My analysis

Actually I write about architecture but this time I wanted to use the opportunity to talk a bit about our beloved cryptos and bitcoin especially and why I think this is probably the best time to buy some as an logterm investment right now. So first of all, although I've spent a good time analyzing all of this I'm neither a financial professional and there is no guarantee you can't lose all your money in cryptos so keep that in mind. But anyway I truly believe in Bitcoin and am holding some value in it too.

The bubbles

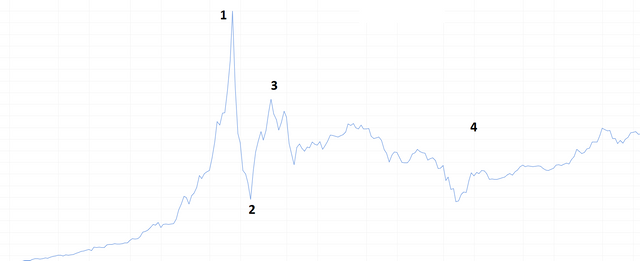

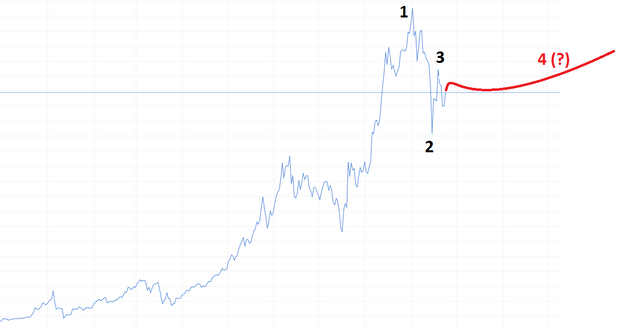

Even though I don't think Bitcoin is a bubble and is here to stay it definitely has bubbles in its price behavior. It overshoots its own value sometimes so that it crashes. Then it slowly recovers just to run into the next bubble. Let's take look at this behavior with the example of the bubble in April 2013:

This is a typical course for a bubble. It builds up and overshoots its value (1). That's where people get suspicious and start to sell, which then starts a viscous circle resulting in panic sells and a crash in price. When it reaches a specific point some people start to buy (2) because the price is now way below the actual value and they see the opportunity to buy at this low price. More people start to jump on that train and the price again overcorrects itself upwards only to fall again but this time slightly less. This kind of rubber effect takes a while of up and forth before the price has adjusted itself to a higher baseline before the bubble (4).

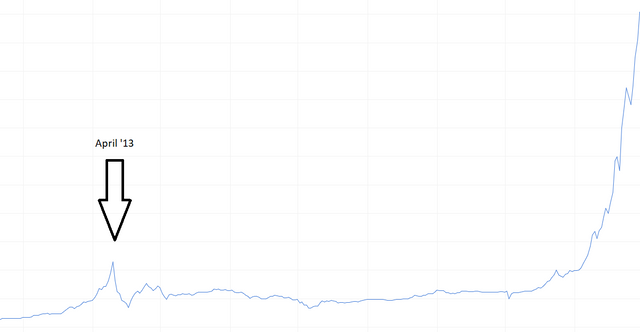

But what happens after the bubble? Look at it yourself: It runs straight in to the next exponential raise in price to end in the next bubble.

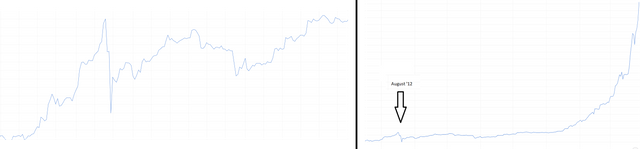

More examples of this

August 2012

December 2013

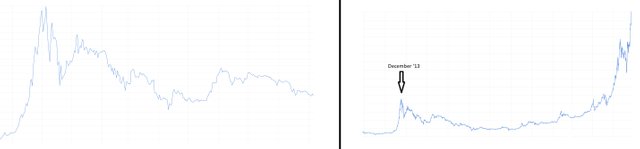

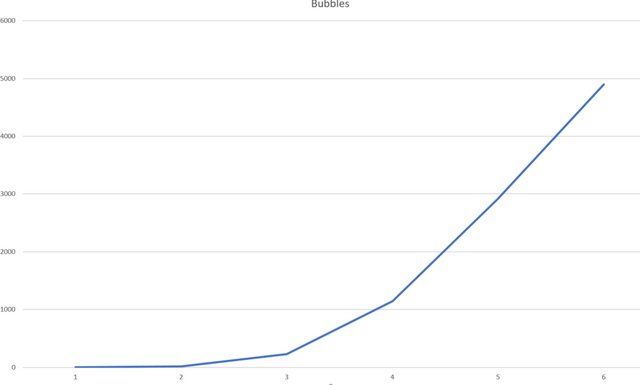

The history of bubbles

So there happened a lot of bubbles in the past. If you look at to point where bubbles in the past popped it shows a clear picture of increasing value each bubble (naturally). But this increasing looks actually like the beginning of an exponential graph, which would mean if true the prices the of the next bubbles could be significantly higher than the ones in the past.

A look at whats happening today

My point might look obvious to some: What happened this September is just another one of these bubbles and it just entered the fourth phase. Now what I think what will happen is that there will be some up and down the coming week and then another slow raise into the next bubble. My purely personal guess is in mid 2018 another one is going to burst, maybe around 10 - 15k in price. So if history repeats itself (which it has done a lot of times again and why should this time be different) the best time to buy is this week. Again I personally think around 3.5k is a price at which i would be comfortable buying.

today:

A reminder

All of this is my own prediction and guess! Don't make decisions purely based on this and inform yourself. I only can decide what I do with my money and my bet is: buy:

Thank you for reading!

If you want to follow me because of this post I won't complain but I will mainly write about design and architecture (good texts though^^)

Sources

- Graphs: de.investing.com/

- Title picture: pixabay.com

Go invest free 5$!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lumpi! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lumpi! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit