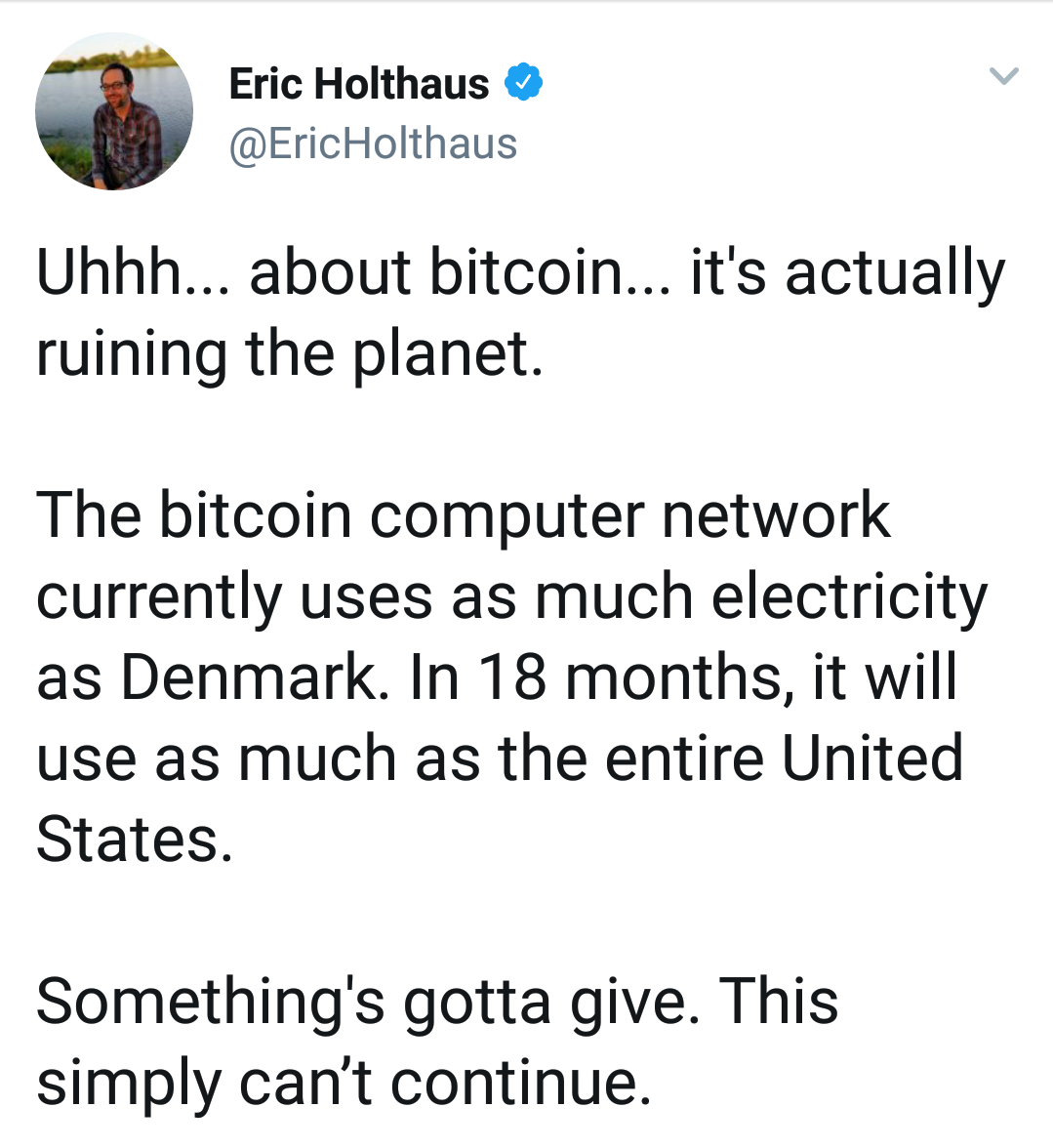

So I saw this tweet this morning and it got me thinking

Right now bitcoin is predominantly understood to be being mined from renewable hydro electricity.

So why do bitcoin farms get great rates v distribution companies?

They obviously get better rates because they want a 247 contract. The distribution companies do not. Generating companies want an income stream that runs all the time.

If the bitcoin mining farms continue to purchase these contracts the only way the distribution companies can actually compete is to actually buy storage batteries along the lines the Elon Musk and James Dyson are working or at least work on storage solutions.

Not only has bitcoin accelerated nano etching at chip level, it's also going to force the storage issue of electricity where the electrical distribution companies in the US previously had no competition and no real incentive to develop storage solutions.

If my half-baked idea has any legs then competition in the US utility marketplace will devastate profits. But for the average John Doe it will reduce their bills.

Over the next 2-3 years this could be a massive deflationary force permitting yet more QE before the spectre of inflation rears it's head.

Informative post.

You can check my @babuplrk

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @markcross! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit