditing procedures.

#2. ???

#3. Profit!

What the underpants gnomes fail to mention, is the final step:

#4. Evoke the spectre of Mt. Gox, setting crypto markets back with a large crash; wipe out many exchange holders.

I don't like what I'm seeing on this front, and I suspect Tether's days are numbered. However, recent developments over the last month have increased the likelihood of an unpleasant "exchange liquidation event", so I would implore all my readers to move any coins they can secure via cold storage or hardware wallet off exchanges as soon as possible.

If that isn't an option, consolidate into your most reputable exchanges and ensure you have 2-factor authentication for both your exchange accounts and your associated email (very important! otherwise, they can remove your 2FA if they get into your email account.) Bittrex is, in my opinion, one of the most secure, having been designed and operated by two former Amazon security executives.

Add notifications for logins to all your accounts and keep on top of them so you can intercept any attacks - setup desktop or phone alerts. Add 2FA to your Discord and your dog food bucket - get paranoid.

Here are a few coins that can both be staked (approximately 5% annually) and secured with a Ledger hardware wallet at the same time (also, they are all promising projects):

- Neo

- Ark

- Pivx

Remember that you can secure any ERC20 token via a Ledger hardware wallet by using MyEtherWallet.

WARNING - MEW may be having serious issues, see this thread and do your due diligence:

More:

Click here to see other currencies supported by the Ledger: https://www.ledgerwallet.com/cryptocurrencies

The Trezor wallet may no longer be secure, as I have not researched it since I posted some months ago about a critical vulnerability allowing the private key to be extracted.

Steem is one of the safest coins, if you keep them locked into either savings or being powered up. It's literally impossible to steal it under most circumstances, unless the owner is not monitoring their account. Use Vessel if you want an alternate option for monitoring your Steem account.

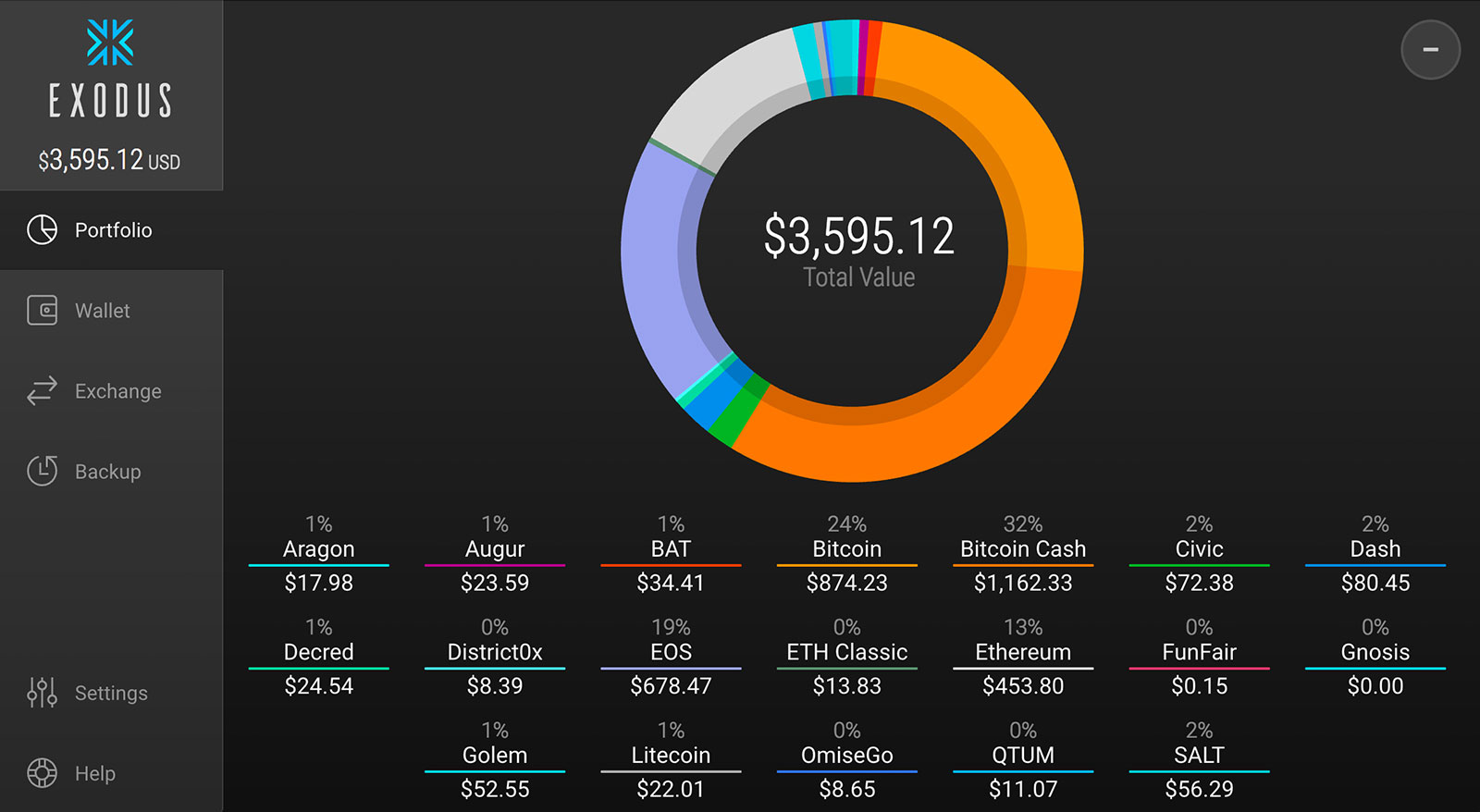

Be skeptical of any wallet you can't secure beyond pass-phrase encryption, such as Exodus - it looks great, but it is not secure for hodling.

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Ledger, Google, Reddit, Medium, CryptoInsider.com

Copyright: South Park, Exodus

HAHAHAHA i love your sense of humor!!!! Yes! time to get paranoid!

Where was this piece of advise when my cats bowl was stolen? I did not have 2FA on it and lost it like an idiot... got rekt bigtime...

You've been talking about the tether thing for months now, and they have printing money like it monopoly just went on sale... i give it.. 1 to 2 months before something horrible happens.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"i give it.. 1 to 2 months before something horrible happens."

With my luck, this will be about when I decide it's a good time to take a position in it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

don't even say that lexi!! this is our year bro!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I kid, I kid!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, exchanges and such are really creeping me out. Myetherwallet seems possibly less trust-able too.

I have some funds on Binance and with them closing down the exchange some days ago this spooked me too. I guess these things are good... they remind us that we need to stop trusting them blindly.

Also, PivX doesn't stake without running a node.... or does it??? 'cause I may be interested if it's easy like 'staking' NEO

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, I referenced the same ongoing drama in my post. I didn't have a chance to fully research it, and I suspect it may blow over, however it's a very real concern as of today.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an option for PIVX:

https://pivxmasternode.org/masternode-setup/masternode-service-providers/

I have no idea how much counterparty risk this adds, due diligence required. I haven't staked PIVX.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So, I looked into it a bit more ( https://pivxmasternode.org/what-is-a-masternode/ ), and came across this passage:

"To promote an even ratio between staking nodes and masternodes in the network, the PIVX team has developed a variable Seesaw Reward Balance System that dynamically adjusts its block reward size between masternodes and staking nodes."

"Each PIVX PoS block reward is split with 10% dedicated to the budgeting system and 90% dedicated to both the masternodes and stake mining reward. The reward portion is further split dynamically via the Seesaw Reward Balance System between masternodes and staking nodes."

Sounds like you may be able to stake with less than a Masternode, but I haven't looked into doing this with Pivx and don't currently own any. One of the better looking projects out there IMO though, I've traded it in the past and it did well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmmm... interesting, but I think both a regular node as well as a masternode require you to actually run a node, aka keep a computer online or rent something to run it for you.

This never works out cost-wise for me as I don't usually invest enough to make it profitable enough.

Not like NEO or Ark where you have no costs or real effort involved to get the reward. I love these easy systems: they are like my crypto savings account that gives me interest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If there is going to be a black swan for crypto that would send us into an extended bear market it's going to be the Tether and Bitfinex debacle. They were accused of propping up the price with Tether buys of BTC and that helped fuel the ridiculous all time highs.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good advice mate. I am starting to think that if Tether hasn't folded by now then they might make it through this Crypto downturn.

The bigger risk might be the bigger financial markets. If we get a stockmarket correction and a few banks do a Bear Stearns or Lehman Bros on us then we could lose Tether deposits that way too.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree almost exactly with what you said. Tether did fine while we touched $6000 Bitcoin. (bottom call looking pretty good there, in other news).

However, who knows what happens if we have a Beahman (tm) event?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like what you did there. Doesn't quite roll off the tongue though.

Good job calling the bottom. Hope it holds true! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coincidentally I have been thinking about doing my first trade with crypto using binance.

I am still not sure about doing this, but I will take this words of you into account.

Perhaps the best thing is to wait a few days/weeks instead.

Btw, have you ever thoughts about making a post sharing your crypto holdings? Or perhaps you already made it I don’t know, but either way an update would come in handy for the community I believe.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Beware of current issues at Binance. It's all over the Reddit.

If you are trading a pair that can be traded at Bittrex, I recommend going there instead if that is an option.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was thinking of getting a binance account, thanks for the analysis, I think I have to be even more careful now. really deep write up @lexiconical thanks much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a good idea to grab a Binance account if you can get one, since sign-ups are only sporadically available.

However, they appear to have just been DDoS'ed or hacked or something. Beware for now, don't deposit if you don't need to until they sort things out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Be cautious.

I tried a trade with Binance, as a first step getting away from Coinbase and GDAX, and made a single trade.

Despite having my correct username and password, and getting past their irritating little puzzle piece captcha without any issues, my 2FA through Google Authenticator hasn't worked since that first transaction, meaning that no matter how many times I sign in, I NEVER receive a code, and Binance's customer support so far seems to be nonexistent.

I finally went into to my Google account and switched Authenticator over to sending me SMS texts . . . which I am STILL not receiving.

So at this point, I have a small amount of crypto on Binance . . . which is in limbo, and completely inaccessible. Frustrating as hell.

I've been dealing with this for three weeks and counting, so at this point, I can't recommend Binance to anyone.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I read this great post 8 months ago..it s very useful for me ..I followed his advices..and i am holding my coins in my blockchain ..

https://steemit.com/crypto/@razvanelulmarin/don-t-keep-your-coins-in-exchange

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good advice.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah I need to definitely start pulling some profits off the exchanges I don't have much on there, but every time I see an exchange go down I think to myself will this be the next one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely better to be proactive than reactive.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm listening to your warning. I have by big positions in wallets, but I've been hesitant to move E20 coins to myetherwallet because it didn't make sense that you use a single address for all coins you move in and the wallet knows which coins they are. Doing a test move, you have a minimum number of coins for instance on Binance you have to move and one coin's fee was 180 coins... I also realize this is just an excuse. Can you confirm for myetherwallet that we indeed use the "your address" to send any of the E20 tokens? Thanks for the heads-up as well about the drama between the founders who seem to have split. I will likely move them to myetherwallet and use a hard wallet to store the keys.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 2.64% upvote from @buildawhale courtesy of @lexiconical!

If you believe this post is spam or abuse, please report it to our Discord #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh yay, I just noticed you're back. I've missed your posts. I read/heard somewhere the other day that tether had 30 days to about 3 months. I can't remember who said it though.

The MEW thing is a bit annoying.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How to set the 2FA for Email?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm usually the smartest guy in the room, (granted, my friends aren't exactly waiting for their MENSA paperwork to come in the mail) but you are operating on a whole other plane of existence than me. I got the Southpark refrence, and that's about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post reflects one of my thoughts that scares me the most: It is not what happens to people who hold money in Tether, but what happens to all the crypto market if Tether goes down. How long will it take for the market to recover after a hit like that considering that today we are seeing many exchanges adding conversions directly to Tether from different cryptocurrencies.

Funny times ahead...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the advise content. As a new cyptocurrency investor have lots to learn. Glad to have read endorsement of Bittrex and use of 2FA. Did you happen to explore using the Cardano ADA wallet? I think the one they have out now is a beta and they are making another.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great piece. Not sure to what degree a potential Tether fallout would rattle the cryptocurrency markets though, considering Tether's market cap is just over $2B, versus Bitcoin sitting at roughly $150B at the time of this post.

What stands out to me from your post though and what seems applicable to the Steem blockchain is the regulatory implications of asserting that a cryptocurrency is pegged to an external asset such as the USD. There is no way of truly ensuring that this is in fact the case without recurring audits by established third-party entities, as you alluded to you in your post and what has prompted the wave of scrutiny around Tether.

Similarly, Steem Blockchain Dollars (SBDs) present a dilemma for the community here and the marketing of the Steem blockchain at large. I say this because , in my view, they are mislabeled as a token that is pegged to the USD in the Steem White Paper. As described therein, "...Steem Dollars were designed as an attempt to bring stability to the world of cryptocurrency and to the individuals who use the Steem network."

The free market has unequivocally demonstrated that the initially conceived stability that SBDs were supposed to offer is simply not the case. SBDs are currently trading above $5. When a buyer and seller exchange an asset at an agreed upon price, a market is made; this basic truth of trading seems to have gone over the heads of many of the Witnesses, some of whom continue to debate about their supposed obligation to manipulate the SBD price down to $1 by whatever "tools" they may have at their disposal.

Dan Larimer himself recently conceded in an interview that he accepts that SBDs are trading just as any other "...relatively fixed supply currency that is growing at a predictable rate..."

Why can't the Witnesses accept this evident reality too then? In my view, since Steemit Inc possesses the most Steem Power and thus largely defines the developmental trajectory of the Steem blockchain, it should represent the nature of SBDs accurately to the general public and users of the platform by removing any portrayal that their is somehow a pegged floor below which the price of SBDs can't fall and a maximal ceiling above which their price can't rise. With everything going on with Tether, one would think Steemit Inc would be on top of this.

The primary role of the Witnesses should be to maintain the blockchain. As for any notion that they have the ability to control the price of a token derived from the blockchain itself, such as SBDs, that is inviting the hammer of official scrutiny as time goes by and the adoption of Steem advances, especially considering what is now happening with Tether.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for the advices

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Vote me back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 1.70% upvote from @postpromoter courtesy of @lexiconical!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So crazy that people leave there money on exchanges and trust them 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit