Why Digital Gold Won’t be a Thing

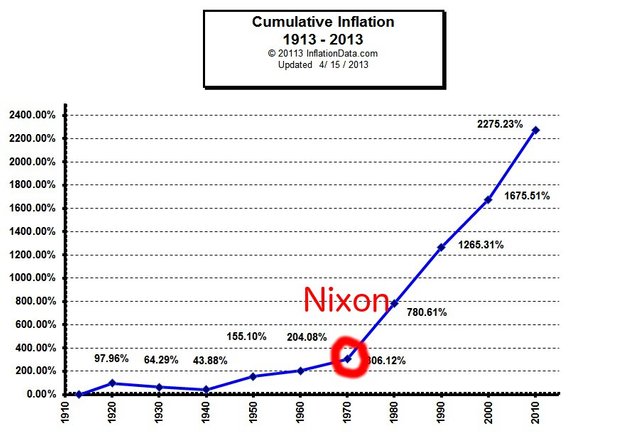

Prior to August 15th, 1971, a US dollar was worth 1/35th of an ounce of gold — known as the gold standard (actually the Gold Window, FDR had started the process of removing the gold standard in 1993).

This was a monumental moment. The gold standard kept the US (and other governments honest) — because there was only so much gold in the ground, there could only be so much Fiat — preventing rapid inflation.

Changing this dynamic was a paradigm shift…

The concept of money

Historically “money” has served three purposes:

- medium of exchange (ability to trade)

- unit of account (standardization)

- store of value (risk management).

In practice, the first two are linked. Because the US issues US dollars and while the UK works with British pounds (GBP), there are standards of exchange across currencies. Due to the number currencies worldwide, it would be impractical to peg every fiat currency to every other, and thus the US dollar is the primary pegging mechanism (as is BTC in crypto).

Rather than maintaining exchange rates with 180+ currencies worldwide, everyone trades into (and out of) USD — the standard.

Gold as a store of value

The storage of value is really nothing more than trust. You trust gold to stay relatively consistent in price as do others around the world because there is only a limited supply and the ROI on holding is quite low (meaning low demand).

If however the price of fluctuated or countries began dumping gold bricks into the oceans, the decreased supply would trigger price jumps and subsequent unrest. But because we are all motivated by money, that does not happen.

This isn’t true with dollars (or any Fiat currency). Here trust is in the issuing entity. You and I both need to trust the US government and the stability of the dollar to be able to transact with it. And because a government is inherently less stable than a distributed supply of gold, the trust relative to gold is significantly lower — thus equating to lower value.

And as the supply of fiat is not fixed, the value of the dollar decreases every year with inflation as more dollars are printed (and so does our trust in the dollar and by definition US government).

NOTE: I am not leaning one way or another or using the term “cash” or “digital cash” to represent Bitcoin Cash or any other cryptocurrency. This is a noun to describe a purely theoretical and probable outcome.

But along comes Bitcoin

Cryptocurrencies change everything. The reason gold is trusted isn’t any inherent value, it is its limited supply and our historical fascination with it.

That said, due to its lack of utility, Warren Buffett isn’t a fan:

“(It) gets dug out of the ground in Africa or someplace.

Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it.

It has no utility. Anyone watching from Mars would be scratching their head.”

But Bitcoin started as a peer-to-peer payment system with utility — quickly morphing into digital cash, a non-governmental currency that citizens of the world could use in a trustless, decentralized fashion.

Today Bitcoin sits at $9065, down from an all time high of $19,343 on December 16th, 2017.

Source: CoinDesk

What started as a medium exchange has turned into a high cost, high demand speculative asset.

This has driven transaction prices through the roof, now making small payments untenable and disenfranchising many of Bitcoins early advocates — Bitcoin is again changing.

Digital gold is dumb

Enthusiasts call Bitcoin digital gold. This is a flawed understanding of the nature of money. There won’t be a digital gold, it serves no purpose. Gold was valuable for its trust, nothing else.

With decentralized, trustless, non-governmental cryptocurrencies, what is the purpose of assets?

There is literally no reason to have a “store of value.” In a scenario where one (or more) cryptocurrencies become actual currencies, ie begin being used for commerce and penetrate the mass market, there has to be relatively stable pricing. When supply and demand are relatively consistent, prices hardly fluctuate.

This is the reason you can ride the bus and pay at the beginning or end of the trip without worrying about inflation/deflation. The cost in units of trust is the same — that is how functioning economies work.

So if we can all agree that at least one cryptocurrency will reach this level, which I believe most crypto enthusiasts can, then isn’t the trust in this currency essentially infinite? Anyone can use/accept it, no one controls or can stop it…

Gold wasn’t a good everyday currency because it was too cumbersome, thus paper replaced it for everyday use.

This isn’t true for crypto. You can put 0.001BTC or 100k BTC on a hardware wallet and it takes the same amount of work (and time).

Designing a trifecta currency

Cryptocurrencies have become a bloodbath recently, between greed grabs and differences in theology (yes cryptocurrency is a religion/theology — see here ), it has been an interesting and exciting time to be in the blockchain space.

But at the same time, the original vision of cryptocurrencies is transparent, trustless money for and by the people. If we get to this point, it doesn’t matter who “wins.”

A cryptocurrency looking to be “the digital cash” and replace currencies and cryptos of the world, needs the following attributes:

Trustless

I don’t trust you, you don’t trust me. Transparency (at least between parties) is necessary to conduct business without a “trusted” intermediary (like a bank that charges lots of fees).

Cryptocurrencies currently don’t have regulatory bodies. If you get robbed, Batman (or the police) isn’t coming to save you.Decentralized and censorship-resistant

If governments or illicit organizations can shut off or alter the supply of money, we are right back to fiat.

This creates the question of how to decentralize/secure the network. Currently Proof of Work and Proof of Stake are the common protocols — both with strengths and weaknesses.

Solving this problem may prove the most important key to cryptocurrency adoption.Private

Transparency isn’t always a good thing. Why should the barista at Starbucks know your net worth and all the organizations/individuals you interact with? You are just asking to get robbed or hacked.

For privacy coins to work without a complete governmental collapse, there will need to be certain auditable information. But beyond the basics, sharing economic status with the world seems a recipe for disaster.Stable

For mass adoption, we need stable cryptocurrency. You cannot buy things, pay salaries or expect to function in a society of rapidly changing rates…

There may need to be DAO-like governance structure needed to maintain stable prices. This however has not been worked out adequately to date and needs a lot of work.

Closing thoughts

What is cryptocurrency? What are your thoughts on the article? Can you understand the ignorance of digital gold? Do you have other views or beliefs?

Any favorites on cryptos to win the overall currency game?

Before you go…

If you got something actionable or valuable from this post, like this and share the article on Facebook and Twitter so your network can benefit from it too.

LIKE THIS ARTICLE? THEN YOU’LL REALLY WANT TO SIGN UP FOR MY NEWSLETTER OVER HERE — AND GET SOME FREE BONUSES!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/bitcoin-store-of-value-is-a-useless-use-case-f786b2ddbb25

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit