With Cryptocurrencies becoming more popular and exchange trading expected to take off in the coming years, there will be an increasing need to offer services similar to those offered by traditional investment regimes and Margin lending is one of them. Margin Lending is the process of allowing individuals to borrow money for the purposes of trading against a collateral. The ability to borrow funds is generally determined by the borrower's assets (cash, gold, house & so on ) & financial position. However in the crypto world, since the idea of tokenising the real world assets like Gold, Real Estate etc remains far from reality in the short term, there will be an increasing need to offer margin lending against Digital Assets. Lendroid is a trustless, non-rent seeking, open, peer to peer digital asset lending platform that aims to do this.

The decentralised 0x protocol allows for peer-to-peer exchange of ERC20 tokens Eg. Ethfinex, Radar, The Ocean etc. However the Lending and Margin Trading functions still remain outside of this ecosystem. So the ultimate goal of Lendroid is to enable seamless Lending and Margin Trading functions like holding of leveraged trade positions and short positions of ERC-20 tokens.

Built on the Ethereum network, the Lendroid protocol is designed to handle the complete lifecycle of collateralized digital asset loans. It allows borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. The four main actors in the Lendroid Ecosystem are;

Lender- The primary participant on the platform is the lender who broadcasts his/her loan-offer to all decentralized exchanges. Each loan offer is a data packet called the offer object containing the terms of the loan like Loan Amount and Interest Rate , Loan Expiration Period and Offer Expiration. The loan offer can be cancelled if it has been left unavailed and unfilled.

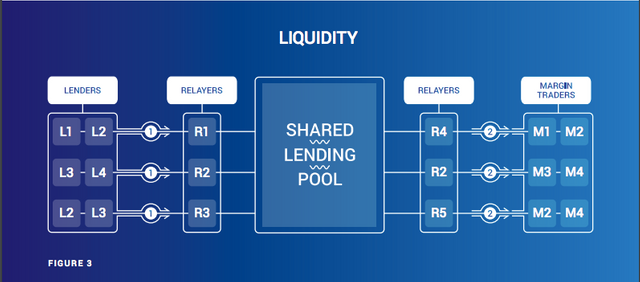

Relayer - The Relayer "relays" or makes the offers signed by the respective Lenders to the Trader. Hence a Relayer is the first point of contact for both lender and trader on the Lendroid protocol. Off chain, this entity effectively takes up the liquidity related functions of an exchange in a wholly decentralized manner. Relayers provide an interface, and manage order books and offer books and they are key to creating the shared global lending pool.

Trader - More specifically speaking the Margin Trader, is one who avails the loan offered by lenders in a decentralized environment after depositing a collateral. The loan will be utilised to engage in margin trading or short selling.

Wrangler - A wrangler monitors and ‘wrangles’ terminal accounts at liquidation level, its function is similar to a clearing house and is resposible for maintaining the general health of the ecosystem, while also protecting the interests of the Lenders. Wranglers are the main actors during the Lendroid Auction process. Wranglers can choose to repay a

portion of the total outstanding loan to win a proportional amount of the assets/collateral. Wranglers who detects an unhealthy margin account gets a reward in LST for his/her vigilance.

Loan offers are transmitted off-chain aggregated and and displayed by relayers. A margin trader deposits collateral and avails loan by picking loan offers. Using the borrowed capital, the trader opens trade positions while wrangler will margin level monitoring of the trader accounts. Monitoring will involve active listening of state changes in the margin account, recursive querying of market data and reporting the defaulting account to initiate liquidation. In the event of non repayment there will be a margin account collateral auction where multiple wranglers can bid for small portions of the account. Wranglers who bid for least share of collateral are chosen and positions are transferred.

The system will effectively create a global shared lending pool for digital assets. Both the lenders and the Margin Traders on the platform contribute to liquidity in the ecosystem.

Lendroid Support Token (LST)

The native token in the Lendroid network is the LST token, it keeps the Lendroid network operational also enabling community governance. LST will act as a secondary collateral for the loans provided through the platform. The instrinsic value of LST tokens is driven by the fact that they are required by;

- Lenders for loan initialisation i.e to pay for the Relayer's services at the end of the loan period.

- Traders for "staking" tokens when opening a Margin Account. These tokens are refundable upon closing the trade positions and repayment of the loan but traders run the risk of losing these tokens if their margin account drops below the liquidation level.

Both Relayers & Wranglers are incentivised in LST tokens. The Relayer gets incentivised for recording and relaying the loan offer while the first Wrangler to detect the unhealthy Margin Account who is guaranteed 25% of the LSTs staked as a reward during the Lendroid Auction process.

Token Generation Event

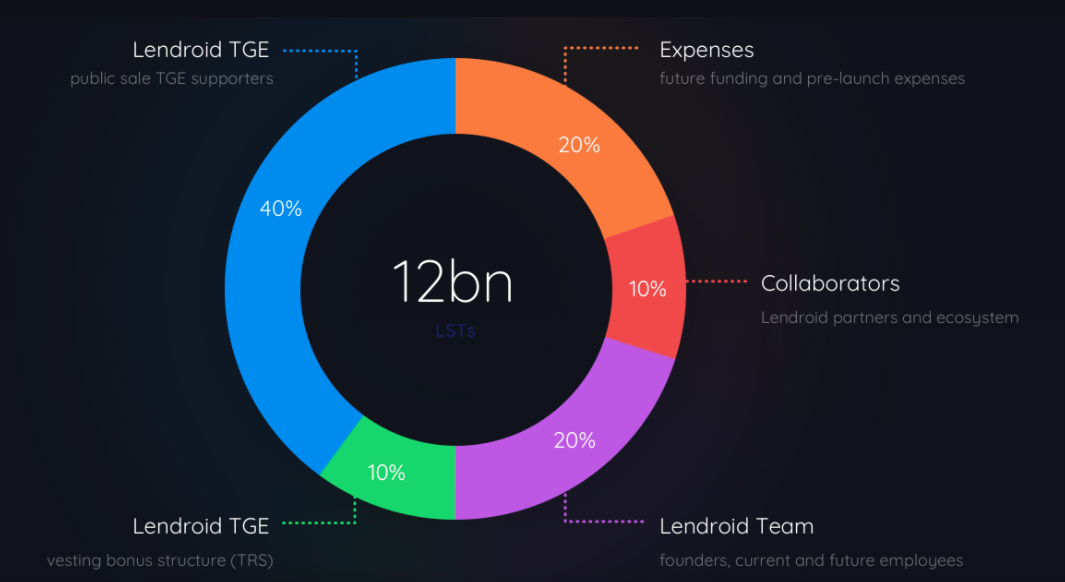

Details are as follows;

Hard Cap : 5000 ETH

Total supply: 12 000 000 000 LST

Presale (over): 240 000 000 LST

Rate: 1 ETH = 48 000 LST

There will be a Whitelist which is expected to open for applicants on February 11. The expected date for TGE is Feb February. Head over to Lendroid Website for more info on the token launch!

Team, Partners & Other details

Vignesh Sundaresan, with his vast experience in the blockchain space including being the founder of Bitaccess (a YCombinator backed Bitcoin ATM company) leads the Lendroid team. Vii Sundaram is the tech lead. Paul Martens takes care of branding & UX while Supriya Vasu is in charge of communications & operations. Haseeb Awan takes care of business development. Full team

It should be noted that the Lendroid platform finds its existence in presence of other Dapps and tokens on the Ethereum like Melon, Stabl, Digix etc. For example Lendroid when incorporated with the Melon platform will allow traders to leverage their positions and hold a short position. Similarly, Lendroid with Stabl / Decentralized capital will allows users to avail loans against any Ethereum token in stable government currencies (FIAT).

Lendroid has partnered with FundRequest to harness the power of open source development. Also, Lendroid's partnership with the fantastic Keep Network will enable their smart contracts to sign off-chain by acting as a digital notary - Read More.

Visit the Lendroid Website —https://lendroid.com

Join the Telegram group —https://t.me/lendroidproject

Follow Lendroid on Medium —https://blog.lendroid.com/

Lendroid White Paper - https://lendroid.com/assets/whitepaper-margin-trading.pdf

My BitcoinTalk profile - https://bitcointalk.org/index.php?action=profile;u=1404731

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit