The strong appreciation of bitcoin can be more than a speculative frenzy. The upward trend is driven, in part, by many investors who are moving away from the digital assets with greater risk and are falling in this cryptocoin that with more than seven years of life begins to seem a more secure asset.

"A lot of bitcoin volume right now is not dollars or yen or euros going into the cryptocoin, but rather alternative digital assets," explains Peter Smith, co-founder and CEO of the Blockchain digital asset software platform, in a Conference of the sector. "People think that many of these newer assets are at greater risk, so they end up doing asset rotation in which the winner in the new portfolio is bitcoin."

Numerous alternative cryptocoins, such as ripple, have emerged since bitcoin began to be known in 2013. While the price of a bitcoin has soared to over $ 2,000 from just 8 cents to those it traded in 2010, you can also buy a Litecoin for about 30 dollars. However, the risk perceived by investors is not the same.

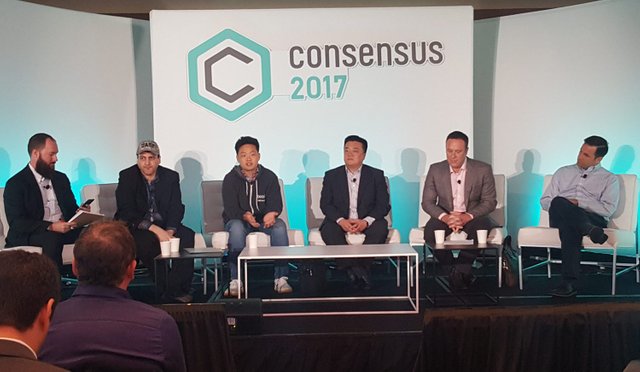

Some are worried that a bitcoin bubble is forming, but Smith and Erik Voorhees, founder and CEO of the ShapeShift cryptocoin Market, are not too worried. Booms and falls are a normal part of any economic cycle, as they have reported at the Consensus 2017 conference.

"Every time Bitcoin goes through these bubbles, a new wave of users enter," says Voorhees. "The reason why bitcoin is getting so successful is because banks have not been innovating and have been left behind."

ShapeShift users, of whom only about 15 percent are in the United States, are moving small amounts of value between different digital currencies as they analyze the best place to invest their money, Voorhees adds. Bitcoin is the "least speculative" of digital assets, ruling.

Bitcoin has also been able to take advantage of the turbulence in countries like Greece, China or Venezuela. Many investors in these countries have traded their traditional currencies by bitcoin against expectations of future depreciations of their traditional currencies. Undoubtedly, these demand peaks have helped bitcoin to continue climbing.

"One of the most beautiful things about Bitcoin is that you can see the free market economy in operation every day and the bubbles and creative destruction are part of that process," Smith argues.