Welcome to Bitcoin Basics Lesson 2: The Essentials of Bitcoin

In yesterday’s lesson, we learned that cryptocurrencies are decentralized currencies secured by cryptography. You learned that bitcoin, the world’s first cryptocurrency, was created by a mysterious individual – or group – known as Satoshi Nakamoto in 2009.

In today's lesson, you’ll learn more about bitcoin and how it works, including:

- Why bitcoin transactions aren’t 100% anonymous

- How bitcoin wallets can protect your digital money

- How bitcoins are stored within the public ledger or blockchain

- Why bitcoin can’t be printed like regular money – it has to be “mined” with a computer

Bitcoin Transactions Aren’t 100% Anonymous

- How to Safely Store Bitcoin in a Bitcoin Wallet

- Mobile apps

- Physical wallets, including cold storage wallets like Trezor and the Ledger Nano S

- Paper wallets, which are pieces of paper on which you’ve written or printed your private key or passphrase

- Other software programs

- How Bitcoins Are Stored on the Blockchain

- Bitcoin Mining - Why Bitcoin Has to Be “Mined” By Computers

- How Buying and Spending Bitcoin Works

- Buying & Spending Bitcoins

- Open a Bitcoin exchange account.

- Trade a fiat money for Bitcoins or receive coins.

- Transfer your Bitcoins to a secure private Bitcoin wallet.

Where To Open a Bitcoin Exchange Account?

Many people believe bitcoin transactions are totally anonymous. People will tell you that bitcoin is the preferred payment method for scammers, drug dealers, and denizens of the “dark web”.

This isn’t really true. Bitcoin does have a shady past and it has been used for plenty of illegal transactions, money laundering schemes, and scams.

However, bitcoin is far from anonymous. Yes, it’s a decentralized currency that can be transferred without the need for a third party – like a bank. Yes, you can own bitcoin without disclosing your identity to anyone. But it’s far from anonymous.

Bitcoin is best described as “pseudonymous” and not anonymous. Here’s the reason: anyone can see your bitcoin wallet. Your bitcoin wallet is a public address. Your funds are held on the transparent bitcoin blockchain, and anyone can see those funds by checking the bitcoin blockchain.

Your bitcoin wallet address looks like a string of numbers and letters like x8j324inxcgf89joiadfj8dsj.

Nobody knows your identity specifically from that string of numbers and letters. However, someone can link your bitcoin address to your identity quite easily.

You might post a donation link on your forum post, for example, asking for donations to a bitcoin wallet address. From that point forward, your bitcoin wallet is linked to your username on that forum.

Even if you’re careful about linking your identity to your bitcoin wallet address, anyone can still track your funds. You might collect $100,000 at a bitcoin wallet address linked to your anonymous business, for example. However, an IRS agent can sit and watch that bitcoin address to see where your funds are moved, then tax the final destination of those funds.

Here’s the final reason why bitcoin transactions are rarely anonymous: most cryptocurrency exchanges abide by strict Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, which means they collect and verify the personal information of all users on their forum. As soon as you transfer any cryptocurrency funds to or from your exchange account, your bitcoin address is linked to your personal identity forever.

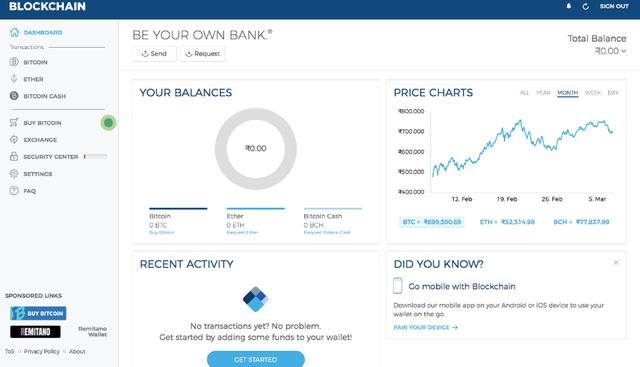

The term “wallet” has a different meaning in the bitcoin world. A bitcoin wallet is a place where you can store your bitcoins.

Of course, your bitcoins aren’t physical units. They’re just strings of data – including your private keys. A bitcoin wallet will store your private keys, which means only you can access the funds within that wallet.

There are a few different types of bitcoin wallets, including:

In any case, your wallet is controlled by you and you alone. There’s no third party bank in charge of your wallet. Your wallet lets you send, receive, and store your bitcoins. If your wallet is compromised – like if you lose your private keys – then it’s likely due to your own fault.

All bitcoin transactions are recorded in a public distributed ledger called the blockchain. That blockchain is the center of the bitcoin network. It’s a string of transactions dating all the way back to January 2009 when the bitcoin network first launched. A new “block” of transactions is added to the “chain” every transaction. That means you can look at the blockchain – which is now about 160GB in size – to verify any transaction in the history of bitcoin.

Wallet apps and other software applications will send transactions to the bitcoin network. Once a transaction hits the bitcoin network, it has to be approved by a node. A node is a computer running the bitcoin network software. That computer will perform a complex mathematical operation to solve a cryptographic problem, then receive a reward – in the form of bitcoin – for their work in securing the network.

Each network node verifies and stores its own copy of the blockchain. This is why the blockchain is called a “distributed” ledger. The ledger is “distributed” across a network of millions of nodes – millions of computers – in every corner of the world. If someone tried to change the ledger – say, by falsifying a transaction – it would quickly be overruled by the other nodes on the network.

One of the key differences between bitcoin and fiat currencies is the way it’s created. Fiat currencies like the USD are printed on a daily basis. More US Dollars are constantly entering into the circulating supply.

The bitcoin network also issues new bitcoins on a daily basis – although there’s a fixed supply of bitcoin that will ever be created. There will never be more than 21 million bitcoins in existence. That’s a fixed number.

As of 2018, approximately 17 million BTC have been mined. That means there are just 4 million bitcoins remaining to be mined.

Bitcoins are “mined” by nodes. When a node verifies a bitcoin transaction, it receives a mining reward. In the early days of bitcoin, the mining reward was 50 BTC. That means the network distributed 50 new bitcoins every 10 minutes. The bitcoin code required the block reward to be cut in half over time. The bitcoin block mining reward halves every 210,000 blocks. As of 2018, the block reward sits at 12.5 BTC. In May 2020, that reward will drop to 6.25 BTC per block.

In order to mine bitcoin in 2018, you’ll need a specialized computer. Today, special custom-designed bitcoin miners use immense processing power to solve bitcoin’s increasingly complex cryptographically-secured math problems.

You can buy bitcoins online from any cryptocurrency exchange. You can also purchase bitcoins from private sellers in your area or from two-way bitcoin ATMs.

In the early days of bitcoin, the only way to spend your bitcoin was to withdraw your bitcoin into a usable currency like the USD.

Today, however, bitcoin users have more options than ever before. Major retailers now accept bitcoins and other major cryptocurrencies for many transactions. You can buy condos in Dubai using bitcoin, for example. You can buy plane tickets or cars using bitcoin in website like Expedia.com for example.

Many cryptocurrency banking companies now offer bitcoin debit cards. You sign up for the card, send bitcoin to the card, then use that card in the real world. These cards are spendable anywhere VISA and MasterCard are accepted. Spending your bitcoin in the real world is as easy as using an ordinary credit card.

There are a variety of specialized currency exchange websites to buy bitcoins and altcoins with funds from a bank account or credit card. Buying Bitcoins is simple, there are a few options for buying coins. The quickest way to get started with bitcoin is to sign up for a bitcoin exchange, where you can quickly buy, store and receive coins. Here’s the basic process you’ll need to follow:

That’s it! click here to check out the best exchanges in the US and Internationally. Below, we’ll explain more specific instructions – like tips on how to choose a good Bitcoin exchange and what to watch for.

There are several major Bitcoin exchanges, and there are several preferred exchanges. Different people have different needs, and multiple exchanges offer different services.

Your country and location also play a role when deciding which exchange to choose. Coinbase is the preferred leading exchange in the US and Europe for example, but if you are in Mexico Bitso is the best option to start.

Thanks to Bitcoin Exchange Guide for this article, click for more

Congratulations @mitems! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit