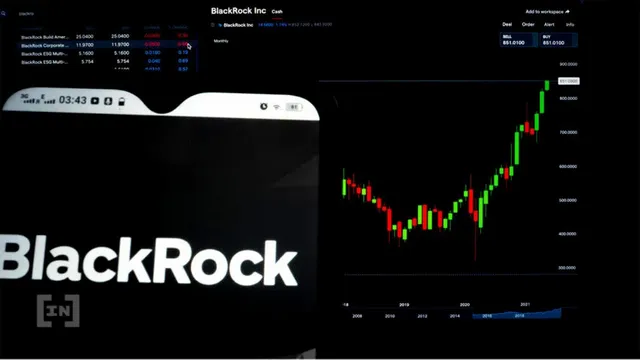

BlackRock has launched a spot bitcoin private trust open to institutional inventions in the United States, the world’s largest asset manager said in a release on its website.According to the announcement, the trust will track the performance of Bitcoin, despite the steep downturn in the digital asset market. The company said it was “seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.”

“The launch of BlackRock’s Bitcoin fund is a sign of how far crypto has matured as an asset class,” said Sui Chung, CEO of crypto index provider CF Benchmarks.

Share Article

IN BRIEF

The world’s largest asset manager announces the launch of a spot bitcoin private trust.

BlackRock’s new product will be open to institutional investors in the United States.

The move follows a partnership with Coinbase to offer crypto trading access for institutional investors.

Promo

Top Crypto Exchanges Without KYC Read Now

The Trust Project is an international consortium of news organizations building standards of transparency.

BlackRock Announces Spot Bitcoin Private Trust on Heels of Coinbase Deal

BlackRock has launched a spot bitcoin private trust open to institutional inventions in the United States, the world’s largest asset manager said in a release on its website.

According to the announcement, the trust will track the performance of Bitcoin, despite the steep downturn in the digital asset market. The company said it was “seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.”

“The launch of BlackRock’s Bitcoin fund is a sign of how far crypto has matured as an asset class,” said Sui Chung, CEO of crypto index provider CF Benchmarks.

Sponsored

Sponsored

The announcement also highlighted that BlackRock has been focusing on four areas of digital assets and associated ecosystems. These include permissioned blockchains, stablecoins, crypto-assets, and tokenization.

BlackRock partners with Coinbase

The move comes on the tail of BlackRock announcing a partnership with Coinbase earlier this week. The asset manager will connect its Aladdin investment technology platform with the exchange, due to its comprehensive trading, custody, prime brokerage and reporting capabilities.

This will enable BlackRock’s institutional clients to trade cryptocurrencies, starting with Bitcoin. The Aladdin network is widely used in fund management to link asset managers, insurers and banks to markets, who will also now be able to use it to manage their Bitcoin exposures.

https://beincrypto.com/blackrock-spot-bitcoin-private-trust-comes-on-heels-of-coinbase-deal/

Great Crypto post. We've reshared it.

🙏🔁👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit