Bankera is building a digital bank for the blockchain era, with the aim of integrating traditional and cryptocurrency related banking and becoming the one-stop-shop for all financial services. Bankera will offer three core lines of service:

Payments: Payment accounts with personal IBAN, debit cards, interbank foreign exchange rates, and payment processing. All services will support both fiat and crypto currencies. In the long term, Bankera will implement innovative solutions such as GDP-linked currencies or use equity traded funds as a substitute for money.

Loans and deposits: Not only savings, but also current deposits will receive interest. All Bankera clients will be able to benefit from higher interest rates due to proprietary information about borrowers’ cash flows, as most loans will be given to business clients who use the payment processing solution.

Investments: Low-cost investment products such as equity traded funds (ETFs), crypto-funds (a portfolio of various cryptocurrencies and crypto-tokens), and robo-advisory solutions for wealth management. Later on, Bankera will offer investment banking services including financing corporate strategies of business clients.

Bankera is an operational fork of SpectroCoin, a web-based bitcoin wallet and exchange provider, which serves as Bankera’s MVP (with features such as Bitcoin debit cards and payment processing), and will also be hosting its pre-ICO. SpectroCoin will continue to provide a solution for cryptocurrencies, while Bankera will provide the banking services listed above.

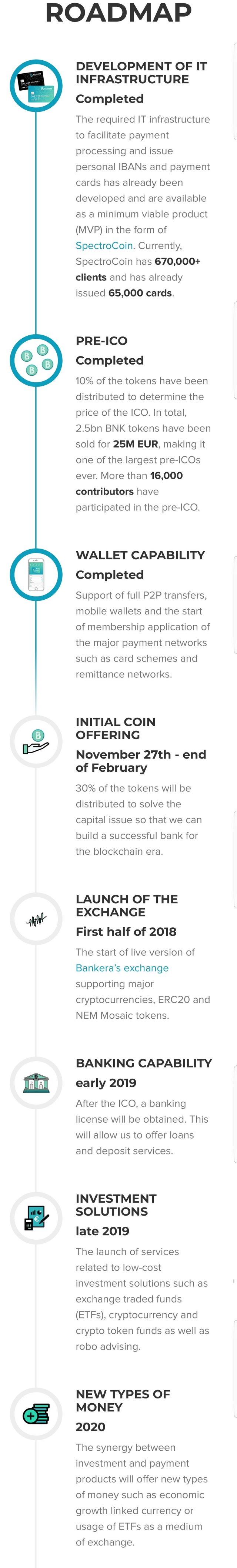

Bankera plans to have significant infrastructure in place prior to the initial coin offering (ICO). The company claims to already have the necessary regulatory and IT arrangements to offer individual international bank account numbers (IBAN) which can handle payments in the Single Euro Payments Area (SEPA), and says it will apply for additional banking licenses in key jurisdictions so as to be able to handle a wide variety of fiat currencies and facilitate cross-border transactions. Although Bankera will not have physical branches, it will issue payment cards that can be used at ATM’s and also plans on partnering with retail providers of cash deposit and withdrawal services, and on developing such a network of retail agents in developing areas. Bankera’s wallets will initially cover 22 fiat currencies, including major currencies such as USD, EUR and GBP, and in addition will also support cryptocurrencies such as Bitcoin, Ethereum, DASH, NEM and others.

Furthermore, in order to facilitate the acceptance of cash payments via Bankera’s gateway, Bankera will also provide businesses with extensions of its proprietary know-your-client (KYC) and fraud screening technologies, and offer incoming payments financing (as an alternative to invoice financing) or short-term finance products to bridge businesses’ cash flow gaps.

To obtain the capital necessary for implementing its vision, Bankera is launching an ICO and issuing ERC20 tokens called Bankers (BNK). Bankers token holders will be entitled to receive pro-rata shares of 20% of Bankera’s net transaction revenues in ETH on a weekly basis.

Most of the capital raised in the ICO will go towards satisfying capital adequacy requirement ratios and obtaining banking licenses in new jurisdictions. Currently, Bankera has a payment institution’s (PI) license and is authorised to operate in European Economic Area (EEA) regions. Bankera expects to obtain an electronic money institution (EMI) license before the ICO, which will enable all services except deposits and investments. After the ICO, the company’s key objective will be to obtain a banking license in the EU. Bankera will also work on obtaining membership in key financial networks such as card schemes and remittance channels, as well as additional banking licenses in key jurisdictions.

In accordance with margin calculations detailed in its whitepaper and estimates based on SpectroCoin’s current cost structure, Bankera expects a revenue of 11M EUR in its first year with stable growth to 500M EUR within ten years, while most of the company’s expenses will consist of wages (for 200 employees in the first year, growing to 2000 employees within ten years), as well as legal and IT expenses. Due to its strong foundation, operational product, and the initial SpectroCoin user base, Bankera expects to be profitable right from the start.

Lead Team (information taken from company website):

Vytautas Karalevicius, CEO: Vytautas is currently completing a Ph.D. in Cryptocurrencies at KU Leuven University in Belgium. Has an MPhil degree in Finance from Cambridge University and has interned at Bloomberg (London office).

Mantas Mockevicius, CCO: Mantas has over eight years of experience in managing operations and compliance for electronic and digital money exchanges. He holds a bachelor’s degree in Economics and master’s degree in Finance.

Justas Dobiliauskas, CTO: Justas has nine years of experience in developing software for medium and large financial institutions as well as five years of experience working with blockchain technology and cryptocurrencies. He is an expert in P2P technologies and holds a master’s degree in Information Systems Security.

Craig Grant, VP Business Development: Craig has experience in the payment processing industry including three years at Skrill (now a part of the Paysafe Group) as a senior business development manager.

Egle Eidimtaite, VP Business Development: Egle has 3+ years of experience in business development in the e-gaming industry. Before entering the corporate world she worked at the European Parliament.

Ruta Cizinauskaite, VP Marketing: Ruta is a B2B and B2C marketing expert with experience in both the corporate and governmental sectors. Before coming to Bankera, she accumulated experience in social media, SEO, project management, and sales while working for a startup based in Brussels, the US Embassy, and the Lithuanian government.

Tse-Hsin Lu, VP Communications: Tse-Hsin is an expert in digital marketing, especially for financial services, who gained her SEO and social media experience working as leader of the SpectroCoin marketing team. She has lived in the USA, Taiwan, and Belgium.

Advisors (information taken from company website):

Lon Wong, President of the NEM.io Foundation, CEO of Dragonfly Fintech

Antanas Guoga, Member of the European Parliament, serial entrepreneur, and a well-known poker player.

Eva Kaili, Member of the European Parliament, chairman of the EP’s scientific foresight unit.

Modestas Kaseliauskas, formerly Director General of the State Tax Inspectorate (STI) in Lithuania (2005–2014), tax partner at TaxLink (Correspondent of Mazars).

Damon Rasheed, CEO and founder of Rate Detective.

Dr. Eugene Dubossarsky, head of the Sydney Data Science group, the Sydney Users of R Forum, and Datapreneurs, and the creator of ggraptR.

Warren Lush, was head of PR at PartyPoker and held similar roles at Ladbrokes and Sky Sports; worked for Rt Hon William Hague MP (former leader of the opposition and Foreign Secretary).

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptorated.com/ico-reviews/bankera/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 16.39 % upvote from @morwhale thanks to: @miranas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 0.67 % upvote from @booster thanks to: @miranas.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit