Entering early 2018, Bitcoin continued to fall from its highest point of 20,000 US Dollar to a low of 5,750 US Dollar. There are many reasons why the value of Bitcoin and other crypto currencies can go up and down, but one of the most dominant factors is market supply and demand. On this occasion, we will outline 7 reasons why Bitcoin has dropped dramatically in 2018.

1 Regulatory Pressure

Regulations from various countries have the greatest impact on the price of Bitcoin and other crypto. Some countries have implemented some rules or have discussed plans to limit the use of crypto currencies in their territories. Here are some countries that show a counter-Bitcoin attitude:

South Korea

South Korea has implemented several regulations and is considering several additional regulations. The South Korean government has also announced that Bitcoin users will be fined, if they do not convert from anonymous virtual accounts to original accounts that have passed KYC (Know Your Customer) standards.

China

As quoted by Reuters in January 2018, the Chinese authorities banned the centralized trading of crypto currency as well as individuals and businesses providing related services. Not only Bitcoin, China also prohibits the activities of ICO or Initial Coin Offerings, restrict Bitcoin mining, and close the crypto trade and bursa-bursanya.

India

In April 2018, RBI (Reserve Bank of India) has banned all financial institutions in the country to engage with crypto currency. In this ultimatum, all entities under government regulation are given a time limit for terminating relationships with the crypto currency business in any form.

Over the past 2 months, the Bitcoin blockade in India has continued. Although the Supreme Court in India has held a trial on the legality of Bitcoin trading in the country on July 20, 2018, but Bitcoin's demand in India has plummeted. Prior to the legalization of Bitcoin from the Central Bank of India was reached, the crypto currency exchange in India has not been able to move freely

2 High Volatility

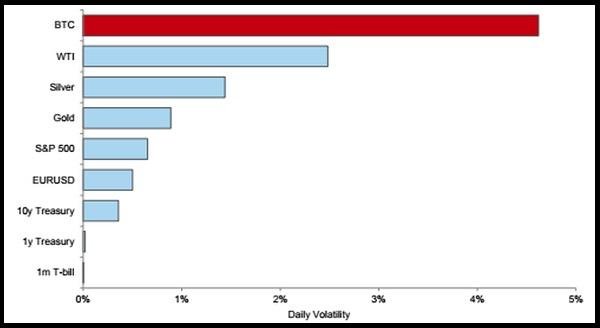

Goldman Sachs has a graph that shows the daily volatility of Bitcoin versus other investments such as WTI, Gold, S & P 500, and several other instruments.

From the graph above, Bitcoin proved to be far more unstable than other assets. This is good for traders (as long as they know what they're doing), but it's hard for long-term investors. As time went on, many investors began to understand the risks of Bitcoin investment. Volatility that is too dynamic can indeed generate high profits, but so does the risk that accompanies it.

3 Competition With Altcoin

There are more than 1,600 Altcoins listed on coinmarketcap [dot] com, and more than half have a market capitalization of under 10 million US Dollars. It can not be denied that the new Altcoin range has more functions than Bitcoin. As an example:

Bitcoin Cash is able to provide Scalability of up to 32MB.

Ripple and Stellar offer instant cross-border payments.

EOS offers transfer capabilities of more than 1.5 million transactions per second, and almost no cost.

With the various advantages offered by Altcoin, the demand for crypto is widened and distributed to various alternative coins. The emergence of these competitors is one of the causes of the value of Bitcoin down from early 2018.

4 ICO (Initial Coin Offerings)

The rapid increase in the price of Bitcoin has led to hundreds of ICOs or Initial Coin Offerings being launched in recent months. For example, Dentacoin which was launched in August last year for the scope of the dental industry, experienced a drastic decline from 2 billion US dollars to 600 million US dollars in just a few days.

This example is for new coins that are legal and still running, so imagine how the turmoil in the ICO new tokens is not yet convincing. There are various people who make the ICO a fraud. The SEC has warned about ICO fraud, so that investors stay away from new investments that have not really proven legal.

IFCERT (China National Internet Financial Risk Analysis Technology Platform) revealed that out of 1,450 ICOs conducted globally between January-May 2018, 421 were proven fraud. Various ICO bodong that fled investors' funds could gradually reduce interest in the crypto currency as a whole, including Bitcoin.

5 Hacks And Thieves

The most famous and biggest hacking case with Bitcoin theft is Mt. Gox, a Bitcoin exchange in Japan. The case caused more than 70% of Bitcoin owned by Mt. Gox was hacked in February 2014 and 850,000 Bitcoin was stolen. At that time, the loot was priced at 450 million US Dollars, about 10 billion US Dollar with Bitcoin exchange rate now.

End of December 2017, a similar incident hit Youbit, Bitcoin exchanges in South Korea. Hacking and theft was successfully looted 4,000 Bitcoin, or 17% of Youbit's assets worth about 48 million US Dollars. A Reuters article says that all customer assets will experience a 25% decrease in refunds.

January 2018 is also a bad start for one of the exchange and crypto exchanges in Japan, Coincheck. The exchange confirmed that it had stopped sales and withdrawals for NEM crypto instruments (XEM), after hackers stole XEM coins worth 58 billion yen. If converted, then the losses incurred are 7.1 Trillion Rupiah.

June 20, 2018, Bithumb announces a temporary suspension of deposits due to changes in their crypto currency exchange service wallet. Although changes in the wallet exchange system aim to improve security, but what happened to Bithumb actually boomerang, that is unexpected crypto hacking.

Just 12 minutes after Bithumb suspended their deposit system, the crypto exchange market announced that it would suspend all deposit and withdrawal services, as more than 30 million US Dollars have been hacked from their wallet.

Actually there are still many exchanges and exchanges that have experienced hacking and theft incidents in the past 6 months. Although this is not tied to the security of Bitcoin and Blockchain as a whole, but these unexpected losses certainly make other investors think many times to jump into crypto currency investment.

6 Great Media Blocks Bitcoin

In the span of time between February-June 2018, various major media including Google, Facebook, Instagram, Twitter, Baidu, and Weibo China have blocked crypto-related advertisements, including ICO, Exchange, and crypto mining. Almost all of the most popular crypto currencies decreased by 20-70 percent, because public confidence was drastically reduced following the rejection of various giant media.

7 Fraud and Malware Mining

Since Bitcoin gained its highest popularity by the end of December 2017, there is a new concept called cloud mining, which means you don't need to buy a physical mining rig, but rather hire the computing power of different companies, and get paid according to how much power you have.

At first, this idea sounds really good because you don't have to bother buying expensive equipment, storing it, cooling it, etc. However, when calculating, there were no cloud mining sites that were profitable in the long run. Those who seem profitable are usually fraudsters who don't even have mining equipment, but only apply complicated Ponzi schemes.

In addition, the spread of hidden mining-based malware has spread and infected millions of computers in various countries. The malware is able to run quietly, unwittingly by computer users. The malware basically uses another computer's computing power to mine crypto like Monero and Zcash, without being noticed by the owner of the device.

https://www.seputarforex.com/artikel/7-alasan-kenapa-bitcoin-turun-drastis-di-tahun-2018-284546-38

Now this is great info luthvandy3 thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks friend .:)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit