Lesson 3: The Price of Bitcoin and what makes it go up and down

Thanks to Bitcoin exchange guide, click here to get more info (aweber.com)

In our last lesson, we learned the basic foundations of bitcoin. We talked about how the distributed ledger – the blockchain – works. We also explained how you can store bitcoin in bitcoin wallets, buy bitcoin from cryptocurrency exchanges, and spend bitcoin in the real world using bitcoin debit cards and other payment solutions.

In today’s lesson, we’ll explain all of the following:

- The value behind bitcoin, including how supply and demand control bitcoin’s price

- How bitcoin prices can be sharply influenced by news and events

- Why bitcoin has a fixed supply of 21 million total units – and how that affects price

- Bitcoin’s Value: How Supply and Demand Control the Price of Bitcoin

- How News Can Affect the Price of Bitcoin

- A country like China just announced new regulations regarding bitcoin and cryptocurrencies

- A country announced a bitcoin ban

- Regulators raided a major cryptocurrency exchange

- Developers announced a bitcoin hard fork or another major technological shift

- A retailer like Amazon announced it was accepting bitcoin as a payment method effective immediately

- A cryptocurrency exchange was just hacked, leading to the loss of thousands of BTC

Many people have the mistaken idea that the price of bitcoin is “backed by nothing”. That’s just not true. Bitcoin’s price is governed by two crucial factors: supply and demand. Bitcoin’s supply and demand, meanwhile, are based on the technological innovation behind bitcoin, its usability, and its value when purchasing real-world goods and services.

Supply and demand is easy to understand. Let’s say someone has 1 BTC and they want to sell it. Due to increased demand, two buyers are interested in buying that 1 BTC – but there’s still only one seller. One buyer offers to buy the 1 BTC for $1,000. Another buyer offers $1,001. The seller always takes the higher offer. This is the basic concept of supply and demand.

Bitcoin’s price can be affected by a number of different things. Typically, news from the cryptocurrency industry can send the price of bitcoin soaring or plummeting. Common news stories online include:

All of these news events can have a significant effect on the price of bitcoin.

Some news events send the price soaring – say, when a major retailer announces plans to support or accept bitcoin.

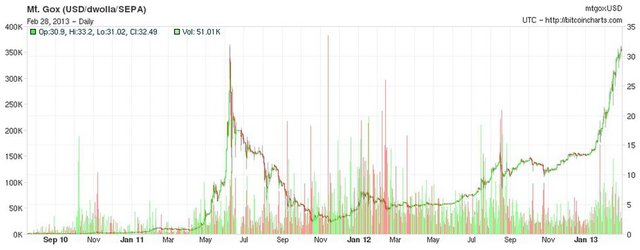

Other news events send the price plummeting – say, when China banned bitcoin and crypto exchanges in September 2017 or when Mt. Gox, the world’s largest bitcoin exchange at the time, was hacked in 2014 and lost $500 million in bitcoin.

One of the crazy things about bitcoin – especially to traditional financial traders – is that cryptocurrency markets never close. You can buy and sell bitcoin at any time of the day or night. Major news can break at midnight on a Saturday night or 6am on a Friday morning. You might leave work with bitcoin priced at $5,000 on Friday afternoon only to find it at $10,000 by the time you get back to work on Monday.

>Bitcoin’s Fixed Supply of 21 Million and How It Affects the Price

Bitcoin has a fixed supply of 21 million. There can never be more than 21 million bitcoins in circulation.

As of 2018, approximately 17 million bitcoins have been mined, which means there are only 4 million bitcoins remaining to be mined. Of those 17 million, anywhere from 2 to 4 million have been “lost” because users have lost or destroyed their private keys.

Unlike the USD, we can’t just print more bitcoin when demand rises. Central banks worldwide often want to keep their currency at a stable exchange rate. That’s why they’ll print money to keep a steady rate of inflation. If the Bank of England suddenly stopped printing GBP, for example, the value of the GBP could dramatically rise. Demand continues to grow, but supply stays steady, leading to an increasing price.

This is one reason why the price of bitcoin has steadily increased over time. There’s been a steadily growing demand and awareness of bitcoin – but the total supply of bitcoins has never changed, nor will it ever change.

This is why bitcoin is called a “deflationary” currency while the USD and most fiat currencies are inflationary.

To put this concept into perspective, consider this: between December 2008 and October 2014, the US Federal Reserve added $4 trillion USD to the money supply.

Bitcoin, meanwhile, has remained steady at a fixed supply of 21 million. 12.5 BTC are mined every 10 minutes as a block reward and added to the circulating supply, although the total supply of BTC never changes.

The combination of steady supply and increasing demand leads to a predictable result: the price of bitcoin grows over time.

As long as demand for bitcoin continues to increase, the price should continue rising.

Thanks to Bitcoin exchange guide, click here to get more info(aweber.com)

Congratulations @mitems! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit