Our civilisation was once a mighty oak, sturdy enough to withstand the winds of time. And while the gales of yesteryear nearly uprooted our tree of life, our branches were ultimately strenghtened by the growing pains, further solidifying the hegemony of the western story. Post WW2, the generation of the baby boomers were privileged enough to grow up in what can only be described as the most prosperous period of human history.

I try to cast my mind back to a halcyon era of which many of the generations after never witnessed; a time of white picket fences in quaint small towns, a time where a man could go to work in a factory and earn enough to support a family. A time where the future seemed bright.

For my generation however, the millennial generation, such images are little more than a fleeting echo of a paradise lost. Our economic security, defined by a burgeoning middle class has been replaced by a society of debt laden wage slaves. Our money, which once held genuine value is now little more than confetti following the Nixon shock of 1971 which took us off of the gold standard, allowing a cabal of central bankers to pursue their most usurious instincts and pillage our economy for their own benefit.

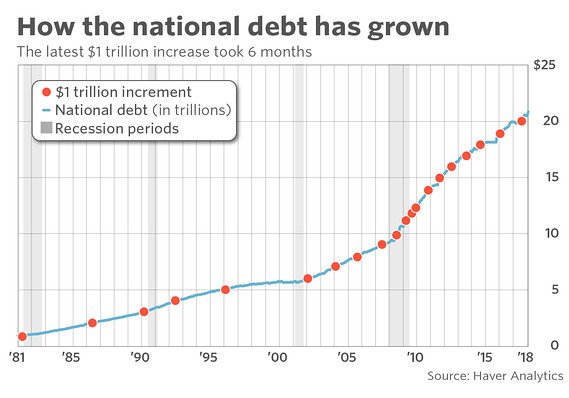

As they got richer, we became poorer. But not just on a micro level, the central bankers and rootless transnationalists have continued to ride the wave of boom and bust as the national debt climbed to a staggering $22trillion. Anybody who is paying attention can see this economy is a house of cards, built on a foundation of sand, waiting to come crashing to earth.

But the economic paradigm is just one to consider when we analyse the dangers we face today. Societal division is a cause of great concern. The changing nature of western nations due to demographics and all of the negatives associated with such change are becoming clear for many to see. From acts of sporadic violence to the increasingly acrimonious seperation of the inhabitants of western nations along racial, political and ideological parameters, one can be forgiven for thinking that battlelines are being drawn. Add to that, the dispensers of information, namely the media and entertainment establishments seem determined to exacerbate these divisions even further.

![2019-06-04T111725Z-1606691836-RC11E414A0E0-RTRMADP-3-USA-TRUMP-BRITAIN.jpeg]

( )

)

The very same people who have plundered our national treasure have created an environment where these cultural divisions are causing an irreparable fracture that threatens to consume our nations in an outpouring of violence and chaos. Corporate powerhouses and their government lackey's have destroyed the cohesion of our nations all in the name of GDP and lower operating costs as they exploit migrant labour, hurting both migrant and citizen alike as we all compete in a workforce where wages stagnate. But as our towns and cities begin to burn when we reach zero hour, they will flee to their gated communities and leave us to dwell in the anarchy they have created.

We are coming to the end of a cycle. All the signs indicate that we are in the final days of western civilisation. Our excessive debt, the increasing division and the nauseating decadance of the modern world eerily mirror the final days of many a great civilisation that came before ours. As the framework begins to crumble, those with foresight begin to look for alternatives, a safe haven away from the chaos if you will. In the last week, gold prices have reached a six year high as investors have flocked away from other means of wealth storage as political instability in Hong Kong, coupled with the ongoing US/China trade war have made investors jittery. But it is not just in gold where the action has been bullish.

There has also been talk in the mainstream media this week of investors flocking to Bitcoin as Stock Markets performed badly last week. An apparent large influx of investors in the market saw Bitcoin rise to £10,000 this week, continuing an overall bullish trend which began a few months back. Since then, the market experienced a few unstable moments before Bitcoin stablised around the £9,400 mark for the past few days. Now, in the short term I wouldn't really get excited as it is likely there will be a future correction(s), but in the long term, there is a lot to be optimistic about.

There are several reasons why Bitcoin will become not just a safe haven for investors but why it will also grow exponentially in the future. The first and most obvious reason is Bitcoin's finite supply. Unlike Fiat currency which central banks print with no limit, there will only ever be 17-21 million Bitcoin in circulation. Similar to gold, Bitcoin's limited supply will see prices skyrocket as demand increases. But where Bitcoin has an advantage on gold in the supply/demand arena of economics is that gold can still be mined from the earth, albeit at a diminshing rate. The supply of Bitcoin on the other hand will never surpass 21 million. This in some senses could make Bitcoin more valuable than gold one day. And when we look at the gold market comparative to Bitcoin, the total value of the world gold market is approximately $7.7trillion, rising and falling according to price fluctuations. If Bitcoin was one day to achieve the status of digital gold as some are already calling it, then Bitcoin could rise potentially from its current market cap of $200billion (as of today) to an equal level with gold, making the price of one Bitcoin roughly $400,000 (if 19.2 million BTC was in circulation.)

Secondly, Bitcoin has seen a rapid acceptance in the mainstream finance world. From once being a product that was called rat poison by Warren Buffett, only yesterday Goldman Sachs stated they were bullish about Bitcoin, with one of their trading desks indicating that they saw a buy signal. Bitcoin has come so far since its inception that it is now thought to be the world's 11th largest currency, ahead of the Korean won. As Bitcoin enters into the mainstream consciousness more and more, its legitimacy will begin to climb, as faith in Fiat currencies and other financial assets continue to fall.

But finally, and I think the most important thing to consider is the current state of the world today. I started this article by giving you a brief synopsis of some of the problems our nations are currently facing. Many of us may take for granted the stable societies we live in today, but it is not like that for everyone in the world. If you take a nation like Venezuela which has seen its economy collapse and hyper inflation make it impossible for many to acquire basic amenities, you might be surprised (or not) to hear that many are turning to Bitcoin and crypto in general to survive. I would like to ask you to consider this, given what I outlined to you earlier on in this article, do you think the same thing could happen in western nations? Are our economies really that secure given the levels of debt that currently straddle our countries?

It is clear we are going through a time of great change. The wealth and treasure of western civilisation has been nearly sucked dry by a small group of vampires who know that the gravy train is about to end. A new world order is about to be implemented. The same people who got us into this mess are riding the dying carcass of western civilisation into the ground. On a personal level, I am preparing. It is not impossible to imagine the US or the UK becoming Venezuela in the near future. If that does occur, mark my words it will be the gold hoarders and Bitcoin HODLers who will survive the coming anarchy, because your dollar or pound will be as worthless as the paper it is printed on.

This has to be the safest till now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit