ISLAMABAD: The top intelligence department of the Federal Board of Revenue (FBR) is investigating cases where investors trade digital currencies probably to evade taxes or launder money.

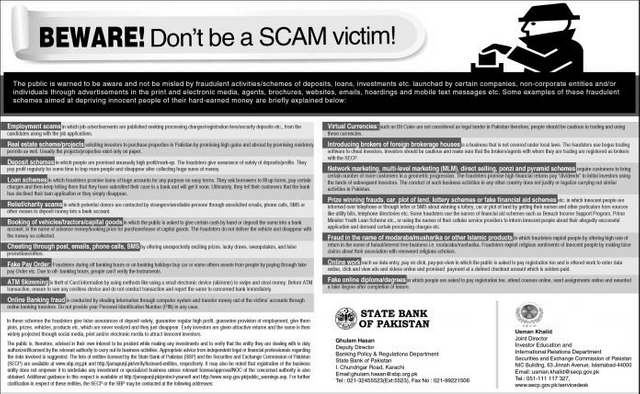

The State Bank of Pakistan **(SBP) **does not perceive cryptographic forms of money, for example, bitcoin. These computerized monetary standards are likewise exchanged as wares.

A senior expense official said individuals dodge charge and launder cash utilizing digital currencies. They purchase bitcoin to launder their assessment avoided cash, he stated, including that they stop their dark cash out of Pakistan as a rule.

The counter illegal tax avoidance cell of the Directorate General of Intelligence and Investigation, Inland Revenue** (I&I-IR)** began exploring on Wednesday the money related issues of individuals having enormous interests in digital forms of money, including bitcoin.

Tax avoidance is a predicate offense under Anti-Money Laundering Act 2010. The legislature has delegated the Directorate General of** I&I-IR** as examining and arraigning office in situations where charge dodged cash is washed.

As indicated by the expense official, the exchange of bitcoin is on the ascent in Pakistan. The underlying request uncovered that bitcoin is being exchanged for the most part against trade out the nation.

The present cost of bitcoin is drifting around Rs200,000. Endless supply of dependable data, the Directorate General of I&I-IR attempted an inquiry to follow the exchange.

Summonses were served on significant brokers of bitcoin for facilitate examination. According to a report distributed on the web, the exchange volume of bitcoin in Pakistan expanded 400 for each penny amid December 2016 alone.

Bitcoin is some of the time utilized as a device for illegal tax avoidance because of the decentralization of shared online exchanges and their namelessness. No laws at present direct the exchange bitcoin.

As per the expense official, the request demonstrated real dealers of bitcoin are utilized in a multinational media transmission organization in Islamabad. They likewise keep up ledgers in a couple of different nations.

Notwithstanding, they were not revealing their business exercises to the assessment specialists, which offered ascend to the doubt of tax evasion.

The expense official said there is a high shot of tax avoidance and tax evasion in the exchange of digital money.

Subsequently, an inside and out test is being completed to measure the real quantum of bitcoin exchanging and examine whether its pay is as a rule appropriately detailed under the duty laws.

Eventually, everyone will start to accept bitcoin!

You can't hide from what is supposedly the future of the financial economy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit