The launch of the CME bitcoin futures contract comes a week after the first bitcoin futures launched on an established exchange, the Cboe Futures Exchange.

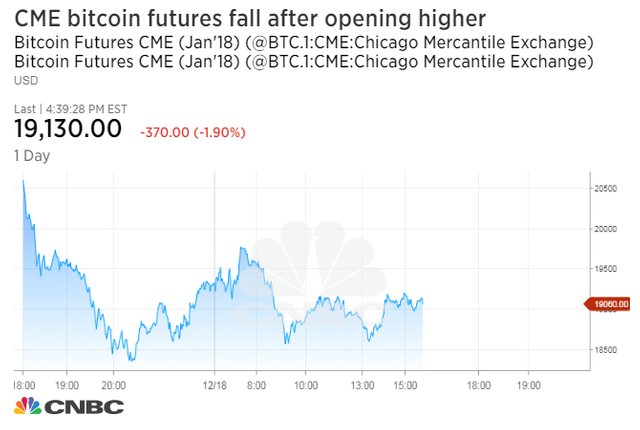

Bitcoin CME futures settled slightly lower, a stark contrast from the 19 percent surge in CBOE bitcoin futures on their first day of trading a week ago.

To monitor both types of bitcoin futures on CNBC.com, type "bitcoin futures" into the ticker search box at the top of the page.

Bitcoin futures launches on the CME Bitcoin futures launches on the CME

23 Hours Ago | 01:09

CME, the world's largest futures exchange, launched its own bitcoin futures contract Sunday under the ticker "BTC."

The CME's most popular futures contract, which expires in January, settled 2.05 percent lower Monday at $19,100. The product had opened at $20,650 and initially traded higher.

Trading was far less volatile than the initial 19 percent surge in Cboe bitcoin futures during their first day of trading a week ago. The Cboe bitcoin futures, traded under the ticker "XBT," on Monday settled 5.25 percent higher at $19,055.

Because of the initial gains in the Cboe bitcoin futures, "I think today people were anticipating a similar type of event," said Joe Van Hecke, founder and managing partner at Chicago-based trading firm Grace Hall. "The aggressiveness of the bids did take me by surprise."

Van Hecke, who said he was one of the first to trade both the Cboe and CME bitcoin futures, noted that it appears more institutional-level investors are trading the CME contract.

A key difference between the Cboe and CME futures is that the Cboe contract represents one bitcoin, while a CME contract represents five bitcoins. The Cboe also settles its futures against a daily price auction from Gemini, while the CME uses its own bitcoin reference rate which tracks several cryptocurrency exchanges.

Trading volume in the CME contract was slightly higher than that of the Cboe as of late Monday afternoon. The CME said about 1,049 contracts for January – the equivalent of 5,245 bitcoins — had traded versus Cboe's roughly 3,860 contracts representing one bitcoin each.

"CME is a little better known for futures so there may have been a comfort there," said Tom Lehrkinder, senior analyst at consulting firm Tabb Group. He added that traders may have grown more comfortable with a bitcoin futures product after Cboe's launch a week ago.

Bitcoin itself fell about 2 percent to $18,718 , according to the CoinDesk bitcoin price index. CoinDesk tracks prices from digital currency exchanges Bitstamp, Coinbase, itBit and Bitfinex.

Bobby Cho, head trader at major bitcoin trading company Cumberland, a subsidiary of DRW, pointed out that the CME futures were trading closer to the actual price of bitcoin than the Cboe contract had at launch last Sunday.

"There's more people who are involved in the CME launch than there were at Cboe's," Cho said. "The spot market still dictates where futures are trading, just because of the sheer volume."

Leading U.S. exchanges have raced to offer derivatives contracts for bitcoin, which has surged more than 1,600 percent this year on growing investor interest.

CME had made its announcement on Dec. 1 for bitcoin futures. But two days later Cboe Global Markets said it was launching its own futures contract on Dec. 10, a week before CME. Nasdaq and Cantor Fitzgerald are also planning their own bitcoin derivatives contracts.

Cboe's bitcoin futures contract had a relatively smooth first week of trading, although volume was on the light side. The most popular contract, which expires in January, gained 17.1 percent in the first week of trading to settle Friday at $18,105.

About 20 firms participated, including Interactive Brokers and Wedbush Futures. TD Ameritrade announced late Friday afternoon that it would allow certain clients to begin trading the Cboe bitcoin futures, but not the CME futures, on Monday.

TD confirmed to CNBC on Monday morning that trading in the bitcoin futures, including the ability to short — or bet against — them, was available for some qualified clients.

"They've gone about the launch of these products with their guard up a bit," Van Hecke said. "I can obviously see how somebody could game the system with a bit of capital."

Many see the launch of bitcoin futures as a step toward establishing the digital currency as a legitimate asset class. The derivatives allow institutional investors to buy into the cryptocurrency trend and could pave the way for a bitcoin exchange-traded fund.

In less than 10 years, bitcoin has quickly evolved from being a fringe asset and the focus of tech nerds to a globally traded asset. More than 170 "cryptofunds" have launched to invest in cryptocurrencies and start-ups focused on the blockchain technology behind the digital currencies, according to financial research firm Autonomous Next.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cnbc.com/2017/12/17/worlds-largest-futures-exchange-set-to-launch-bitcoin-futures-sunday-night.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit