After the hard fork of the Bitcoin blockchain and the creation of a new crypto-currency, Bitcoin Cash, the course of our favorite currency beats its previous records by exceeding the $ 3,400 mark. Total capitalization of the Bitcoin network now exceeds $ 55 billion; Bitcoin Cash is valued at more than $ 5.5 billion at the time of writing. After a period of uncertainty, the free market is more robust than ever, proof of the resilience of the Bitcoin network.

The debate on the size of the blocks took a new turn after this amicable separation:

On the one hand, a majority of actors focus on the off-chain scalability of the network, thanks to the Segregated Witness lock, which will allow the deployment of the Lightning Network

On the other hand, the supporters of Bitcoin Cash believe they can give life to the vision of Satoshi Nakamoto through the scalability on-chain (increase in the size of the blocks). An opinion shared by many miners in the Bitcoin network, who reached a compromise with the New York agreement (SegWit 2X: SegWit and 2MB blocks).

Bitcoin Cash :

The community supporting Bitcoin Cash has always been in opposition to the cautious approach of Bitcoin Core developers. The "vision of Satoshi", that of a Bitcoin accessible to the largest number, inexpensive in terms of transaction costs and inclusive for the non-banked, seems to be shared by the entire community, but the way of proceeding divides. The on-chain approach is preferred by minors because it increases their power; The off-chain approach is privileged by developers because it is safer and allows to solve many problems like the malleability of the transactions or their level of anonymity.

The hard fork of the Bitcoin blockchain was triggered by block 478 559. A few hours later, the first block larger than 1 MB was mined by ViaBTC (1,915 KB).

The price of the BCH peaked at $ 700 relatively quickly on the BitFinex exchange platform, and at 695 euros on Kraken. Indeed, in the early days, only users who had left their bitcoins on these exchange platforms had access to their corners. This artificial scarcity coupled with greater fool theory [6] was enough to propel the Bitcoin Cash course to highs while only a few blocks had been mined on the blockchain.

This overvalued price was quickly corrected by the market as of the first massive sales and this correction continued with the transfer of the Bitcoin Cash Coins from the portfolios of many users on the exchange platforms accepting the BCH deposit.

Because the hash power for Bitcoin Cash is low, few blocks have been mined since the altcoin was created. New readjustments of the difficulty will therefore take place. For now, the network mines a block every 40 minutes or so, and the difficulty of mining the Bitcoin Cash blockchain represents 13% of the difficulty of mining the Bitcoin blockchain.

The choice of the free market:

It is therefore the free market that will decide the value it accords to each of the channels. Despite many criticisms, Bitcoin Cash did not sink to the bottom of the table of Coin Market Cap, on the contrary, the altcoin is the fourth of the ecosystem in terms of capitalization just a few days after its creation. However, many BCHs are not yet in circulation and it is difficult to predict whether their holders will separate from them.

Allegations Concerning the Handling of the Bitcoin Course:

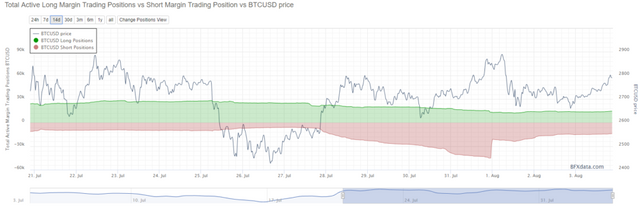

In an article published on Medium, BitCrypto'ed accuses an unknown entity (traders or groups of traders) of using certain tactics in order to manipulate the course of the bitcoin, mainly on BitFinex.

The methods of handling are well known:

Spoofing: placing orders without intending to execute them, in order to influence other traders (or their bots) with false signals, to his advantage. For example, place huge buying orders but that will never be executed to drive up the price and entice other traders to close their short positions, if possible buying back the spoofy bitcoins trader. Or conversely, placing massive selling orders to launch false bear signals, and entice traders to close their long positions, preferably by completing the purchase orders of the spoofy trader.

Wash trading: using different accounts within the same platform to buy and sell its own positions and manipulate the volumes and the course. The author of the article attributes to these techniques the very rapid rebounds of the price that one can often observe.

BitCrypto'ed insists on the illegality of spoofing (in American law), but it is also worth recalling that the market of crypto-currencies is by definition wild and little regulated. These practices are common in the crypto-universe and traders are solely responsible for their strategy. If it is based on the reading of the order book, it is obvious that the latter is regularly biased. It is common on all crypto-currency platforms to witness sudden disappearances of very important orders at the moment when they are likely to be executed.

Moreover, it is difficult to differentiate between deliberate spoofing and adjustments made by trading bots. And in the world of Bitcoin, there are already many "whales" in the markets that obviously have an interest in manipulating these to their advantage. The small trader should be aware of his non-existent power against these wealthy and aggressive traders and adjust his strategies accordingly.

Shortly before the BCH distribution on BitFinex, a 24,000 BTC wash trade was carried out at one time. BitFinex decided to distribute the BCHs according to a coefficient that depended on the ratio between the long positions and the short positions: by purchasing their own short positions, wash traders were able to obtain "free" BCHs. The platform said that it had sanctioned the trader (s) who performed this operation and readjusted the coefficient accordingly, but BitCrypto'ed rather suspects that the trader (s) is very close to the platform .

The point of the article which is a more disturbing hair concerns the solvency of BitFinex and the tethers.

Tethers are tokens whose price is maintained at the price of 1 tetherUSD = 1 US dollar. These tethers are therefore supposed to correspond to real dollars, held by a traditional investor. BitCrypto'Ed questioned the creditworthiness of the companies behind Tether (including BitFinex because each entity owns shares in the other): for several months Wells Fargo has refused to provide liquidity to BitFinex and Tether LTD. However, the issuance of tethers did not cease and the amount of tokens issued rose from 60 million to more than 318 million. BitCrypto'ed therefore believes that the value of the token is highly biased and that it is impossible for BitFinex or Tether to be able to convert to dollars at the fixed parity exchange rate. Adding to the shenanigans earlier in his article, Tether's likely role in money-laundering cases, and the inability to give legal status to tethers, BitCryto'ed questions the solvency of businesses. In the event that Tether's bank accounts are seized, the value of the token would become null.

These are just speculations and for now, BitFinex has not reacted to this ticket damaging to the image of the platform.

The future :

SegWit has been locked since August 9, and will be activated in just over 2016 blocks (around August 24), paving the way for many improvements to the Bitcoin protocol, including:

Confidentiality of transactions:

There are several ways to hide the amount of inputs and outputs while ensuring the cryptographic integrity of the transactions: using a technique called Pedersen commitment (using a soft fork) or using circle signatures at Like Monero (requires a hard fork).

MAST (Merkelized Abstract Syntax Trees):

The idea behind MAST is to link the P2SH (Pay to Script Hash) script system with the possibilities offered by Merkle trees in order to implement even more complex scripts, and why not, smart-contracts on the (BIP 114).

Signatures of Schnorr:

The cryptographic signatures used to verify the validity of a transaction by the data of the transaction and the public key of the issuer are based on the ECDSA method. Schnorr signatures are currently regarded as the best performers because they make it possible to add signatories very easily, and greatly increase the current level of confidentiality.

TumbleBit:

TumbleBit is certainly the most promising innovation in terms of confidentiality within the Bitcoin network, especially since its development is already at an advanced stage. This is a mixing service: via a TumbleBit server, the sender of a transaction is assured that the receiver will not know the origin of the bitcoins because they will be mixed with those of the many other connected users, (The cryptographic methods used protect against theft of corners and make it impossible to disclose the parties, even to the server).

. . .

The upcoming activation of Segragated Witness is seen as excellent news for the Bitcoin network. The resistance zone around $ 2,900 was cheerfully crossed as soon as the post-fork situation became stable, and a bitcoin at $ 4,000 could be in sight. However, with Bitcoin Cash's adjustment of the difficulty of mining, some fear that this blockchain will become more profitable to undermine than Bitcoin, prompting miners to devote their power to it, which could decrease the hashing power of the Bitcoin network , Slow down the activation of SegWit and cause the BTC to fall. A scenario that is not impossible; The war of the blocks is not over.

In the middle of the bubble for some, completely undervalued for others, Bitcoin silenced for a time the many birds of misfortune that predicted his death following the fork: exactly the opposite happened, and the clarification Of the situation regarding the war of the blocs is for the moment greeted by the market.

The next hard step will be the hard fork aimed at increasing the maximum size of mined blocks to 2MB, scheduled to begin 3 months after SegWit activation (so by the end of November). This will be an opportunity for the network to verify whether the promises given by the industrial players in the ecosystem will be fulfilled.